Aanchal Parmar

Product Marketing Manager, Flexprice

Feature-Level Comparison

1. Real-time usage metering (high-volume, low latency)

Flexprice

Flexprice is designed for real-time ingestion of granular events like API calls, tokens, or GPU-seconds. It is built to handle 20bn+ events per month without batching delays or lag, making it suitable for AI and infra workloads.

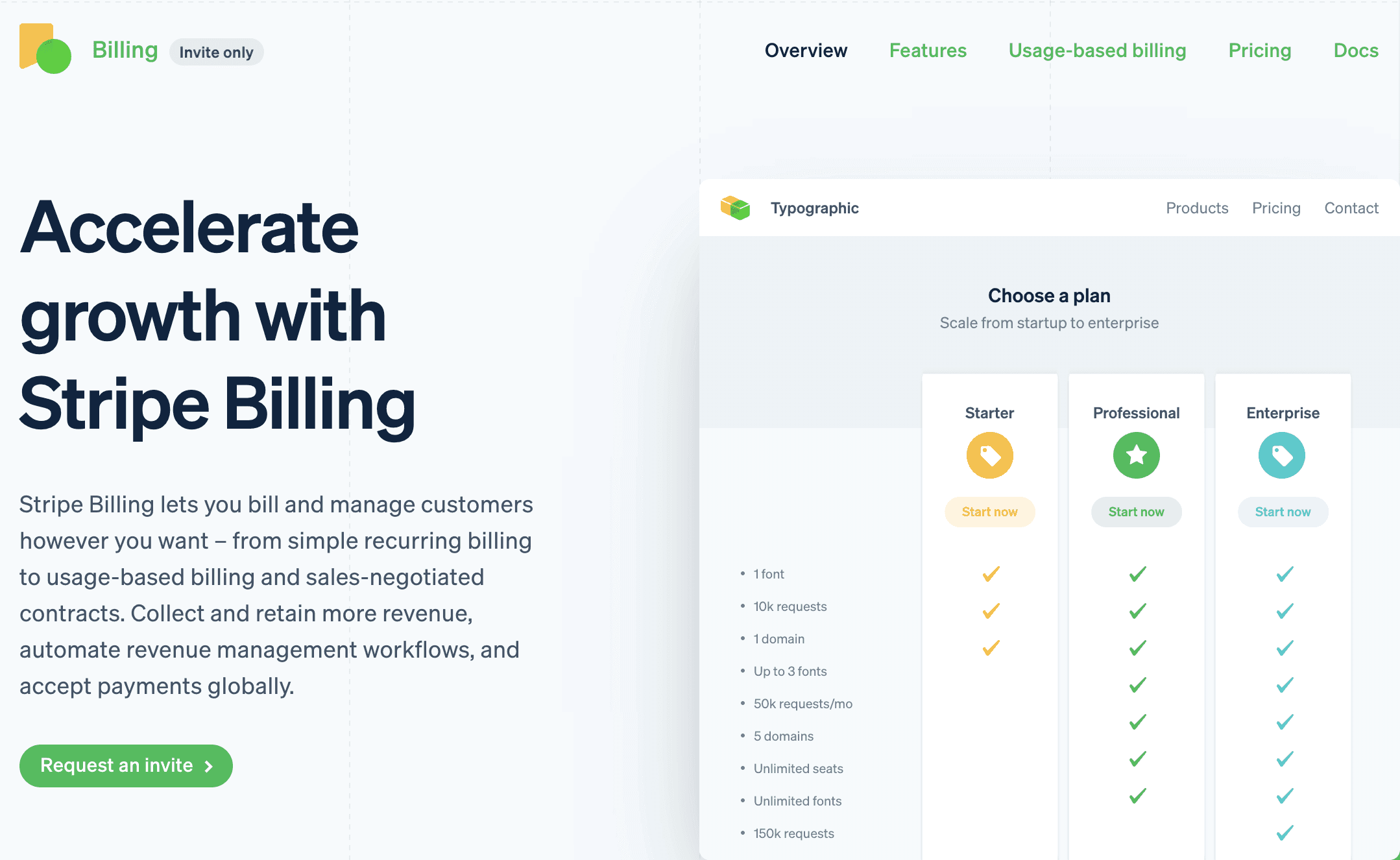

Stripe

Supports usage-based billing through meters, but usage is typically period-aggregated, not optimized for ultra-high-volume real-time streams.

Many teams throttle or pre-aggregate usage before sending to Stripe.

Chargebee

Usage billing exists, but ingestion is generally batch-oriented and better suited for SaaS-scale usage rather than infra-scale or AI token-level events.

Verdict: Flexprice is purpose-built for real-time, infra-scale usage. Stripe and Chargebee assume lower-frequency usage patterns.

2. Usage ingestion and event model

Flexprice

Flexprice is designed around ingesting granular usage events and then applying metering and pricing rules on top of that event stream.

Usage is modeled as structured events with attributes (such as model, region, or workload), and billing is derived from those events rather than the other way around.

This makes it well suited for usage-heavy and multi-dimensional pricing models where billing logic needs to evolve without changing product code.

Stripe

Stripe uses meters and meter events to record usage. Applications send usage events to Stripe, which aggregates them over a billing period and converts them into invoice line items.

Usage is primarily treated as billing input rather than as a general-purpose telemetry or analytics stream. This model works well for teams that want Stripe to handle billing aggregation, while product analytics and higher-volume telemetry typically live elsewhere.

Chargebee

Chargebee records usage via its Usages API or usage file uploads and associates that usage with catalog items or metered features on a subscription. Usage is tied directly to plans and features and is used to calculate charges on top of a base plan.

This model works well for SaaS-style usage (for example, monthly API calls, seats, or feature consumption), and is often used in batch or periodic reporting flows rather than continuous, high-frequency streaming.

Verdict: Flexprice wins on usage ingestion and event modeling because it treats usage events as the primary primitive and derives billing from them, while Stripe and Chargebee primarily treat usage as an input into their billing and subscription systems.

3. Aggregation functions and rating logic

Stripe, Chargebee, and Flexprice all support usage aggregation, but they differ significantly in how expressive those aggregations are and where complex rating logic is expected to live.

Flexprice

Flexprice supports a broader set of aggregation types directly on the event stream, including sum, count, unique count, latest, max, and weighted sum, all configurable declaratively.

Events are ingested as raw facts, and metering logic (including these aggregations) is applied within Flexprice itself, so you do not need to pre‑compute complex metrics in your app before sending them.

This design lets teams support more advanced, product‑specific billing models such as per‑model usage, weighted workloads, or unique entities, while keeping billing logic in the billing platform instead of scattering it across custom pipelines.

Stripe

Stripe supports built-in aggregation modes on meters, such as summing usage over a period or taking the latest or maximum reported value.

These aggregation modes are defined when the meter is created and are applied uniformly over each billing interval before usage is converted into invoice line items. This works well for straightforward usage models, but the structure is intentionally simple.

More advanced logic, such as filtered metrics, unique entity counts, weighted calculations, or composite rules, is typically computed in the application before sending usage to Stripe.

This keeps Stripe’s billing layer clean and predictable, but pushes complex metering logic into the product and data pipelines.

Chargebee

Chargebee lets you configure how each metered feature aggregates usage across a billing period using operations such as Sum, Count, Min, Max, and Average.

This fits standard SaaS usage patterns like “per API call,” “per seat,” or “per GB stored,” where a single aggregate number per feature per period is sufficient.

Chargebee does not natively support richer aggregation patterns such as unique counts, filtered subsets, or weighted metrics, so use cases like “unique active users,” “per-model usage,” or other custom rollups usually require preprocessing usage in your own systems before sending it as metered quantities.

As a result, Chargebee handles typical SaaS metering well but is less flexible for highly custom or multi-dimensional usage models.

Verdict: Flexprice wins on aggregation and rating logic because it is designed to apply richer aggregation and pricing rules directly on usage events, whereas Stripe and Chargebee intentionally keep aggregation simple and push complex rating logic into the application layer.

4. Multi‑dimensional usage (model/region/latency)

Flexprice

Flexprice ingests structured usage events that can include attributes such as model, region, or workload class, and those attributes can be used directly in metering and pricing rules.

This makes it possible to support multi-dimensional pricing, for example charging different rates for different models or regions, without having to create a separate meter or catalog item for every combination.

As a result, teams can evolve pricing across dimensions without significantly increasing catalog or configuration complexity.

Stripe

Stripe can support multi-dimensional usage, but this is typically modeled through careful meter and price design, for example by creating separate meters or prices for different models or regions.

As the number of dimensions grows (model × region × workload, etc.), this approach can lead to more billing objects and rate definitions, which increases operational and maintenance complexity over time.

Chargebee

Chargebee ties usage to specific features or add-ons in the product catalog, so multi-dimensional pricing is constrained by how the catalog is modeled.

Supporting different prices for different models or regions usually means defining separate metered features for each dimension, which can lead to a combinatorial increase in catalog items and make it harder to iterate on pricing across multiple dimensions.

Verdict: Flexprice wins on multi-dimensional usage because it treats dimensions as part of the usage model itself, whereas Stripe and Chargebee primarily express dimensions by multiplying meters, prices, or catalog items.

5. Usage visibility for internal teams

Flexprice

Flexprice exposes usage and billing data through APIs, including usage summaries by customer, meter, and feature, as well as detailed usage data.

This makes it easier to build internal dashboards that show near real-time consumption, spend, and trends across customers and products, without relying only on periodic exports or downstream finance reports. This supports closer collaboration between product, operations, and finance around usage and monetization.

Stripe

Stripe provides dashboard views of usage and meter data that are useful for basic monitoring and billing validation.

For deeper or more customized visibility, teams typically rely on Stripe Sigma or export data into external BI tools and data warehouses.

As a result, Stripe is effective for billing-oriented visibility, while product-level or operational usage analytics usually lives outside the Stripe platform.

Chargebee

Chargebee has strong billing and subscription reporting, giving finance and RevOps teams clear visibility into revenue, MRR, churn, invoices, and usage totals.

However, usage visibility is primarily oriented around billing rather than product telemetry, and teams that need granular or near real-time insights into how customers are consuming features typically export usage data and build custom dashboards in their own analytics stack.

Verdict: Flexprice wins on internal usage visibility because it is designed to expose usage data as an operational signal, while Stripe and Chargebee primarily expose usage through billing and finance reporting.

6. Auditability

Flexprice

Flexprice is designed to retain detailed usage records alongside billing and pricing data, which supports stronger traceability between invoice line items and the usage that generated them.

This makes it easier to investigate, explain, and resolve billing questions by correlating charges with underlying usage patterns, without relying as heavily on separate telemetry or logging systems.

Stripe

Stripe invoices show line items with usage totals and prices, making it clear what was billed and at what rate.

However, linking those invoice line items back to the specific product usage that generated them typically requires stitching together Stripe data (meters, invoices) with your own application logs or telemetry.

This means detailed audits or customer disputes often involve cross-referencing multiple systems.

Chargebee

Chargebee invoices show usage totals and prices per metered feature, so it is straightforward to see how much was charged for each feature in a billing period.

However, Chargebee does not provide event-level visibility into the underlying product activity, so investigating detailed questions like “which exact API calls or users contributed to this charge” usually requires referring back to your own usage tracking systems.

Verdict: Flexprice wins on auditability because it is designed to preserve a closer link between usage data and billing outcomes, while Stripe and Chargebee focus on invoice-level transparency and rely on external systems for deeper traceability.

7. Guardrails and abuse/risk controls

Flexprice

Flexprice is designed to pair billing with wallets, credits, entitlements, and usage limits, which allows teams to define spend limits, expiry policies, and balance-based controls at the account level.

When combined with feature gating in the product, this provides a more structured way to manage risk and abuse without pushing all guardrail logic into custom billing and pricing pipelines.

Stripe

Stripe can surface alerts and usage or spend thresholds, but enforcement and gating are typically implemented in the product itself using webhooks, limits, or custom logic.

Stripe does not have a native wallet or credit abstraction, so spend controls and abuse prevention are usually built as application-level logic on top of meters, prices, and invoices.

Chargebee

Chargebee can track usage against plan limits and trigger notifications when thresholds are reached, which is useful for billing and customer communication.

However, stronger guardrails such as hard spend caps, real-time blocking, or abuse prevention are usually implemented in the product or through external systems and integrations, rather than directly within Chargebee.

Verdict: Flexprice wins on guardrails and risk controls because it provides native constructs for limits, credits, and entitlements, while Stripe and Chargebee rely primarily on external enforcement and product-side logic.

8. Credit‑Based Pricing

Flexprice

Flexprice treats wallets and credits as a core billing concept and this makes it a great alternative to Stripe and Chargebee. You can create wallets per customer, track balances, and see detailed balance and transaction history for grants, top-ups, and usage deductions, so you always know what the balance is, how it changed, and why.

For recurring or promotional credits, Flexprice supports defining cadence (for example monthly or quarterly), priority (promo vs prepaid), and expiry policies.

Rollover behavior (carrying unused credits forward) is handled through grant and expiry configuration rather than as a separate “rollover” feature.

Flexprice supports defining burn priority (for example, promotional credits first, then prepaid), and wallets can be restricted by price type or feature. Top-ups and low-balance alerts are available, which makes prepaid and credit-based flows easier to implement.

For real-time enforcement, Flexprice pairs wallets with entitlements and usage limits. When a wallet reaches zero, the product can gate or restrict access to features or workloads so unpaid usage does not continue. Enforcement still happens in the product layer, but the wallet and entitlements model provides the structure needed to implement this cleanly.

On custom credit values per feature (for example, “1 credit = 10 tokens for model A and 5 for model B”), Flexprice does not handle this at the wallet layer. Instead, this is modeled in the metering and pricing layer: the wallet holds a simple credit balance, and each feature or workload defines how many credits it consumes.

Check how Segwise Shipped Credit-Based Pricing in 3 Days After Spending 3 Weeks Building It In-House

Chargebee

Chargebee does not have a native wallet abstraction; credits are typically modeled using metered features, add-ons, allowances, and manual adjustments. You can define included quantities and track usage against them, but there is no persistent wallet balance that can be queried or enforced in real time.

Recurring or promotional credits are implemented through catalog configuration and manual adjustments. Rollover behavior is not native and usually requires custom logic, such as adjusting limits or allowances each billing period.

Burn priority (for example promo vs prepaid vs card) is not a built-in concept and must be implemented in external systems and coordinated with Chargebee’s state. Top-ups and low-balance alerts are also custom workflows: Chargebee can handle the payment side, but the logic and notifications live in your own stack.

Real-time enforcement when balances are exhausted is not handled by Chargebee itself and must be implemented in the product using your own usage tracking and gating logic.

Custom credit values per feature are modeled at the catalog and pricing layer, by defining separate metered features or prices, rather than as a flexible wallet-level conversion.

Stripe

Stripe does not have a native wallet abstraction; credits are usually implemented as a custom ledger in your own database or by using Stripe customer balances as a payment primitive. The wallet itself is not a first-class billing object.

Recurring or promotional credits are implemented using subscription logic and custom ledger entries. Cadence, priority, expiry, and rollover behavior are all custom and must be built and maintained in your application.

Burn priority (for example promo first, then prepaid, then card) also lives entirely in your own logic; Stripe does not provide a native mechanism to define or enforce this order.

Top-ups and low-balance alerts are possible using Stripe’s APIs and webhooks, but the workflows, notifications, and enforcement logic are custom. Stripe handles charging and invoicing, while the semantics of credits and balances live in your own system.

For real-time enforcement when balances reach zero, Stripe does not provide a built-in mechanism; the product must check its own ledger or Stripe balances and gate usage accordingly.

Custom credit values per feature are modeled at the meter and pricing layer (for example different prices per model or region), not as a wallet-level conversion between credits and units.

9. Hybrid Pricing

Flexprice

Flexprice is designed to support hybrid pricing models that combine seats, usage, credits, and multiple metered features in a single billing flow. Prepaid plus postpaid (prepay first, then bill in arrears for overages) is supported as a standard pattern.

Because billing is derived directly from usage and wallet state, this approach helps keep hybrid invoices clearer and makes it easier to reason about charges as pricing models evolve.

Stripe

Stripe can combine subscriptions with usage-based components, so hybrid plans are possible.

However, more complex flows such as prepaid plus postpaid (prepay first, then bill for overages) typically require stitching together multiple objects and handling edge cases in application logic.

As hybrid models become more complex, invoices can become harder to interpret, especially when credits, adjustments, and multiple usage components are involved.

Chargebee

Chargebee has strong plan and add-on modeling, which makes it straightforward to configure hybrid plans using base subscriptions plus metered features or add-ons.

For more complex usage-driven or AI-style pricing, however, the catalog can become heavy as more combinations are introduced. Prepaid plus postpaid behavior is possible using catalog patterns and manual adjustments, but it is not a first-class workflow. This can add operational complexity when managing and explaining hybrid pricing.

10. Outcome-Based Pricing

Flexprice

Because Flexprice is designed around event-based billing, outcome events can be treated as billable inputs in the same way as usage events. This makes Flexprice as one of the best choices for outcome based pricing.

Attribution, corrections, and reversals can be modeled using billing adjustments and usage corrections rather than being entirely hard-coded in product logic.

This makes it easier to represent outcome-based pricing in the billing layer itself, while still relying on the product to emit and validate outcome events.

Stripe

It is possible to model outcomes as metered usage in Stripe, but the logic to verify outcomes, define attribution windows, and handle reversals or corrections lives entirely in the application.

Stripe does not provide built-in workflows for outcome validation, delayed attribution, or automatic reversals, so these behaviors must be implemented and maintained in product and data pipelines.

Chargebee

Outcome-based pricing can be modeled in Chargebee, but it is typically catalog-heavy: each outcome type is represented as a feature or add-on in the product catalog.

Reversal logic, such as refunding or adjusting charges when outcomes fail, is not a native billing concept and must be implemented externally through custom workflows and manual adjustments.

Verdict: Flexprice wins on outcome-based pricing because it can treat outcomes as first-class billable events, whereas Stripe and Chargebee require outcome logic to be modeled and managed almost entirely outside the billing system.

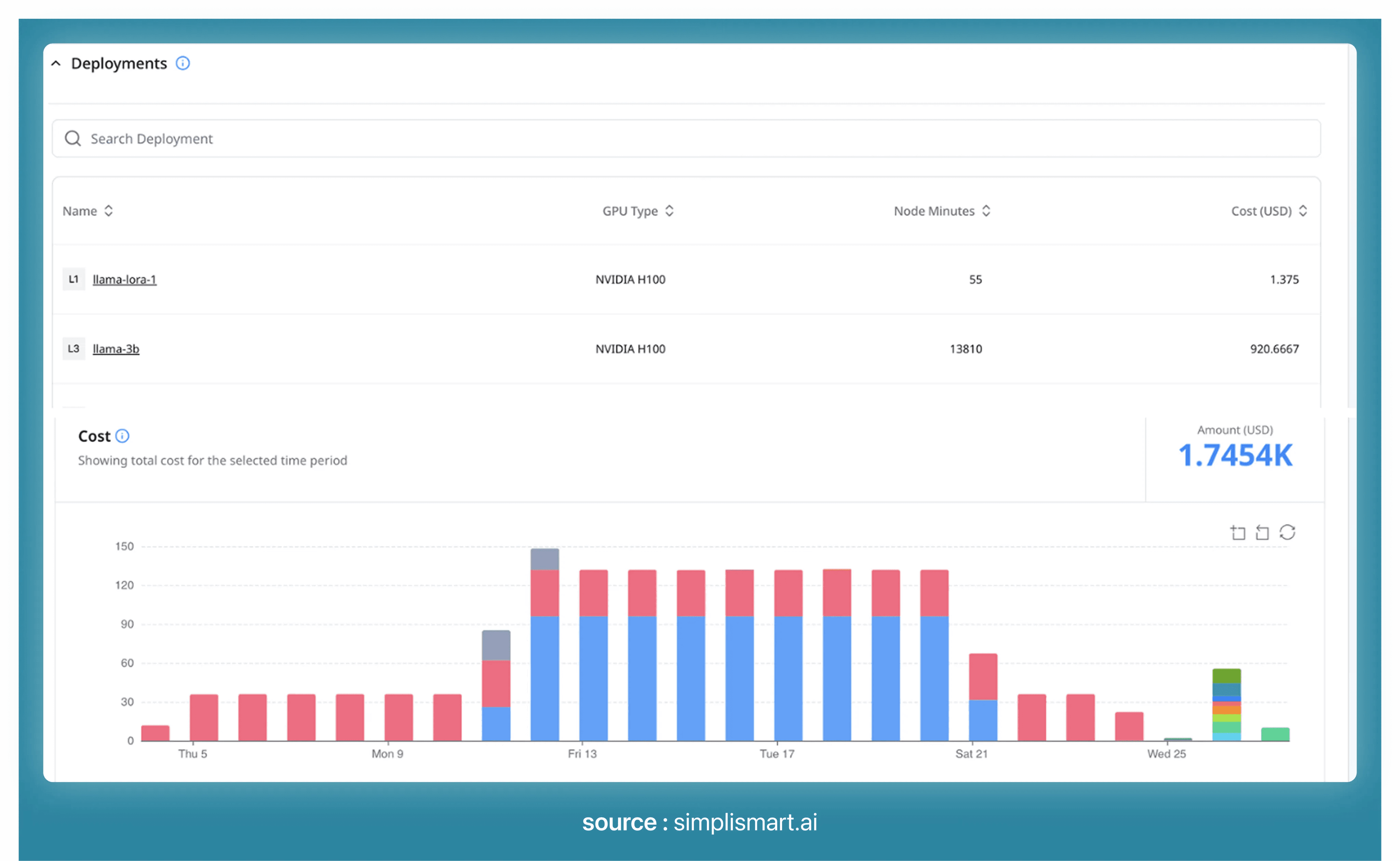

11. AI cost sheet / internal cost visibility

Flexprice

Flexprice is designed for usage-based pricing and billing in AI and infrastructure products, with metering, pricing, credits, and billing integrated into a single system.

It supports mapping usage to internal cost models and exposing cost and margin data alongside billing and usage.

This makes it easier to analyze cost, revenue, and margin by customer, feature, or model without building and maintaining separate cost attribution pipelines, and to use that information for pricing, engineering, and financial decision-making.

Chargebee

Chargebee supports usage-based billing with aggregation (for example sum and count) and includes metered usage on invoices and in reports.

It is strong for billing and revenue visibility, but it does not provide a built-in internal cost sheet that ties usage events to underlying resource costs such as LLM tokens or GPU time.

There is no native view that automatically aggregates cost, revenue, and margin, so teams that need unit economics or cost analysis typically export usage and billing data and build cost reporting in BI tools or internal dashboards.

Stripe

Stripe Billing supports usage-based billing, usage meters, and internal analytics, and it offers primitives for recording token usage and pricing for LLM workloads.

Stripe Sigma provides full SQL access to usage, invoices, and related data, which makes it possible to build detailed internal cost and margin reports.

However, Stripe does not provide a native, out-of-the-box cost sheet that automatically maps raw usage to provider cost and revenue. Teams typically rely on Sigma queries or external BI tools to construct internal views of cost versus revenue and margin.

Verdict: Flexprice wins on AI cost visibility because it is designed to connect usage, pricing, and internal cost data, while Stripe and Chargebee rely on external analytics to build comparable cost and margin views.

12. Customer dashboard API

Flexprice

Flexprice is designed so that usage, credits, and billing data can be exposed to both customers and internal teams without building a separate analytics stack.

It provides APIs on top of its low-latency usage ingestion pipeline, which can be used to power dashboards showing current usage, burn rate, credit balance, and charges as they accrue, not just at invoice time.

Because usage, credits, and billing are modeled within the same system, Flexprice can expose granular, line-item-level detail that ties each charge back to the underlying usage that generated it.

Stripe

Stripe’s Customer Portal is focused on invoices, payment methods, and basic subscription management.

Customers can see what they have been billed and manage their payment details, but they do not get granular or near real-time usage visibility out of the box.

To provide a live usage dashboard, teams typically need to build a custom front end on top of Stripe’s APIs, meters, and events, which adds engineering overhead and separates billing from usage analytics.

Chargebee

Chargebee offers a hosted self-serve portal that is strong on subscription and invoice management, making it easy for customers to manage plans, view bills, and update payment details.

However, near real-time usage transparency is limited: while metered usage can be included on invoices and raw usage can be pulled via the Usages API, anything beyond that (such as burn-down charts, time-based usage breakdowns, or live credit consumption) usually requires exporting data and building custom dashboards or analytics on top.

Looking at the feature sets side by side, Chargebee exposes usage primarily through invoices, reports, and APIs, but does not provide a native near real-time usage dashboard or burn-rate visualization.

Stripe similarly focuses on billing and payments and relies on custom integrations for usage transparency.

Flexprice, by contrast, is designed around low-latency usage ingestion and unified modeling of usage, credits, and billing, which makes it easier to build customer-facing and internal dashboards that reflect current consumption and charges.

Verdict: Flexprice wins because it is architected to treat usage as a first-class signal that can be exposed to users, not just something summarized on invoices.

13. Ramped contracts

Flexprice

Flexprice is designed to support ramped pricing as a standard enterprise use case rather than an edge case.

It provides built-in support for defining phased pricing, commitments, or rate changes over time, so enterprise contracts can move from pilot to scale according to a predefined schedule.

Ramps can be configured once and then used to drive billing, proration, and reporting across phases, which reduces the need for manual intervention or custom code as contracts evolve.

Stripe

Stripe can model ramped pricing using subscription schedules or by manually updating prices over time.

However, each phase of a ramp typically involves coordinating multiple objects such as prices, subscriptions, and proration rules.

As the number of ramped contracts grows, this approach can become operationally complex and harder to manage reliably.

Chargebee

Chargebee supports ramp deals through its advanced billing and plan configuration features, allowing teams to define phased pricing for enterprise customers.

However, as the number of customers and pricing variations increases, these configurations can become rigid and admin-heavy, requiring careful catalog and plan management to avoid operational complexity.

Verdict: Flexprice wins because ramping is treated as a first-class workflow rather than a workaround.

14. Parent-child accounts

Flexprice

Flexprice is designed to support parent–child billing structures, including consolidated usage and shared credit pools across teams or workspaces.

You can model a parent account with multiple child workspaces, roll usage up to the parent, and apply shared credits or commitments at the parent level.

This makes it well suited for platform businesses, resellers, and multi-team enterprise setups where shared usage and centralized billing are required.

Relative to traditional billing systems, Flexprice is more flexible for modern B2B and platform billing models where parent–child relationships, shared credits, and consolidated usage are core parts of the pricing and billing design.

Stripe

Stripe Billing does not provide a native billing hierarchy model. Teams that need parent–child relationships typically implement them using Stripe Connect or maintain their own account hierarchy in application code, and then layer billing logic on top.

This approach is flexible, but it adds operational complexity and maintenance overhead.

Chargebee

Chargebee supports account hierarchies that allow you to define parent and child accounts and centralize invoicing at the parent level.

This model is primarily oriented around invoice ownership and payment flows rather than shared usage pools or shared credits across the hierarchy, so more advanced sharing models usually require additional logic or external systems.

15. Feature management and entitlements

Flexprice

Flexprice is designed so that features and entitlements are closely aligned with billing and usage.

Entitlements can be tied to plans, usage metrics, or credit balances, which makes it easier to coordinate feature access, limits, and pricing in one model.

This helps keep billing, usage, and feature access in sync and reduces the need for custom glue logic between pricing and product systems.

Stripe

Stripe supports entitlements primarily through subscription status and product or price associations.

While these primitives can be used to drive basic feature access, they are not deeply integrated with granular usage or credit logic by default.

As a result, fine-grained gating, such as enabling or disabling features based on usage thresholds or balances, typically lives in application code.

Chargebee

Chargebee has a strong entitlements model for classic SaaS plans, where features are mapped to plans and add-ons and used for product gating.

However, the model is less dynamic for usage-heavy or AI-style products, where entitlements may need to react to granular usage patterns, credits, or near real-time consumption.

Verdic: Flexprice wins on feature management and entitlements because it is designed to align feature access with usage and pricing, while Stripe and Chargebee focus primarily on plan-based entitlements and rely on application logic for dynamic gating.

16. Automated invoicing and unified billing

Flexprice

Flexprice is designed to generate invoices that combine subscriptions, granular usage, credits, and adjustments into a single document.

This is particularly useful for AI and usage-heavy products where prepaid credits, overages, and contract-specific terms all need to appear together in a way that finance teams and customers can reconcile clearly.

For teams evaluating Chargebee alternatives or Stripe alternatives specifically because of usage-first or credit-based pricing needs, this unified approach can reduce the need for stitching together multiple billing systems.

Stripe

Stripe provides a strong invoicing engine that ties directly into subscriptions and usage meters. It works very well for subscription-plus-usage scenarios. But more complex constructs such as multiple credit types, prepaid wallets, or custom credit logic typically require additional modeling in the application or in surrounding systems.

As a result, some teams look for Stripe alternatives when their pricing or billing requirements go beyond what Stripe Billing natively supports.

Chargebee

Chargebee is widely regarded as strong in invoicing, credit notes, dunning, and general billing operations.

Its strength lies in mature, finance-oriented workflows, making it a common choice for companies that need robust accounts receivable processes and detailed invoice handling out of the box.

At the same time, companies with highly usage-driven or AI-native business models sometimes explore Chargebee alternatives when the catalog and subscription-centric model becomes operationally heavy.

Verdict: Chargebee wins on automated invoicing and billing operations because it is built primarily as a finance and RevOps platform, while Stripe and Flexprice prioritize programmability and usage-driven billing respectively.

17. Plan versioning and overrides

Flexprice

Flexprice allows per-customer or cohort-level overrides without always requiring full plan migrations or heavy catalog changes.

You can adjust prices, attach custom terms, or run pricing experiments on specific segments, which makes it easier to iterate on pricing and negotiate enterprise deals.

This is often one of the reasons teams exploring Stripe alternatives or Chargebee alternatives look for a system that can support faster, more flexible pricing changes.

Stripe

In Stripe, overrides usually involve creating new Prices, attaching them to specific customers, or managing multiple subscriptions per account.

This approach is flexible, but it can lead to catalog sprawl over time and make it harder to keep a clean and understandable pricing model, especially as the number of custom deals grows.

Chargebee

Chargebee supports plan overrides through add-ons, coupons, and custom pricing configurations.

However, doing this at scale often requires careful plan and catalog management to avoid a proliferation of similar plans, which can increase administrative overhead for RevOps and finance teams. One reason some companies later explore Chargebee alternatives when pricing becomes more dynamic.

Verdict: Flexprice wins on plan versioning and overrides because it allows targeted pricing changes without excessive plan duplication, while Stripe and Chargebee rely more heavily on cloning prices or plans.

18. Low‑engineering integration

Flexprice

Flexprice offers developer-first APIs, SDKs, and webhooks so that integration focuses more on sending events and wiring integrations than on writing custom billing logic.

Most billing behavior such as metering, aggregation, credits, and pricing can be configured in the platform rather than hard-coded into your application.

This is one reason teams looking for Stripe alternatives or Chargebee alternatives often choose Flexprice when they want to reduce engineering ownership of billing.

Stripe

Stripe is known for excellent APIs and developer experience, but advanced billing logic often ends up living directly in your codebase.

For complex usage models, credits, or hybrid flows, engineering teams typically own a substantial portion of the billing behavior, which can slow down iteration for non-technical stakeholders.

Chargebee

Chargebee is more admin-driven: a lot of configuration happens through the UI, which works well for standard SaaS workflows but can become limiting for non-standard or highly dynamic pricing.

When you move beyond classic subscription models, engineering effort often increases because you need custom integrations or glue logic around the core product.

Winner: Flexprice wins because it centralizes billing logic in configuration rather than code.

19. Payment gateway integrations

Flexprice

Flexprice integrates with multiple payment providers such as Stripe, Razorpay, and others, while keeping billing logic decoupled from the payment processor.

This means you can add or switch gateways without rewriting your billing core, which helps reduce long-term dependency on any single payment provider.

This is one reason teams evaluating Stripe alternatives or Chargebee alternatives often look for a billing layer that sits cleanly above payments.

Stripe

Stripe Billing is tightly integrated with Stripe Payments. That close coupling is convenient if you are fully committed to the Stripe ecosystem, but it also means your billing workflows are strongly coupled to Stripe’s payment stack and roadmap.

Chargebee

Chargebee supports multiple payment gateways and can route payments through different providers, while Chargebee itself remains the primary billing system of record.

This provides flexibility at the payment-processor layer, while keeping billing logic centralized within Chargebee.

Verdict: Flexprice wins on payment gateway flexibility because it decouples billing from payments, while Chargebee provides multi-gateway routing within a centralized billing system and Stripe tightly couples billing to its own payment stack.

20. Multi‑currency support

Flexprice

Flexprice supports multi-currency billing and localized pricing, allowing you to define billing currencies at the plan or usage charge level and charge customers across regions and currencies.

This makes it possible to localize pricing and set region-specific rates while keeping usage and contract logic consistent, a capability that helps companies scale revenue globally without managing separate billing stacks per locale.

Teams exploring Stripe alternatives or Chargebee alternatives often prioritize multi-currency flexibility to avoid manual FX handling and complex reconciliation.

Stripe

Stripe offers strong multi-currency capabilities, including pricing and billing in many currencies, automatic FX handling, and settlement in supported currencies.

Its extensive international payment infrastructure makes it a solid choice for global subscription and usage billing, particularly for teams already committed to the Stripe ecosystem.

Chargebee

Chargebee provides robust multi-currency support, including region-specific price lists and localized invoicing.

It allows customers to be billed in their local currencies with flexible exchange rate options, making it a mature choice for SaaS businesses expanding internationally.

At the same time, organizations with very dynamic, usage-driven pricing needs might explore Chargebee alternatives when they need finer control over pricing rules per region or usage model.

Verdict: For global AI and usage-heavy products, Flexprice and Stripe both support strong multi-currency billing; Flexprice adds flexibility in pricing rules tied to usage and contracts, while Chargebee and Stripe provide robust out-of-the-box FX and currency settlement.

21. Security and compliance

Flexprice

Flexprice follows SOC 2–aligned practices and is built with enterprise security expectations in mind, particularly around handling sensitive usage, pricing, and billing data for AI and SaaS workloads.

For teams evaluating Stripe alternatives or Chargebee alternatives, this security posture is important when billing becomes part of core infrastructure rather than just a back-office function.

Stripe

Stripe has an industry-leading compliance posture, including PCI DSS Level 1, SOC reports, and multiple ISO certifications.

It is widely trusted as a payment and billing infrastructure vendor across industries, especially for companies that prioritize best-in-class security and regulatory coverage from day one.

Chargebee

Chargebee also offers enterprise-grade compliance, with certifications and controls designed to satisfy mid-market and enterprise customers.

For many SaaS companies, it serves as a trusted billing and revenue operations platform, although teams with more usage-heavy or AI-native workflows sometimes explore Chargebee alternatives when their billing and security needs evolve.

Verdict: Stripe leads on formal compliance breadth, while Flexprice and Chargebee meet enterprise security expectations with models better aligned to modern usage-driven and SaaS billing needs.

22. Community and support

Flexprice

Flexprice leans into a builder-centric support model with an active Slack community and hands-on help during integration and iteration.

This makes it easier for product and engineering teams to get quick feedback, share patterns, and move faster on pricing and billing changes, one reason teams exploring Stripe alternatives or Chargebee alternatives often value a more collaborative support experience.

Stripe

Stripe provides extensive documentation, reference examples, and ticket-based support. The ecosystem around Stripe is large and mature, and many developers are familiar with its APIs, but support typically flows through structured documentation and ticketing rather than community-driven collaboration.

Chargebee

Chargebee offers primarily ticket-driven and account-managed support, with a focus on helping finance and RevOps teams operate billing reliably.

It is well suited for organizations that prefer structured, account-manager-led engagements, although teams looking for more hands-on or product-centric collaboration sometimes explore Chargebee alternatives.

Billing Challenges Faced by AI and Modern SaaS Teams

Variable unit economics (tokens, GPU time, API calls): Every customer and workload has a different cost curve, so pricing and margins are constantly in flux.

Need for real-time usage tracking and enforcement: Teams must see usage as it happens and enforce limits instantly to avoid surprise bills and runaway infra costs.

Credit-based and hybrid pricing becoming standard: Customers expect simple “buy credits + base fee” models, which require tight coordination between wallets, subscriptions, and metering.

Frequent pricing and packaging changes: Product and GTM teams iterate on plans, tiers, and bundles often, so billing needs to adapt in hours, not quarters.

Customer-specific contracts and overrides: Enterprise deals come with bespoke terms, discounts, and ramps that must be modeled cleanly without breaking the core catalog.

Finance needs accuracy while product needs speed: Finance demands precise, auditable numbers, while product and sales push for rapid experiments, creating constant tension on the billing stack.

How to choose the right usage based billing tool for AI startup

1. Start with your pricing reality

Before picking a billing tool, look at how you actually charge customers today. Are you mostly selling seats, running heavy usage, or doing something in between with credits and hybrid plans?

Your current pricing reality should drive your tooling choice, because changing billing platforms is much harder than updating a pricing page.

2. Ask where billing logic should live

This is the most important and most overlooked question.

With Chargebee, Billing logic lies in the admin dashboard; You configure plans, coupons, and changes mostly through an admin UI. This gives strong back‑office workflows but makes experimentation slower and less flexible for non‑standard pricing.

For Stripe, Billing logic in your application code. You get maximum flexibility, but your engineers now own billing logic, edge cases, and migrations. Billing becomes a product‑engineering concern and competes with feature work.

Billing logic lives as configuration shown over APIs in Flexprice, rather than being hard‑coded in your application. Pricing lives outside app code as configurable meters, plans, and contracts, with APIs to wire it into your product. This makes pricing changes faster and less risky because you are not redeploying application logic every time you tweak a plan.

3. Evaluate how fast you need to iterate pricing

If you tweak pricing every few weeks, rigid subscription‑first tools will slow you down; you need something that lets you change pricing as configuration, not code.

If you regularly run pilots before full enterprise rollout, you need proper ramped contracts so you can move from pilot to scale without manual work.

If different customers end up with different pricing logic, you need clean overrides and hierarchies rather than duplicating plans. If you expect pricing to keep changing as the product matures, you should lean toward usage‑first billing.

5. Look at usage and scale honestly

Ask yourself whether you are billing millions or billions of events, whether customers expect real‑time usage visibility, and whether you need tight cost alignment with infrastructure like GPUs, tokens, and compute seconds.

If the answer is yes, batch‑based usage models will eventually slow you down, credit systems become unavoidable, and manual reconciliation turns into a hidden tax on growth.

In that world, usage‑native systems tend to outperform subscription‑first tools because they are built to handle high‑volume events, credits, and real‑time metering.

6. Understand lock-in and long-term flexibility

Stripe Billing ties your billing closely to Stripe Payments, which is great if you never plan to leave that ecosystem but limiting if you might want other processors later.

Chargebee becomes your billing system of record, centralizing plans, invoices, and finance workflows in one place.

Flexprice decouples pricing and billing logic from payment gateways, so you can treat payments as replaceable infrastructure while keeping your core billing brain independent.

Which usage based tool to choose and when?

Choose Flexprice when billing is clearly part of your product infrastructure, not just any back‑office workflow.

If your pricing is still evolving, your revenue depends on usage, credits, or hybrid models, and you care about real‑time visibility into tokens, GPU time, or API calls, Flexprice gives you a programmable, developer‑first, open stack that can actually keep up.

It lets you treat pricing as configuration instead of code, plug directly into AI‑grade metering and cost sheets, and avoid getting locked into a single payments provider as you scale.

Choose Chargebee when your business looks more like classic subscription SaaS and stability matters more than rapid pricing experiments.

If you mainly sell seats or flat plans, change pricing occasionally, and want strong revenue operations, invoicing, and rev‑rec out of the box, Chargebee is a solid, known quantity. It does a very good job when usage is an add‑on to the subscription rather than the heart of your monetization.

Choose Stripe Billing when you’re already deep in the Stripe ecosystem and want a programmable billing layer your engineers can fully control.

If your team is comfortable owning some billing logic in your application and your usage is meaningful but not at infra‑scale with complex credits, Stripe is a convenient, flexible option.

It’s especially appealing for developers‑first SaaS and API products that value building custom flows over using a dedicated billing UI.

Do Stripe or Chargebee support credit wallets natively?

Are these tools mutually exclusive?

Does Flexprice replace my payment gateway?

Can we self-host Flexprice and do you support multi-currency?

Which tool is the most flexible for pricing experiments and per-customer overrides?