Ayush Parchure

Ayush Parchure5 Best Multi-Entity Billing Platforms For AI And SaaS In 2026

5 Best Multi-Entity Billing Platforms For AI And SaaS In 2026

5 Best Multi-Entity Billing Platforms For AI And SaaS In 2026

5 Best Multi-Entity Billing Platforms For AI And SaaS In 2026

Feb 21, 2026

Feb 21, 2026

Feb 21, 2026

• 19 min read

• 19 min read

Ayush Parchure

Content Writing Intern, Flexprice

Every platform claims multi-entity support. But what's listed as supported rarely matches what actually works in real deployments. especially when your setup means a US parent, an India subsidiary, and global customers on a mix of usage tiers and credit packs.

You know that the moment you try to introduce usage-based tiers or a credit system, you might hit a wall that wasn't visible during the demo.

Then there's the pricing. That 0.5% of revenue fee sounds harmless right now. Run the math at $2M ARR, then at $5M, and it stops feeling like a platform cost and feels more like a silent tax on your growth.

Switching later is an expensive option. Multi-entity billing software like Flexprice is purpose-built for exactly these scenarios, handling cross-entity structures, usage-based tiers, and credit systems without the hidden limitations that surface after go-live.

Here we've broken down the best 5 multi-entity billing platforms for AI and SaaS companies in 2026, we've analyzed every feature, and as a bonus, how to go from decision to live in no time.

TL;DR

Multi-entity billing isn’t something you add later; it has to be native, or you’ll end up running parallel systems

Usage attribution is the first thing that breaks at scale; it must happen at ingestion, not during month-end cleanup

Most billing tools support multiple entities on paper, but collapse once you introduce usage, credits, or hybrid pricing

Percentage-of-revenue pricing feels small early, then quietly becomes one of your biggest platform costs as ARR grows

If pricing changes require engineering tickets, your billing stack will slow product experimentation

Consolidated reporting should be real-time and built-in, not something your CFO rebuilds in spreadsheets

Pick a platform that matches where you’re going (usage-first, global, hybrid), not just what works for your current setup

What is multi-entity billing software?

Multi-entity billing software is a financial and operational platform that allows organizations with multiple legal entities, subsidiaries, or divisions to manage billing processes centrally while maintaining separate financial records for each entity.

Multi-entity billing streamlines complex billing operations, ensuring accuracy, compliance, and efficiency across the entire organization.

Advanced billing software is often required to handle these tasks, offering features such as entity-specific invoicing, currency handling, tax compliance, and financial reporting.

Multi-entity billing software also ensures compliance with local regulations and tax laws. Each entity within the organization may be subject to different legal requirements based on its geographical location or business structure.

Advantages of multi-entity billing software

Unified financial view

You see real-time financials across every entity in one place, so consolidated reporting doesn’t require spreadsheets or manual rollups. You always know which entity generated revenue and how much.

Automated intercompany billing

You automatically split revenue or costs between entities, with balancing entries handled for you, no reconciliation cleanup later. Intercompany charges are posted correctly without manual journal entries.

Faster month-end close

You remove manual invoicing, reconciliations, and data entry, helping your finance team close faster and focus on strategic work. Your close timeline shortens because billing data is already structured.

Built-in compliance

You apply the right tax rules, currencies, and billing standards per region while keeping workflows consistent across all entities. Invoices are issued under the correct legal entity every time.

Easy entity expansion

You add new subsidiaries or regions without rebuilding your billing stack or creating parallel systems. New entities go live using the same pricing and billing logic.

Higher billing accuracy

You reduce human error through automation, making audits smoother and financial reporting more reliable. Usage, invoices, and revenue records stay aligned by default.

Top 5 multi-entity billing software for AI and SaaS in 2026

Flexprice

Stripe Billing

Zuora

Maxio

Chargebee

Basis | Flexprice | Stripe Billing | Zuora | Maxio | Chargebee |

Parent–Child Hierarchy | Native parent–child accounts. Customers live once, usage rolls up automatically, each entity invoices independently, and finance sees one consolidated view. | No hierarchy. Each legal entity requires a separate Stripe account; customer sharing and rollups must be built manually. | Built-in hierarchy inside one tenant. Entities stay isolated but can share product catalogs. Requires enterprise configuration. | Available only on higher tiers. Hierarchy exists mainly for reporting, not operational billing. | Enterprise-only. Implemented via multiple “sites,” leading to duplicated customers and configs. |

Multi-Entity Operations | A single system manages all entities with shared pricing logic and entity-aware invoicing. | Separate Stripe accounts per entity, usually stitched together via Stripe Connect and custom middleware. | Native multi-entity but setup-heavy; finance-led workflows. | Multiple sites with rollups on the Scale plan; operational workflows remain fragmented. | Each entity runs its own Chargebee site. Cross-entity workflows require manual coordination. |

Usage Attribution | Real-time attribution at ingestion using metadata like region, model type, or workload. No post-processing required. | No cross-entity attribution. Engineers must route usage to the correct account themselves. | Usage can roll up, but units must match, and setup is rigid. | Multi-dimensional metering supports compute attributes but requires finance-led configuration. | SQL-based metering allows flexibility, but attribution across entities takes manual setup. |

Credits & Wallets | Native wallets with conversion rates, rollover rules, automated top-ups, and real-time balance sync. | No wallet system. Credits require custom implementation. | Prepayments supported, but no wallet abstraction or conversion controls. | Prepaid credits with drawdown billing. No wallet logic. | Credits supported, but no conversion-rate wallets or automated top-ups. |

Hybrid Pricing | Usage + subscriptions + credits in a single flow. Designed for AI and infra workloads. | Possible, but requires multiple price objects and backend orchestration. | Supports tiered, volume, and overage pricing at enterprise scale. | Hybrid supported via Maxio Metering, with finance-driven configuration. | Supports hybrid models, but advanced setups rely on SQL logic. |

Revenue Reporting | Real-time consolidated usage and revenue across parent-child entities. Finance sees one source of truth. | Requires exporting data to a warehouse for consolidation. | Corporate-level reporting is built in, with entity isolation. | Multi-entity rollups and SaaS metrics on the Scale plan. | Consolidated reporting only on Enterprise plans. |

AI / Usage-First Billing | Built specifically for AI: filter by model, token class, region, or custom metadata on a single event stream. | No AI primitives. Each model or workload usually needs its own schema. | Supports large-scale usage but lacks AI-specific metadata layers. | Supports multi-attribute compute tracking. | SQL-based logic allows custom AI attributes, but setup is manual. |

Contracts & Audit Trail | Full version history: amendments, upgrades, downgrades, and renegotiations all tracked. | No native contract lifecycle or versioning. | Full contract lifecycle with CPQ and renewals. | Handles ramp deals and CPI increases with audit-ready reports. | Contracts supported; full audit trails only on higher plans. |

Payment Gateways | Gateway-agnostic. Works with Stripe, Razorpay, PayPal, or custom processors. | Locked to Stripe Payments. | Supports multiple gateways. | Supports multiple gateways. | Supports 30+ gateways. |

Open Source | Fully open source. | Closed source. | Closed source. | Closed source. | Closed source. |

Pricing Change Workflow | Product and finance teams can update pricing from the dashboard. No engineering required. | Engineering must create new Price objects and migrate customers. | Moderate effort; complex changes often need implementation support. | Low–moderate; metering reduces engineering dependency. | Low–moderate; SQL logic still requires technical involvement. |

Implementation Reality | Developer-first APIs. Typically live fast, even with usage + credits. | Quick for simple subscriptions; multi-entity needs custom work. | 3–6 months is common for enterprise rollouts. | Often 2–6 weeks. | Often 2–6 weeks per site. |

Best Fit for | AI-native and usage-first SaaS scaling across entities with hybrid pricing. | Early-stage teams or single-entity setups. | Large enterprises with complex compliance needs. | Finance-heavy B2B SaaS needing revenue recognition + metrics. | Growing SaaS with standard subscription workflows. |

1. Flexprice

FlexPrice is an open source enterprise billing platform built for SaaS and AI companies that monetize through usage, credits, or hybrid pricing models. It’s built to handle all the complex use cases and at the same time the high volume of events.

Unlike platforms that bolt multi-entity support on as an afterthought, Flexprice is architected from the ground up to handle the complexity that comes with operating across multiple legal entities, regions, and customer structures.

It ingests product usage in real time and maps it accurately to the right entity, converting raw consumption into billable revenue through an automated billing system like metering, customer wallets, entitlements, and invoicing. Finance and product teams can define pricing rules, credit packs, and usage tiers directly from the dashboard, without opening an engineering ticket every time something changes.

For companies operating across entities, this matters more than it sounds. When your US entity, India subsidiary, and global customers are all on different pricing models, accurate usage attribution at the entity level is what separates clean books from a month-end reconciliation nightmare.

Multi-entity account support, detailed audit trails, and payment-gateway independence give finance teams the visibility and control they actually need across a distributed structure, without getting locked into a single vendor's ecosystem.

For AI-native companies, especially, where revenue is tied directly to real-time technical metrics and small attribution errors compound fast, FlexPrice acts as the revenue layer that keeps metering, billing, and reporting in one place rather than spread across three systems and a spreadsheet.

Flexprice focuses primarily on usage-based and hybrid billing today; its developer-first SDKs make it a strong choice for AI teams who are preparing for multi-entity complexity.

See how Simplismart was able to bring usage-based billing live fast, integrating Flexprice directly into their stack without prolonged engineering cycles.

/

Key features

Parent-child account hierarchy

FlexPrice supports hierarchical account structures where usage from child accounts rolls up to a parent, credits are shared across departments, and invoicing stays centralized while internal accountability is preserved. For companies operating across multiple teams, entities, or client accounts, this removes the need for manual consolidation entirely.

Committed usage and credit pooling across entities

Organizations can define usage commitments at the entity or organization level and pool credits across teams or workspaces. Consumption is tracked in real time, so finance always knows exactly where the budget is being used without reconciliation work at the end of the month.

Real-time usage metering and attribution

FlexPrice ingests usage events in real time and applies pricing logic at the point of consumption. Granular filtering lets teams attribute usage by region, model type, infrastructure zone, or any custom metadata, so the right entity gets billed for the right workload, accurately and automatically.

Hybrid and usage-based pricing models

FlexPrice handles usage-based billing, committed volumes, and hybrid combinations in a single billing flow. Multi-entity companies with different pricing models per region or entity don't need separate systems or custom backend logic to manage them.

Credit and wallet management

Prepaid balances, promotional credits, recurring grants, rollover rules, and automated top-ups are all tracked through a ledger-backed system. Wallets stay synchronized in real time across entities, giving finance full auditability and customers predictable spend controls.

Custom pricing units

FlexPrice lets you sell in tokens, credits, or any custom unit while storing everything internally in base currencies like USD or INR. This keeps external pricing clean for customers while maintaining accurate accounting and revenue reporting across entities.

Quotes, contracts, and renewals

Built-in quoting with pricing lock-ins, approvals, and automatic sync to billing ensures sales, finance, and RevOps are working from a single source of truth. Ramped contracts with phased pricing timelines and full contract amendment history mean every entity's agreements are tracked and auditable over time.

Feature entitlements per entity

Feature access can be defined by plan tier, enforced automatically against usage limits, and aligned with credit balances, so each entity or customer segment gets exactly what their contract specifies without custom product-side logic.

Invoicing and payments

FlexPrice generates invoices from usage, subscriptions, or credits, with support for partial payments, one-time invoices, and plan overrides per customer. Price localization and discounts can be applied per entity without affecting the broader billing configuration.

SOC II compliance and audit trails

Full contract version history, usage audit trails, and webhook support for enterprise workflows. FlexPrice is SOC II compliant, which matters when multiple entities mean multiple compliance obligations.

Granular usage filtering

You can filter within a single usage stream using any custom metadata attached to events. For AI companies billing across entities with different pricing models or workload classes, this avoids schema explosion and keeps attribution operationally clean.

Wallet conversion rate controls

FlexPrice lets you configure exactly how credits convert to base currency inside every wallet, with separate rates for spending and buying. This means promotional top-ups or discounted credit purchases don't distort how actual spend is calculated. Wallets store credits, invoices stay in one base currency, and finance reconciliation stays clean across every entity.

Pros

Open-source billing infrastructure with full transparency, no black-box pricing logic across entities

Payment gateway independence, no forced consolidation across your entity structure

Finance and RevOps can update pricing rules, credit packs, and usage tiers without engineering involvement

Parent-child account hierarchies with consolidated invoicing and team-level usage visibility

Real-time usage attribution across entities, so metering and billing stay in sync without spreadsheet reconciliation

Native credit wallet support with conversion rate controls, keeping promotional campaigns clean across regions

Audit-ready contract history and SOC II compliance built in, not bolted on

Built for AI and usage-first SaaS, where revenue is tied to real-time technical metrics across distributed infrastructure

Cons

Newer ecosystem compared to other multi-entity billing platforms

Teams opting for self-hosting must manage infrastructure themselves (managed cloud available)

Pricing

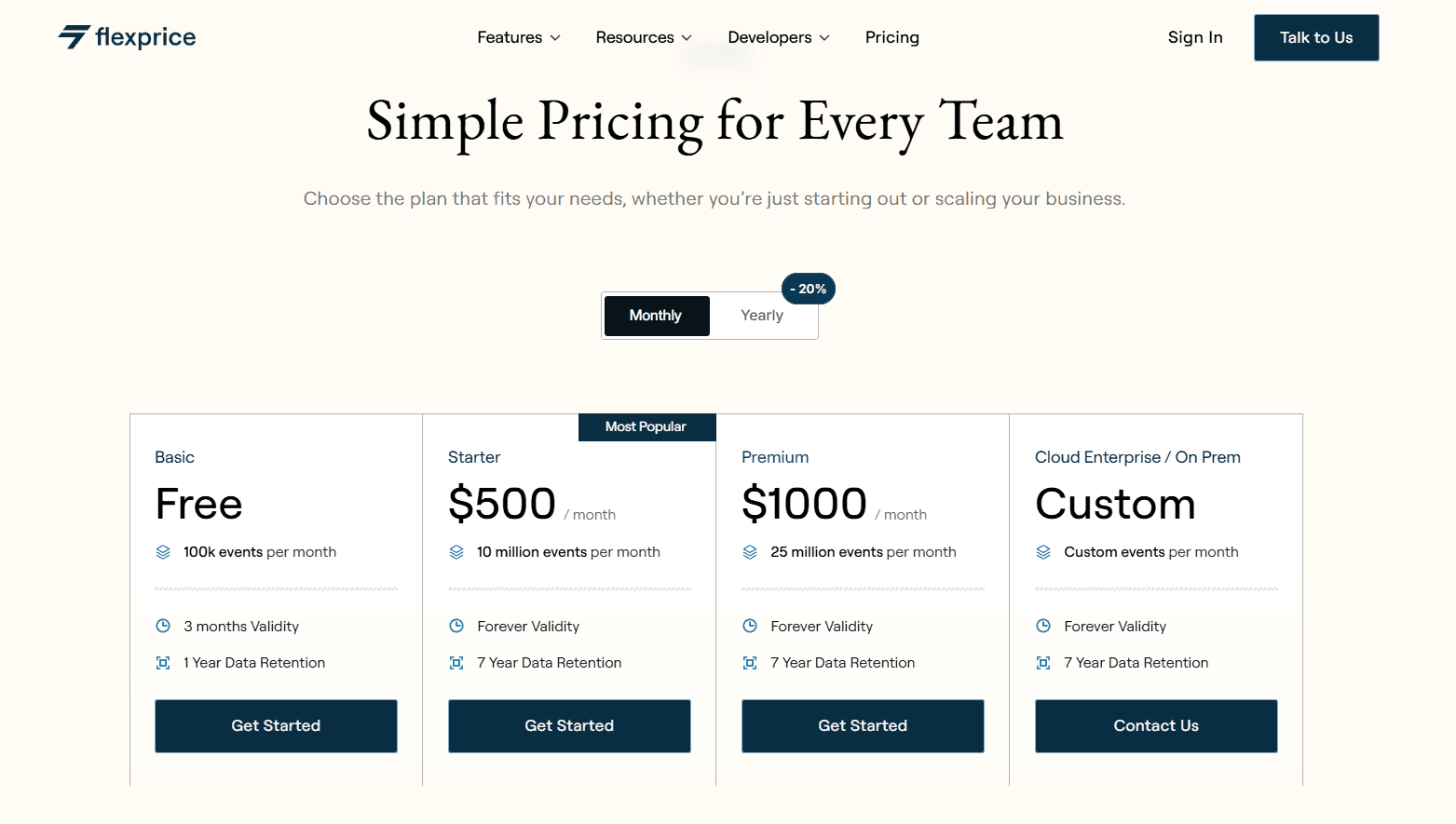

Flexprice offers 4 different pricing options apart from open source, which are:

Basic, which offers 100k events per month and is free

Starter, which offers 10 million events per month, is priced at $500/month

Premium, which offers 25 million events per month, is priced at $1000/month

Cloud/OnPrem, you can customize events per month

Best suited for

AI-native and usage-first SaaS companies scaling across multiple legal entities before their billing infrastructure catches up

Companies running a US parent with regional subsidiaries that need usage attributed accurately at the entity level without custom engineering pipelines

Teams with hybrid pricing models (usage + credits + subscriptions) that need all three working together under a consolidated billing structure

Enterprise customers with centralized budgets but distributed usage across teams, where credit pooling and parent-child hierarchies matter more than per-seat simplicity

Fast-moving AI platforms where pricing scales quickly and finance needs real-time visibility across entities, not a monthly reconciliation report

Get started with your billing today.

Get started with your billing today.

2. Stripe Billing

Stripe Billing is one of the most common platforms for SaaS companies because it’s fast to implement, developer-friendly, and tightly integrated with Stripe payments. For a single-entity team charging straightforward subscriptions or light usage, Stripe delivers a smooth experience with minimal setup.

But once a company adds multiple entities or expands into new regions, Stripe’s limitations become visible. Because actually it was not built with multi-entity structures in mind, meaning each entity typically needs its own Stripe account. This creates a data depot, which leads to manual reconciliation and results in a lack of a consolidated view of revenue across the business.

Key features

API-driven billing workflows. You can create plans, track usage, and generate invoices directly through well-structured APIs that are easy to integrate into your product.

Quick implementation path built-in checkout, customer portals, and lightweight plan setup help you go live fast without heavy upfront configuration.

Metered billing support. You can report usage via API to support usage-based pricing, though this is better suited for batch updates than real-time event streaming.

Straightforward subscription controls. You get core tools for recurring billing, plan changes, proration, and basic reporting, enough to manage standard SaaS workflows.

Pros:

Stripe Billing is easy to set up, making it a strong choice for early teams that need to launch subscriptions quickly without heavy configuration.

Clear APIs and strong documentation allow engineering teams to build custom billing workflows with minimal friction.

Billing integrates natively with Stripe Payments, providing teams with automatic access to global payment methods and card updater capabilities.

Cons:

Each entity requires its own Stripe account, creating operational silos and preventing consolidated reporting or shared customer data.

More complex needs, such as multi-jurisdiction tax logic, GAAP/IFRS revenue recognition, or audit-ready workflows, require manual work or additional tools.

As billing needs grow, teams often rely on spreadsheets or custom scripts for CPQ, usage tracking, and reporting, since Stripe doesn’t natively support more advanced SaaS workflows.

Pricing

Stripe Billing pricing is not disclosed publicly; you can check their website.

Best for

Best suited for early-stage SaaS teams operating with one or two legal entities and simple pricing structures.

Ideal when speed to market matters most, and you need to launch subscriptions quickly without complex multi-entity requirements.

3. Zuora

Zuora is one of the most established enterprise subscription billing platforms, built for large organizations with highly complex billing needs across multiple business units, geographies, and product lines.

Zuora supports global operations with multi-entity setups, multi-currency and multi-language billing, advanced pricing catalogs, usage rating, custom workflows, and enterprise-grade tax and revenue modules.

While Zuora can handle virtually any billing scenario, the tradeoff is complexity. Implementations are lengthy, configuration requires deep expertise, and most teams rely on certified consultants or internal specialists to manage ongoing changes. It’s powerful, but very much an enterprise tool.

Key features

Supports sophisticated pricing models, large product catalogs, and highly configurable billing rules.

Can manage multiple entities or business units, each with its own currency, tax logic, and workflows, with the ability to consolidate at scale.

Offers configurable workflows, event triggers, and custom billing logic for intricate enterprise processes.

Separate module for ASC 606/IFRS 15 revenue recognition, multi-element arrangements, and audit-ready schedules.

Multi-currency, multi-language, global tax handling, and support for diverse regulatory environments.

Pros:

Built to support large, global organizations with sophisticated billing and compliance requirements.

Strong functionality for managing multiple business units, geographies, and reporting layers.

Flexible workflows, advanced pricing configurations, and a modular product suite allow for detailed tailoring.

Cons:

Deployments often take months and typically require specialized Zuora consultants or trained internal teams.

Introducing new products or pricing changes requires careful configuration, testing, and governance, which slows experimentation.

Pricing typically starts around $50,000 per year, often scaling much higher for enterprise deployments.

Pricing

Zuora does not publicly list pricing; contact their sales team for more information.

Best for

Large enterprises with complex billing operations, multiple business units, and strict internal controls.

Organizations with extensive RevOps and finance resources that can support heavy implementation and ongoing administration.

4. Maxio

Maxio is a finance-led billing and revenue platform built for teams that care first about accounting correctness. It brings subscriptions, revenue recognition, and financial reporting into one system, with a heavy focus on GAAP/IFRS compliance and audit readiness.

At its core, Maxio is designed for CFOs and RevOps teams who need clean books and reliable SaaS metrics. You get built-in visibility into MRR, churn, and cohorts, plus tooling for deferred revenue and recognition schedules, useful when finance needs answers fast for board decks or audits.

Where Maxio starts to show limits is in flexibility. It works well for predictable subscription businesses, but usage-heavy products or fast-changing pricing models tend to run into friction. Setup is also more involved than newer product-led billing tools.

Key features

Handles ASC 606 and IFRS 15, including allocating revenue across multiple deliverables and recognizing annual contracts month by month.

Keeps deferred and recognized revenue in sync as invoices go out, so financial statements stay aligned without manual adjustments.

Provides dashboards for MRR, ARR, churn, cohorts, LTV, and other core metrics finance teams rely on for reviews and forecasting.

Supports multiple entities and consolidated reporting on upper tiers, with FX updates baked into billing.

Connects with ERPs like NetSuite and QuickBooks, common CRMs, payment gateways, and Maxio’s own payments stack.

Pros

Strong GAAP/IFRS support, detailed audit trails, and dependable revenue reporting — helpful for fundraising, audits, or IPO prep.

Covers revenue, deferred revenue, AR aging, and SaaS KPIs in one place, reducing reliance on spreadsheets or external BI.

Supports common workflows like annual contracts with monthly recognition, renewals, co-terming, and seat-based pricing.

Cons

Expect months, not weeks. Product mapping, revenue rules, and accounting policies take real upfront effort, and many teams bring in consultants.

Because everything is finance-driven, adding new pricing models or adjusting billing logic often requires support involvement and careful reconfiguration.

Accountants feel at home. Product and engineering teams usually don’t.

Pricing

Maxio offers tiered plans that reward growth, starting around $599/month for standard billing and rising to custom enterprise pricing for high volume and advanced revenue operations.

Best for

SaaS companies with dedicated finance or RevOps teams that need strict compliance, audit-ready reporting, and structured revenue processes.

Businesses with stable pricing (annual contracts, seat tiers) that prioritize accounting accuracy over rapid pricing experimentation.

.

5. Chargebee

Chargebee is a subscription billing platform that many mid-market SaaS teams start with once recurring revenue becomes real. It covers the basics well: plan management, trials, proration, dunning, and automated invoicing. It also connects with most of the tools finance and RevOps already use.

Where things get tricky is multi-entity.

Chargebee technically supports multiple entities, but each one lives in its own “site.” That means separate instances, separate configs, and separate data. If you’re running one or two entities, this is manageable. Once you expand globally, it turns into operational overhead fast, especially when finance needs consolidated reporting.

Key features

Let's price in different currencies and customize invoices by region.

Supports trials, upgrades, downgrades, proration, pauses, add-ons, and one-time charges with consistent billing logic.

Works with tools like Salesforce, HubSpot, QuickBooks, NetSuite, Stripe, Braintree, PayPal, and Avalara.

Offers ASC 606 / IFRS 15 schedules through a paid module.

Pros

Handles the day-to-day mechanics of SaaS billing — plans, changes, proration, dunning without surprises.

Built-in currency and localization features help if you sell across regions (even though entities stay siloed).

Finance and support teams can manage customers and plans from the UI without pulling in engineering.

Cons

Multi-entity means multiple Chargebee sites. There’s no native consolidated reporting or shared customer view.

Moving customers, syncing configurations, or handling cross-entity workflows requires manual work.

Managing multiple gateways, tax rules, and sites adds setup overhead. Many teams end up needing consultants.

Best for

Mid-market SaaS companies with standard subscription pricing and predictable billing flows.

Teams easing into multi-entity operations who are okay with managing one or two separate Chargebee instances.

Pricing

Chargebee pricing is tiered based on revenue and feature access, with enterprise plans negotiated through sales.

How to choose the right multi-entity billing software

Most platforms will tell you that they support multi-entity billing. But the real question is how deep that support actually goes once your structure gets complicated. Here is what to actually evaluate before you commit.

Does it handle usage attribution at the entity level?

If your revenue is tied to real-time technical metrics like tokens, API calls, or compute hours, you need metering that maps usage to the right entity at the point of ingestion, not corrected after the fact. Ask the vendor directly: where does attribution happen, and what does the reconciliation process look like when it goes wrong?

Can it support your pricing model without custom engineering?

Multi-entity companies rarely run a single pricing model across all entities. If introducing a credit system or a usage tier for one entity requires an engineering sprint, that is a sign that the platform was not built for this level of complexity.

How does it handle consolidated reporting?

Your CFO needs a single view of revenue across entities, in one base currency, without manual FX adjustments. If the platform cannot produce board-ready consolidated metrics without exporting to a spreadsheet, it will become a bottleneck as you scale.

What does the account hierarchy actually look like?

Parent-child account structures should let you centralize invoicing at the parent level while preserving usage visibility at the team or subsidiary level. If this is a workaround rather than a native feature, you will feel it operationally.

Is the pricing model itself sustainable?

Percentage-of-revenue billing looks manageable early. At $2M ARR and beyond, it becomes one of your largest platform costs. Evaluate the total cost of ownership across your projected growth, not just your current ARR.

What are the compliance and audit capabilities?

Operating across entities means operating across regulatory environments. SOC II compliance, full contract version history, and audit-ready invoicing are not nice-to-haves when you are closing enterprise deals or preparing for a fundraise.

Why is Flexprice the perfect multi-entity billing software for you?

Most billing platforms were built for one entity, one currency, one pricing model. Multi-entity support got added later in their system, and you can feel it in the workarounds.

FlexPrice was built differently.

The core architecture assumes complexity from the start. Parent-child account hierarchies, real-time usage attribution, credit pooling across teams, and consolidated invoicing are not just add-ons. They are how the platform works by default.

For AI-native companies specifically, this matters more than it sounds. Your revenue is tied directly to technical metrics that move in real time. A token consumed in your global entity needs to hit the right wallet, the right invoice, and the right revenue line without a manual correction cycle at month-end. Flexprice handles that at the metering layer, before it becomes a finance problem.

The open-source foundation means you are never locked into a vendor's interpretation of how multi-entity billing should work. You can extend it, audit it, and adapt it as your entity structure grows, without waiting on a roadmap or negotiating a custom contract.

And unlike percentage-of-revenue platforms that quietly become one of your highest costs as you scale, Flexprice's pricing does not penalize you for growing.

If you are at the point where your current billing setup is holding back how fast you can expand into new markets, launch new pricing models, or give your finance team the consolidated visibility they need, Flexprice is especially built for that stage.

Wrapping up

Multi-entity billing is one of those problems that looks manageable until it isn't. You add a second entity, then a third market, then an enterprise customer who wants centralized invoicing.

This is what causes team-level usage breakdowns, and suddenly, your billing setup becomes the main hurdle that slows everything down.

All platforms mentioned on this list solve parts of that problem. The right choice depends on where you are today and where your structure is heading in the next 12 to 18 months.

But if you are an AI-native or usage-first SaaS company that needs accurate usage attribution across entities, pricing flexibility without engineering dependency, and consolidated reporting your finance team can actually trust, Flexprice, which is worth a serious look.

It is open source, built for the complexity that comes with real growth, and priced in a way that does not work against you as your revenue scales.

If you are still figuring out which direction to go, start with the evaluation criteria in this guide. The right platform is the one that handles your current structure cleanly and does not become a ceiling when your next entity goes live.

2. Stripe Billing

Stripe Billing is one of the most common platforms for SaaS companies because it’s fast to implement, developer-friendly, and tightly integrated with Stripe payments. For a single-entity team charging straightforward subscriptions or light usage, Stripe delivers a smooth experience with minimal setup.

But once a company adds multiple entities or expands into new regions, Stripe’s limitations become visible. Because actually it was not built with multi-entity structures in mind, meaning each entity typically needs its own Stripe account. This creates a data depot, which leads to manual reconciliation and results in a lack of a consolidated view of revenue across the business.

Key features

API-driven billing workflows. You can create plans, track usage, and generate invoices directly through well-structured APIs that are easy to integrate into your product.

Quick implementation path built-in checkout, customer portals, and lightweight plan setup help you go live fast without heavy upfront configuration.

Metered billing support. You can report usage via API to support usage-based pricing, though this is better suited for batch updates than real-time event streaming.

Straightforward subscription controls. You get core tools for recurring billing, plan changes, proration, and basic reporting, enough to manage standard SaaS workflows.

Pros:

Stripe Billing is easy to set up, making it a strong choice for early teams that need to launch subscriptions quickly without heavy configuration.

Clear APIs and strong documentation allow engineering teams to build custom billing workflows with minimal friction.

Billing integrates natively with Stripe Payments, providing teams with automatic access to global payment methods and card updater capabilities.

Cons:

Each entity requires its own Stripe account, creating operational silos and preventing consolidated reporting or shared customer data.

More complex needs, such as multi-jurisdiction tax logic, GAAP/IFRS revenue recognition, or audit-ready workflows, require manual work or additional tools.

As billing needs grow, teams often rely on spreadsheets or custom scripts for CPQ, usage tracking, and reporting, since Stripe doesn’t natively support more advanced SaaS workflows.

Pricing

Stripe Billing pricing is not disclosed publicly; you can check their website.

Best for

Best suited for early-stage SaaS teams operating with one or two legal entities and simple pricing structures.

Ideal when speed to market matters most, and you need to launch subscriptions quickly without complex multi-entity requirements.

3. Zuora

Zuora is one of the most established enterprise subscription billing platforms, built for large organizations with highly complex billing needs across multiple business units, geographies, and product lines.

Zuora supports global operations with multi-entity setups, multi-currency and multi-language billing, advanced pricing catalogs, usage rating, custom workflows, and enterprise-grade tax and revenue modules.

While Zuora can handle virtually any billing scenario, the tradeoff is complexity. Implementations are lengthy, configuration requires deep expertise, and most teams rely on certified consultants or internal specialists to manage ongoing changes. It’s powerful, but very much an enterprise tool.

Key features

Supports sophisticated pricing models, large product catalogs, and highly configurable billing rules.

Can manage multiple entities or business units, each with its own currency, tax logic, and workflows, with the ability to consolidate at scale.

Offers configurable workflows, event triggers, and custom billing logic for intricate enterprise processes.

Separate module for ASC 606/IFRS 15 revenue recognition, multi-element arrangements, and audit-ready schedules.

Multi-currency, multi-language, global tax handling, and support for diverse regulatory environments.

Pros:

Built to support large, global organizations with sophisticated billing and compliance requirements.

Strong functionality for managing multiple business units, geographies, and reporting layers.

Flexible workflows, advanced pricing configurations, and a modular product suite allow for detailed tailoring.

Cons:

Deployments often take months and typically require specialized Zuora consultants or trained internal teams.

Introducing new products or pricing changes requires careful configuration, testing, and governance, which slows experimentation.

Pricing typically starts around $50,000 per year, often scaling much higher for enterprise deployments.

Pricing

Zuora does not publicly list pricing; contact their sales team for more information.

Best for

Large enterprises with complex billing operations, multiple business units, and strict internal controls.

Organizations with extensive RevOps and finance resources that can support heavy implementation and ongoing administration.

4. Maxio

Maxio is a finance-led billing and revenue platform built for teams that care first about accounting correctness. It brings subscriptions, revenue recognition, and financial reporting into one system, with a heavy focus on GAAP/IFRS compliance and audit readiness.

At its core, Maxio is designed for CFOs and RevOps teams who need clean books and reliable SaaS metrics. You get built-in visibility into MRR, churn, and cohorts, plus tooling for deferred revenue and recognition schedules, useful when finance needs answers fast for board decks or audits.

Where Maxio starts to show limits is in flexibility. It works well for predictable subscription businesses, but usage-heavy products or fast-changing pricing models tend to run into friction. Setup is also more involved than newer product-led billing tools.

Key features

Handles ASC 606 and IFRS 15, including allocating revenue across multiple deliverables and recognizing annual contracts month by month.

Keeps deferred and recognized revenue in sync as invoices go out, so financial statements stay aligned without manual adjustments.

Provides dashboards for MRR, ARR, churn, cohorts, LTV, and other core metrics finance teams rely on for reviews and forecasting.

Supports multiple entities and consolidated reporting on upper tiers, with FX updates baked into billing.

Connects with ERPs like NetSuite and QuickBooks, common CRMs, payment gateways, and Maxio’s own payments stack.

Pros

Strong GAAP/IFRS support, detailed audit trails, and dependable revenue reporting — helpful for fundraising, audits, or IPO prep.

Covers revenue, deferred revenue, AR aging, and SaaS KPIs in one place, reducing reliance on spreadsheets or external BI.

Supports common workflows like annual contracts with monthly recognition, renewals, co-terming, and seat-based pricing.

Cons

Expect months, not weeks. Product mapping, revenue rules, and accounting policies take real upfront effort, and many teams bring in consultants.

Because everything is finance-driven, adding new pricing models or adjusting billing logic often requires support involvement and careful reconfiguration.

Accountants feel at home. Product and engineering teams usually don’t.

Pricing

Maxio offers tiered plans that reward growth, starting around $599/month for standard billing and rising to custom enterprise pricing for high volume and advanced revenue operations.

Best for

SaaS companies with dedicated finance or RevOps teams that need strict compliance, audit-ready reporting, and structured revenue processes.

Businesses with stable pricing (annual contracts, seat tiers) that prioritize accounting accuracy over rapid pricing experimentation.

.

5. Chargebee

Chargebee is a subscription billing platform that many mid-market SaaS teams start with once recurring revenue becomes real. It covers the basics well: plan management, trials, proration, dunning, and automated invoicing. It also connects with most of the tools finance and RevOps already use.

Where things get tricky is multi-entity.

Chargebee technically supports multiple entities, but each one lives in its own “site.” That means separate instances, separate configs, and separate data. If you’re running one or two entities, this is manageable. Once you expand globally, it turns into operational overhead fast, especially when finance needs consolidated reporting.

Key features

Let's price in different currencies and customize invoices by region.

Supports trials, upgrades, downgrades, proration, pauses, add-ons, and one-time charges with consistent billing logic.

Works with tools like Salesforce, HubSpot, QuickBooks, NetSuite, Stripe, Braintree, PayPal, and Avalara.

Offers ASC 606 / IFRS 15 schedules through a paid module.

Pros

Handles the day-to-day mechanics of SaaS billing — plans, changes, proration, dunning without surprises.

Built-in currency and localization features help if you sell across regions (even though entities stay siloed).

Finance and support teams can manage customers and plans from the UI without pulling in engineering.

Cons

Multi-entity means multiple Chargebee sites. There’s no native consolidated reporting or shared customer view.

Moving customers, syncing configurations, or handling cross-entity workflows requires manual work.

Managing multiple gateways, tax rules, and sites adds setup overhead. Many teams end up needing consultants.

Best for

Mid-market SaaS companies with standard subscription pricing and predictable billing flows.

Teams easing into multi-entity operations who are okay with managing one or two separate Chargebee instances.

Pricing

Chargebee pricing is tiered based on revenue and feature access, with enterprise plans negotiated through sales.

How to choose the right multi-entity billing software

Most platforms will tell you that they support multi-entity billing. But the real question is how deep that support actually goes once your structure gets complicated. Here is what to actually evaluate before you commit.

Does it handle usage attribution at the entity level?

If your revenue is tied to real-time technical metrics like tokens, API calls, or compute hours, you need metering that maps usage to the right entity at the point of ingestion, not corrected after the fact. Ask the vendor directly: where does attribution happen, and what does the reconciliation process look like when it goes wrong?

Can it support your pricing model without custom engineering?

Multi-entity companies rarely run a single pricing model across all entities. If introducing a credit system or a usage tier for one entity requires an engineering sprint, that is a sign that the platform was not built for this level of complexity.

How does it handle consolidated reporting?

Your CFO needs a single view of revenue across entities, in one base currency, without manual FX adjustments. If the platform cannot produce board-ready consolidated metrics without exporting to a spreadsheet, it will become a bottleneck as you scale.

What does the account hierarchy actually look like?

Parent-child account structures should let you centralize invoicing at the parent level while preserving usage visibility at the team or subsidiary level. If this is a workaround rather than a native feature, you will feel it operationally.

Is the pricing model itself sustainable?

Percentage-of-revenue billing looks manageable early. At $2M ARR and beyond, it becomes one of your largest platform costs. Evaluate the total cost of ownership across your projected growth, not just your current ARR.

What are the compliance and audit capabilities?

Operating across entities means operating across regulatory environments. SOC II compliance, full contract version history, and audit-ready invoicing are not nice-to-haves when you are closing enterprise deals or preparing for a fundraise.

Why is Flexprice the perfect multi-entity billing software for you?

Most billing platforms were built for one entity, one currency, one pricing model. Multi-entity support got added later in their system, and you can feel it in the workarounds.

FlexPrice was built differently.

The core architecture assumes complexity from the start. Parent-child account hierarchies, real-time usage attribution, credit pooling across teams, and consolidated invoicing are not just add-ons. They are how the platform works by default.

For AI-native companies specifically, this matters more than it sounds. Your revenue is tied directly to technical metrics that move in real time. A token consumed in your global entity needs to hit the right wallet, the right invoice, and the right revenue line without a manual correction cycle at month-end. Flexprice handles that at the metering layer, before it becomes a finance problem.

The open-source foundation means you are never locked into a vendor's interpretation of how multi-entity billing should work. You can extend it, audit it, and adapt it as your entity structure grows, without waiting on a roadmap or negotiating a custom contract.

And unlike percentage-of-revenue platforms that quietly become one of your highest costs as you scale, Flexprice's pricing does not penalize you for growing.

If you are at the point where your current billing setup is holding back how fast you can expand into new markets, launch new pricing models, or give your finance team the consolidated visibility they need, Flexprice is especially built for that stage.

Wrapping up

Multi-entity billing is one of those problems that looks manageable until it isn't. You add a second entity, then a third market, then an enterprise customer who wants centralized invoicing.

This is what causes team-level usage breakdowns, and suddenly, your billing setup becomes the main hurdle that slows everything down.

All platforms mentioned on this list solve parts of that problem. The right choice depends on where you are today and where your structure is heading in the next 12 to 18 months.

But if you are an AI-native or usage-first SaaS company that needs accurate usage attribution across entities, pricing flexibility without engineering dependency, and consolidated reporting your finance team can actually trust, Flexprice, which is worth a serious look.

It is open source, built for the complexity that comes with real growth, and priced in a way that does not work against you as your revenue scales.

If you are still figuring out which direction to go, start with the evaluation criteria in this guide. The right platform is the one that handles your current structure cleanly and does not become a ceiling when your next entity goes live.

2. Stripe Billing

Stripe Billing is one of the most common platforms for SaaS companies because it’s fast to implement, developer-friendly, and tightly integrated with Stripe payments. For a single-entity team charging straightforward subscriptions or light usage, Stripe delivers a smooth experience with minimal setup.

But once a company adds multiple entities or expands into new regions, Stripe’s limitations become visible. Because actually it was not built with multi-entity structures in mind, meaning each entity typically needs its own Stripe account. This creates a data depot, which leads to manual reconciliation and results in a lack of a consolidated view of revenue across the business.

Key features

API-driven billing workflows. You can create plans, track usage, and generate invoices directly through well-structured APIs that are easy to integrate into your product.

Quick implementation path built-in checkout, customer portals, and lightweight plan setup help you go live fast without heavy upfront configuration.

Metered billing support. You can report usage via API to support usage-based pricing, though this is better suited for batch updates than real-time event streaming.

Straightforward subscription controls. You get core tools for recurring billing, plan changes, proration, and basic reporting, enough to manage standard SaaS workflows.

Pros:

Stripe Billing is easy to set up, making it a strong choice for early teams that need to launch subscriptions quickly without heavy configuration.

Clear APIs and strong documentation allow engineering teams to build custom billing workflows with minimal friction.

Billing integrates natively with Stripe Payments, providing teams with automatic access to global payment methods and card updater capabilities.

Cons:

Each entity requires its own Stripe account, creating operational silos and preventing consolidated reporting or shared customer data.

More complex needs, such as multi-jurisdiction tax logic, GAAP/IFRS revenue recognition, or audit-ready workflows, require manual work or additional tools.

As billing needs grow, teams often rely on spreadsheets or custom scripts for CPQ, usage tracking, and reporting, since Stripe doesn’t natively support more advanced SaaS workflows.

Pricing

Stripe Billing pricing is not disclosed publicly; you can check their website.

Best for

Best suited for early-stage SaaS teams operating with one or two legal entities and simple pricing structures.

Ideal when speed to market matters most, and you need to launch subscriptions quickly without complex multi-entity requirements.

3. Zuora

Zuora is one of the most established enterprise subscription billing platforms, built for large organizations with highly complex billing needs across multiple business units, geographies, and product lines.

Zuora supports global operations with multi-entity setups, multi-currency and multi-language billing, advanced pricing catalogs, usage rating, custom workflows, and enterprise-grade tax and revenue modules.

While Zuora can handle virtually any billing scenario, the tradeoff is complexity. Implementations are lengthy, configuration requires deep expertise, and most teams rely on certified consultants or internal specialists to manage ongoing changes. It’s powerful, but very much an enterprise tool.

Key features

Supports sophisticated pricing models, large product catalogs, and highly configurable billing rules.

Can manage multiple entities or business units, each with its own currency, tax logic, and workflows, with the ability to consolidate at scale.

Offers configurable workflows, event triggers, and custom billing logic for intricate enterprise processes.

Separate module for ASC 606/IFRS 15 revenue recognition, multi-element arrangements, and audit-ready schedules.

Multi-currency, multi-language, global tax handling, and support for diverse regulatory environments.

Pros:

Built to support large, global organizations with sophisticated billing and compliance requirements.

Strong functionality for managing multiple business units, geographies, and reporting layers.

Flexible workflows, advanced pricing configurations, and a modular product suite allow for detailed tailoring.

Cons:

Deployments often take months and typically require specialized Zuora consultants or trained internal teams.

Introducing new products or pricing changes requires careful configuration, testing, and governance, which slows experimentation.

Pricing typically starts around $50,000 per year, often scaling much higher for enterprise deployments.

Pricing

Zuora does not publicly list pricing; contact their sales team for more information.

Best for

Large enterprises with complex billing operations, multiple business units, and strict internal controls.

Organizations with extensive RevOps and finance resources that can support heavy implementation and ongoing administration.

4. Maxio

Maxio is a finance-led billing and revenue platform built for teams that care first about accounting correctness. It brings subscriptions, revenue recognition, and financial reporting into one system, with a heavy focus on GAAP/IFRS compliance and audit readiness.

At its core, Maxio is designed for CFOs and RevOps teams who need clean books and reliable SaaS metrics. You get built-in visibility into MRR, churn, and cohorts, plus tooling for deferred revenue and recognition schedules, useful when finance needs answers fast for board decks or audits.

Where Maxio starts to show limits is in flexibility. It works well for predictable subscription businesses, but usage-heavy products or fast-changing pricing models tend to run into friction. Setup is also more involved than newer product-led billing tools.

Key features

Handles ASC 606 and IFRS 15, including allocating revenue across multiple deliverables and recognizing annual contracts month by month.

Keeps deferred and recognized revenue in sync as invoices go out, so financial statements stay aligned without manual adjustments.

Provides dashboards for MRR, ARR, churn, cohorts, LTV, and other core metrics finance teams rely on for reviews and forecasting.

Supports multiple entities and consolidated reporting on upper tiers, with FX updates baked into billing.

Connects with ERPs like NetSuite and QuickBooks, common CRMs, payment gateways, and Maxio’s own payments stack.

Pros

Strong GAAP/IFRS support, detailed audit trails, and dependable revenue reporting — helpful for fundraising, audits, or IPO prep.

Covers revenue, deferred revenue, AR aging, and SaaS KPIs in one place, reducing reliance on spreadsheets or external BI.

Supports common workflows like annual contracts with monthly recognition, renewals, co-terming, and seat-based pricing.

Cons

Expect months, not weeks. Product mapping, revenue rules, and accounting policies take real upfront effort, and many teams bring in consultants.

Because everything is finance-driven, adding new pricing models or adjusting billing logic often requires support involvement and careful reconfiguration.

Accountants feel at home. Product and engineering teams usually don’t.

Pricing

Maxio offers tiered plans that reward growth, starting around $599/month for standard billing and rising to custom enterprise pricing for high volume and advanced revenue operations.

Best for

SaaS companies with dedicated finance or RevOps teams that need strict compliance, audit-ready reporting, and structured revenue processes.

Businesses with stable pricing (annual contracts, seat tiers) that prioritize accounting accuracy over rapid pricing experimentation.

.

5. Chargebee

Chargebee is a subscription billing platform that many mid-market SaaS teams start with once recurring revenue becomes real. It covers the basics well: plan management, trials, proration, dunning, and automated invoicing. It also connects with most of the tools finance and RevOps already use.

Where things get tricky is multi-entity.

Chargebee technically supports multiple entities, but each one lives in its own “site.” That means separate instances, separate configs, and separate data. If you’re running one or two entities, this is manageable. Once you expand globally, it turns into operational overhead fast, especially when finance needs consolidated reporting.

Key features

Let's price in different currencies and customize invoices by region.

Supports trials, upgrades, downgrades, proration, pauses, add-ons, and one-time charges with consistent billing logic.

Works with tools like Salesforce, HubSpot, QuickBooks, NetSuite, Stripe, Braintree, PayPal, and Avalara.

Offers ASC 606 / IFRS 15 schedules through a paid module.

Pros

Handles the day-to-day mechanics of SaaS billing — plans, changes, proration, dunning without surprises.

Built-in currency and localization features help if you sell across regions (even though entities stay siloed).

Finance and support teams can manage customers and plans from the UI without pulling in engineering.

Cons

Multi-entity means multiple Chargebee sites. There’s no native consolidated reporting or shared customer view.

Moving customers, syncing configurations, or handling cross-entity workflows requires manual work.

Managing multiple gateways, tax rules, and sites adds setup overhead. Many teams end up needing consultants.

Best for

Mid-market SaaS companies with standard subscription pricing and predictable billing flows.

Teams easing into multi-entity operations who are okay with managing one or two separate Chargebee instances.

Pricing

Chargebee pricing is tiered based on revenue and feature access, with enterprise plans negotiated through sales.

How to choose the right multi-entity billing software

Most platforms will tell you that they support multi-entity billing. But the real question is how deep that support actually goes once your structure gets complicated. Here is what to actually evaluate before you commit.

Does it handle usage attribution at the entity level?

If your revenue is tied to real-time technical metrics like tokens, API calls, or compute hours, you need metering that maps usage to the right entity at the point of ingestion, not corrected after the fact. Ask the vendor directly: where does attribution happen, and what does the reconciliation process look like when it goes wrong?

Can it support your pricing model without custom engineering?

Multi-entity companies rarely run a single pricing model across all entities. If introducing a credit system or a usage tier for one entity requires an engineering sprint, that is a sign that the platform was not built for this level of complexity.

How does it handle consolidated reporting?

Your CFO needs a single view of revenue across entities, in one base currency, without manual FX adjustments. If the platform cannot produce board-ready consolidated metrics without exporting to a spreadsheet, it will become a bottleneck as you scale.

What does the account hierarchy actually look like?

Parent-child account structures should let you centralize invoicing at the parent level while preserving usage visibility at the team or subsidiary level. If this is a workaround rather than a native feature, you will feel it operationally.

Is the pricing model itself sustainable?

Percentage-of-revenue billing looks manageable early. At $2M ARR and beyond, it becomes one of your largest platform costs. Evaluate the total cost of ownership across your projected growth, not just your current ARR.

What are the compliance and audit capabilities?

Operating across entities means operating across regulatory environments. SOC II compliance, full contract version history, and audit-ready invoicing are not nice-to-haves when you are closing enterprise deals or preparing for a fundraise.

Why is Flexprice the perfect multi-entity billing software for you?

Most billing platforms were built for one entity, one currency, one pricing model. Multi-entity support got added later in their system, and you can feel it in the workarounds.

FlexPrice was built differently.

The core architecture assumes complexity from the start. Parent-child account hierarchies, real-time usage attribution, credit pooling across teams, and consolidated invoicing are not just add-ons. They are how the platform works by default.

For AI-native companies specifically, this matters more than it sounds. Your revenue is tied directly to technical metrics that move in real time. A token consumed in your global entity needs to hit the right wallet, the right invoice, and the right revenue line without a manual correction cycle at month-end. Flexprice handles that at the metering layer, before it becomes a finance problem.

The open-source foundation means you are never locked into a vendor's interpretation of how multi-entity billing should work. You can extend it, audit it, and adapt it as your entity structure grows, without waiting on a roadmap or negotiating a custom contract.

And unlike percentage-of-revenue platforms that quietly become one of your highest costs as you scale, Flexprice's pricing does not penalize you for growing.

If you are at the point where your current billing setup is holding back how fast you can expand into new markets, launch new pricing models, or give your finance team the consolidated visibility they need, Flexprice is especially built for that stage.

Wrapping up

Multi-entity billing is one of those problems that looks manageable until it isn't. You add a second entity, then a third market, then an enterprise customer who wants centralized invoicing.

This is what causes team-level usage breakdowns, and suddenly, your billing setup becomes the main hurdle that slows everything down.

All platforms mentioned on this list solve parts of that problem. The right choice depends on where you are today and where your structure is heading in the next 12 to 18 months.

But if you are an AI-native or usage-first SaaS company that needs accurate usage attribution across entities, pricing flexibility without engineering dependency, and consolidated reporting your finance team can actually trust, Flexprice, which is worth a serious look.

It is open source, built for the complexity that comes with real growth, and priced in a way that does not work against you as your revenue scales.

If you are still figuring out which direction to go, start with the evaluation criteria in this guide. The right platform is the one that handles your current structure cleanly and does not become a ceiling when your next entity goes live.

Frequently Asked Questions

Frequently Asked Questions

Frequently Asked Questions

What is multi-entity billing software for AI and SaaS companies?

What is multi-entity billing software for AI and SaaS companies?

What is multi-entity billing software for AI and SaaS companies?

What is multi-entity billing software for AI and SaaS companies?

What is multi-entity billing software for AI and SaaS companies?

What features should the best enterprise billing software include in 2026?

What features should the best enterprise billing software include in 2026?

What features should the best enterprise billing software include in 2026?

What features should the best enterprise billing software include in 2026?

What features should the best enterprise billing software include in 2026?

How is multi-entity billing software different from subscription billing tools?

How is multi-entity billing software different from subscription billing tools?

How is multi-entity billing software different from subscription billing tools?

How is multi-entity billing software different from subscription billing tools?

How is multi-entity billing software different from subscription billing tools?

Can multi-entity billing handle usage-based pricing?

Can multi-entity billing handle usage-based pricing?

Can multi-entity billing handle usage-based pricing?

Can multi-entity billing handle usage-based pricing?

Can multi-entity billing handle usage-based pricing?

How does Flexprice help with multi-entity consolidation?

How does Flexprice help with multi-entity consolidation?

How does Flexprice help with multi-entity consolidation?

How does Flexprice help with multi-entity consolidation?

How does Flexprice help with multi-entity consolidation?

Ayush Parchure

Ayush Parchure

Ayush Parchure

Ayush is part of the content team at Flexprice, with a strong interest in AI, SaaS, and pricing. He loves breaking down complex systems and spends his free time gaming and experimenting with new cooking lessons.

Ayush is part of the content team at Flexprice, with a strong interest in AI, SaaS, and pricing. He loves breaking down complex systems and spends his free time gaming and experimenting with new cooking lessons.

Share it on: