Aanchal Parmar

Aanchal ParmarLearn How to Stop Losing Enterprise Deals to Broken Billing Infrastructure from Navin Persaud, VP of Revenue Operations at 1Password

Learn How to Stop Losing Enterprise Deals to Broken Billing Infrastructure from Navin Persaud, VP of Revenue Operations at 1Password

Learn How to Stop Losing Enterprise Deals to Broken Billing Infrastructure from Navin Persaud, VP of Revenue Operations at 1Password

Learn How to Stop Losing Enterprise Deals to Broken Billing Infrastructure from Navin Persaud, VP of Revenue Operations at 1Password

Feb 21, 2026

Feb 21, 2026

Feb 21, 2026

• 10 min read

• 10 min read

Aanchal Parmar

Product Marketing Manager, Flexprice

Every founder remembers their first enterprise deal. The late nights, the procurement cycles, the security reviews, the legal redlines and then the moment of peace, the signature..

And then before even the celebration ends you find yourself in between all the mess.

The invoicing. The co-termination. The prorated amendments. The integration. The custom payment terms that your finance team agreed to but nobody told your billing system about.

The renewal that's now tied to a rollout schedule that slipped by 90 days. The seat expansion that technically started three months ago but hasn't been billed yet because nobody knows whose job that is.

"They aren't ready for onboarding and rolling out the solution. The work really starts after you've won the customer."

That's Navin Persaud, VP of Revenue Operations at 1Password, a company that went from password manager for individuals to one of the most trusted enterprise security platforms in the world. He's implemented CPQ three times across different companies. He's seen what breaks. He's very clear on why it breaks.

The answer is almost never the product. It's almost never the sales team. It's the monetization infrastructure that was never built to handle enterprise complexity.

ARR doesn’t break your systems, workflow complexity does

There's a pervasive myth in SaaS that billing problems are a scale problem. That they kick in at $10M ARR. Or $50M. Or when you hire your first enterprise AE.

They don't. They kick in the moment your deals stop being uniform. The moment one customer wants annual billing paid quarterly, another wants a ramp deal where seats grow from 200 to 500 over 18 months. The moment a customer wants to co-term three separate products onto one renewal date and your biggest prospect says their procurement runs on Net-60 but your finance team has only ever done Net-30.

None of these are exotic requests. Every enterprise sales team gets them on week one. And every company that isn't prepared for them does the same thing:

Someone manually calculates the proration in a spreadsheet.

Someone builds a one-off quote in a slide deck.

Someone sends an invoice that doesn't match what the contract says.

Someone chases a payment that was due six weeks ago.

This is the sign that you've outgrown your billing infrastructure not when your ARR hits a number, but when humans start doing what systems should do.

Navin put it plainly, the breaking point isn't revenue. It's when you find yourself hiring operators whose entire job is to manage billing exceptions that a well-configured system would handle automatically. That headcount is your canary. When those roles appear, the damage is already compounding.

Stop treating CPQ as a sales tool.

When most people think of Configure-Price-Quote software, they think of it as a way to make sales reps' lives easier. Faster quotes. Fewer approval emails. Cleaner proposals.

That framing undersells it by an order of magnitude.

"CPQ is the lifeblood of a growing SaaS. The longer you wait to develop a system of quoting, the harder it is to implement based on the data you have to migrate."

What Navin is describing isn't a sales productivity tool. It's the programmable contract layer that sits between your pricing strategy and your revenue reality.

It's what makes it possible for your business to model ramp deals, co-terminations, multi-year discounts, usage uplifts, seat amendments, and renewal scenarios, without a RevOps analyst doing it by hand every time.

Without that layer, enterprise pricing becomes a negotiation your systems can't track. Deals get done. Commitments get made. And then the billing system, which only understands flat subscriptions and annual renewals, tries to reconcile it all. It can't. So humans fill the gap.

Think about the full arc of a single enterprise deal:

Sales rep quotes a ramp deal, 300 seats year one, 500 year two.

Customers want to co-term with their existing 50-seat license.

They request quarterly billing on an annual contract.

Mid-year, they add a second product.

At renewal, they want credit for unused seats from a department that churned.

That's five distinct billing events on one account. Each requires accurate prorations, credits, and contract amendments. Without programmable contracts, each of those events is a support ticket, a spreadsheet, a delayed invoice, and a frustrated customer.

With them, it's automated. The rep closes. The system handles the rest.

The triangle no one draws on the org chart.

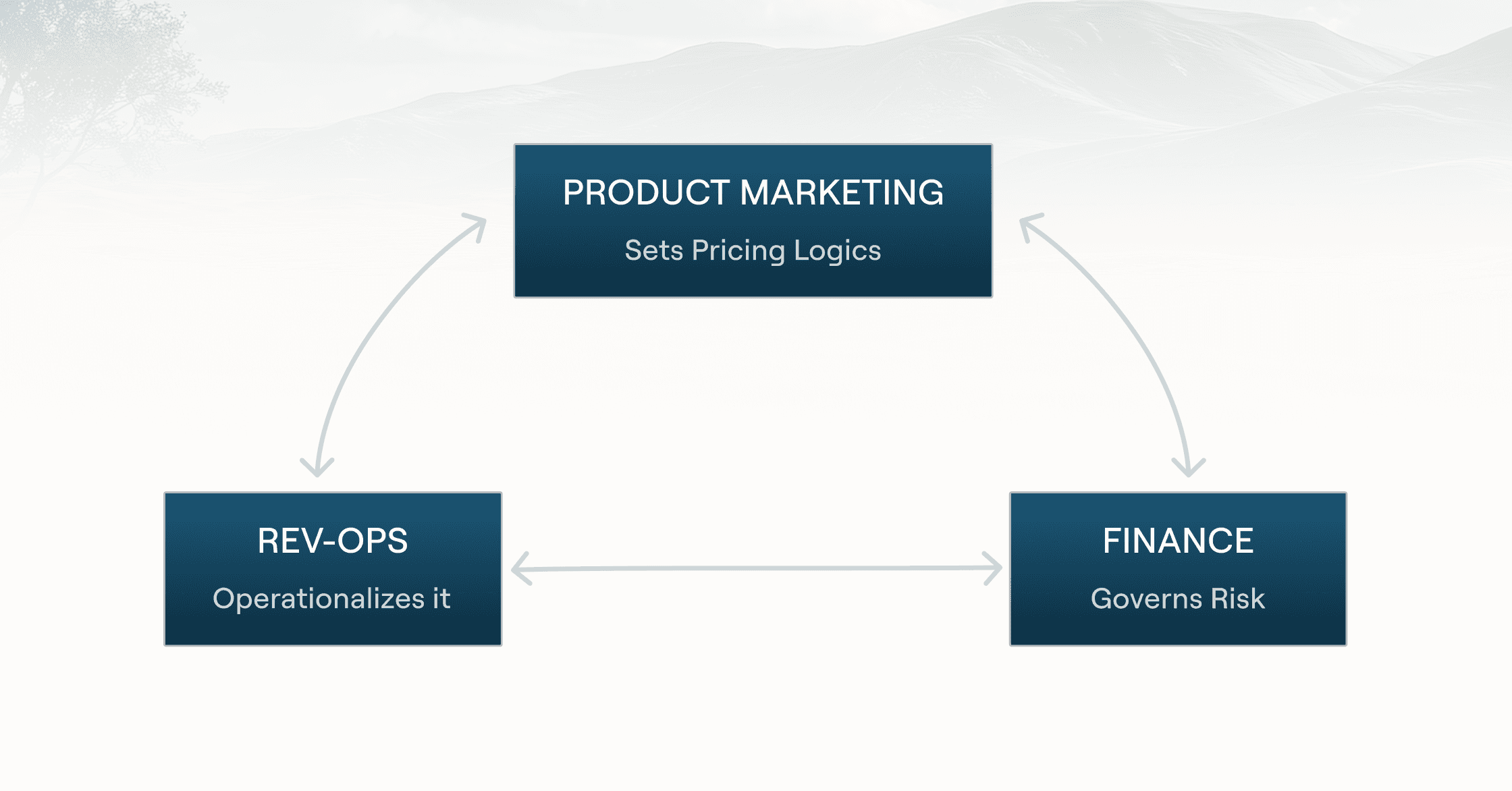

Here's a structural insight that took Navin years of scar tissue to understand clearly: monetization is not owned by any one team. It is the collision of three.

The Revenue Triangle

Product Marketing sets pricing logic. RevOps operationalizes it. Finance governs risk. When these three are misaligned, revenue leaks.

Product Marketing decides what you charge and what elasticity looks like.

RevOps translates that into systems, processes, and guidance reps can actually use. Finance approves deviations, manages collections, and sets the floor on what terms the business can survive.

When all three are aligned, pricing becomes a competitive weapon. You can move fast. You can tailor deals. You can say yes to custom terms because you know exactly what you're giving up and what you're getting in return.

When they're misaligned, or when the systems connecting them are duct-taped together every enterprise deal becomes a negotiation between three internal teams as much as it is with the customer.

That friction has a price. It shows up in deal velocity. In forecast accuracy. In the churn of customers who were promised a billing experience your ops team couldn't deliver.

The boat anchor you're building right now.

At some point, every fast-growing SaaS company faces the same decision: build a billing solution internally, or buy one.

The build camp always has the same arguments. We have unique pricing. Our use case is different. We'll move faster if we own it. Our engineers can do this.

Navin has a word for what that decision looks like five years later: a boat anchor.

"At some point they will have to go buy best-of-breed software and then it becomes a complicated mess of migration. It actually slows the business down."

The trap isn't that homegrown billing can't work at a point in time. It can. The trap is what it costs to maintain, upgrade, and eventually migrate away from it engineering cycles, data migration debt, compliance gaps, and the opportunity cost of every feature request your billing team couldn't build because they were patching the internal system.

If you're an HR company, your board is investing in HR software. Not billing infrastructure. Every engineer hour spent maintaining a custom billing system is an hour not spent on the product that generates the revenue in the first place.

The Build vs. Buy question is flawed

As much as we all want to build our own stuff, you really need to think about what is the automation boundary of your current system and what happens to your headcount when you cross it?

The right time to move isn't when you're in crisis. It's when you're early enough that migration is a choice, not an emergency. When the pain is visible but not yet catastrophic. When you still have the runway to do it properly.

The founders who do this well are the ones who recognize the signal before it becomes a crisis: manual billing tasks proliferating, operators being hired to manage exceptions, spreadsheets showing up in renewal conversations. Those are not growing pains. They are structural warnings.

Get started with your billing today.

Get started with your billing today.

Enterprise pricing is not what you charge. It's what your system can model

Here's the thing about enterprise pricing that no pricing page will ever tell you: the number is almost never the obstacle.

Enterprise buyers are not primarily price-sensitive but they’re risk-sensitive, procurement-constrained, and budget-cycle-driven. What they're actually negotiating is the shape of the deal, the ramp, the term, the payment schedule, the rollout flexibility, the co-term structure.

The companies that win enterprise accounts consistently are not the ones with the lowest price. They're the ones whose pricing infrastructure can meet the buyer where they are.

Can you ramp the seat count over 18 months?

Can you offer a multi-year discount while keeping annual payment flexibility?

Can you give a reference discount in exchange for a logo and a case study?

Can you co-term this with their existing license so they have one renewal date?

If your billing system can model all of that in real time, your sales rep can say yes on the call. If it can't, they have to come back three days later with a manually-built quote — and the deal momentum stalls.

As Navin put it: the tools in the toolbox are what give sellers the confidence to negotiate. Not the pricing strategy document. The system underneath it.

So what should you actually do?

If you're a founder at Series A or B staring down your first enterprise contracts, here is what the evidence from operators like Navin suggests:

1. Treat billing architecture as a GTM decision, not an engineering one.

The question of how you bill is inseparable from what you can sell. If your billing system can't model ramp deals, you can't offer ramp deals. That's a revenue ceiling, not a technical limitation.

2. Don't wait for the breaking point.

The signal is human operators doing systematic work. The moment you hire someone to manage billing exceptions as their primary job, you've already crossed the threshold. Move before that hire.

3. Stay on the yellow brick road.

Navin's rule: configure, don't customize. Every custom code path in your billing system is technical debt that will cost more to migrate than it ever saved in the short term. Buy best-of-breed and use it as designed.

4. Align the triangle before the deals get complex.

Get Product Marketing, RevOps, and Finance into the same room to define pricing rules, approval workflows, and deviation governance before you need them. The companies that do this early move faster on enterprise deals than companies that do it reactively.

5. Build to the post-signature experience.

Enterprise readiness is not a sales capability. It's an operational one. The customer's experience of your company begins the moment the contract is signed and it is defined almost entirely by your billing, onboarding, and collection infrastructure.

Enterprise monetization is not a pricing strategy. It's operational architecture.

The companies that will win enterprise at scale in the next five years are not the ones with the best pricing pages. They're the ones who figured out that pricing is a system — one that has to be designed, maintained, and continuously upgraded as the deals get bigger and more complex.

The invisible tax is real. But it's also optional.

Ready to turn your pricing into programmable infrastructure?

Flexprice is built for SaaS companies that have outgrown static billing and need monetization infrastructure that can keep pace with enterprise complexity, ramp deals, hybrid pricing, usage billing, co-terminations, and more.

This blog is based on an interview with Navin Persaud, VP of Revenue Operations at 1Password, on the AI Pricing Podcast. Views expressed reflect insights shared in that conversation.

Enterprise pricing is not what you charge. It's what your system can model

Here's the thing about enterprise pricing that no pricing page will ever tell you: the number is almost never the obstacle.

Enterprise buyers are not primarily price-sensitive but they’re risk-sensitive, procurement-constrained, and budget-cycle-driven. What they're actually negotiating is the shape of the deal, the ramp, the term, the payment schedule, the rollout flexibility, the co-term structure.

The companies that win enterprise accounts consistently are not the ones with the lowest price. They're the ones whose pricing infrastructure can meet the buyer where they are.

Can you ramp the seat count over 18 months?

Can you offer a multi-year discount while keeping annual payment flexibility?

Can you give a reference discount in exchange for a logo and a case study?

Can you co-term this with their existing license so they have one renewal date?

If your billing system can model all of that in real time, your sales rep can say yes on the call. If it can't, they have to come back three days later with a manually-built quote — and the deal momentum stalls.

As Navin put it: the tools in the toolbox are what give sellers the confidence to negotiate. Not the pricing strategy document. The system underneath it.

So what should you actually do?

If you're a founder at Series A or B staring down your first enterprise contracts, here is what the evidence from operators like Navin suggests:

1. Treat billing architecture as a GTM decision, not an engineering one.

The question of how you bill is inseparable from what you can sell. If your billing system can't model ramp deals, you can't offer ramp deals. That's a revenue ceiling, not a technical limitation.

2. Don't wait for the breaking point.

The signal is human operators doing systematic work. The moment you hire someone to manage billing exceptions as their primary job, you've already crossed the threshold. Move before that hire.

3. Stay on the yellow brick road.

Navin's rule: configure, don't customize. Every custom code path in your billing system is technical debt that will cost more to migrate than it ever saved in the short term. Buy best-of-breed and use it as designed.

4. Align the triangle before the deals get complex.

Get Product Marketing, RevOps, and Finance into the same room to define pricing rules, approval workflows, and deviation governance before you need them. The companies that do this early move faster on enterprise deals than companies that do it reactively.

5. Build to the post-signature experience.

Enterprise readiness is not a sales capability. It's an operational one. The customer's experience of your company begins the moment the contract is signed and it is defined almost entirely by your billing, onboarding, and collection infrastructure.

Enterprise monetization is not a pricing strategy. It's operational architecture.

The companies that will win enterprise at scale in the next five years are not the ones with the best pricing pages. They're the ones who figured out that pricing is a system — one that has to be designed, maintained, and continuously upgraded as the deals get bigger and more complex.

The invisible tax is real. But it's also optional.

Ready to turn your pricing into programmable infrastructure?

Flexprice is built for SaaS companies that have outgrown static billing and need monetization infrastructure that can keep pace with enterprise complexity, ramp deals, hybrid pricing, usage billing, co-terminations, and more.

This blog is based on an interview with Navin Persaud, VP of Revenue Operations at 1Password, on the AI Pricing Podcast. Views expressed reflect insights shared in that conversation.

Enterprise pricing is not what you charge. It's what your system can model

Here's the thing about enterprise pricing that no pricing page will ever tell you: the number is almost never the obstacle.

Enterprise buyers are not primarily price-sensitive but they’re risk-sensitive, procurement-constrained, and budget-cycle-driven. What they're actually negotiating is the shape of the deal, the ramp, the term, the payment schedule, the rollout flexibility, the co-term structure.

The companies that win enterprise accounts consistently are not the ones with the lowest price. They're the ones whose pricing infrastructure can meet the buyer where they are.

Can you ramp the seat count over 18 months?

Can you offer a multi-year discount while keeping annual payment flexibility?

Can you give a reference discount in exchange for a logo and a case study?

Can you co-term this with their existing license so they have one renewal date?

If your billing system can model all of that in real time, your sales rep can say yes on the call. If it can't, they have to come back three days later with a manually-built quote — and the deal momentum stalls.

As Navin put it: the tools in the toolbox are what give sellers the confidence to negotiate. Not the pricing strategy document. The system underneath it.

So what should you actually do?

If you're a founder at Series A or B staring down your first enterprise contracts, here is what the evidence from operators like Navin suggests:

1. Treat billing architecture as a GTM decision, not an engineering one.

The question of how you bill is inseparable from what you can sell. If your billing system can't model ramp deals, you can't offer ramp deals. That's a revenue ceiling, not a technical limitation.

2. Don't wait for the breaking point.

The signal is human operators doing systematic work. The moment you hire someone to manage billing exceptions as their primary job, you've already crossed the threshold. Move before that hire.

3. Stay on the yellow brick road.

Navin's rule: configure, don't customize. Every custom code path in your billing system is technical debt that will cost more to migrate than it ever saved in the short term. Buy best-of-breed and use it as designed.

4. Align the triangle before the deals get complex.

Get Product Marketing, RevOps, and Finance into the same room to define pricing rules, approval workflows, and deviation governance before you need them. The companies that do this early move faster on enterprise deals than companies that do it reactively.

5. Build to the post-signature experience.

Enterprise readiness is not a sales capability. It's an operational one. The customer's experience of your company begins the moment the contract is signed and it is defined almost entirely by your billing, onboarding, and collection infrastructure.

Enterprise monetization is not a pricing strategy. It's operational architecture.

The companies that will win enterprise at scale in the next five years are not the ones with the best pricing pages. They're the ones who figured out that pricing is a system — one that has to be designed, maintained, and continuously upgraded as the deals get bigger and more complex.

The invisible tax is real. But it's also optional.

Ready to turn your pricing into programmable infrastructure?

Flexprice is built for SaaS companies that have outgrown static billing and need monetization infrastructure that can keep pace with enterprise complexity, ramp deals, hybrid pricing, usage billing, co-terminations, and more.

This blog is based on an interview with Navin Persaud, VP of Revenue Operations at 1Password, on the AI Pricing Podcast. Views expressed reflect insights shared in that conversation.

Aanchal Parmar

Aanchal Parmar

Aanchal Parmar

Aanchal Parmar heads content marketing at Flexprice.io. She’s been in the content for seven years across SaaS, Web3, and now AI infra. When she’s not writing about monetization, she’s either signing up for a new dance class or testing a recipe that’s definitely too ambitious for a weeknight.

Aanchal Parmar heads content marketing at Flexprice.io. She’s been in the content for seven years across SaaS, Web3, and now AI infra. When she’s not writing about monetization, she’s either signing up for a new dance class or testing a recipe that’s definitely too ambitious for a weeknight.

Share it on: