Ayush Parchure

Ayush Parchure7 Best Enterprise Billing Software For AI And SaaS In 2026

7 Best Enterprise Billing Software For AI And SaaS In 2026

7 Best Enterprise Billing Software For AI And SaaS In 2026

7 Best Enterprise Billing Software For AI And SaaS In 2026

Feb 14, 2026

Feb 14, 2026

Feb 14, 2026

• 25 min read

• 25 min read

Ayush Parchure

Content Writing Intern, Flexprice

Your pricing model made sense when you launched. Flat subscription, clean and simple. But now you're adding usage-based tiers, credit packs, or consumption pricing, and suddenly your current billing setup is filled with cracks.

So you search for enterprise billing software. You find seven vendors. They all look identical on the surface, with the same polished demo, same fully flexible promise. But you've heard enough horror stories to know the demo is never the reality. You are weeks into implementation, the engineering team is buried, and the platform can't handle your metering logic anymore.

That's exactly the crossroad this guide is sculpted for.

Here, we've broken down the 7 best enterprise billing platforms for AI and SaaS companies in 2026, what they're actually built for, where they fall short, we've analyzed every feature, and as a bonus, how to go from decision to live in no time.

TL;DR

Enterprise billing software helps AI and SaaS companies manage subscriptions, pay-as-you-go pricing, credits, entitlements, invoicing, and revenue reporting without hardcoding billing logic.

The global usage-based billing software market is expected to cross $7B by 2026, driven by demand for real-time metering and automated revenue operations.

Core capabilities buyers' expectations in 2026 include real-time usage tracking, credit wallets, entitlement management, pricing changes without engineering, multi-entity billing, and no vendor lock-in.

Traditional platforms like Stripe Billing and Chargebee were built for a static subscription model, and then later added usage-based billing as an additional layer on top of their core recurring billing model.

Modern enterprise platforms such as Flexprice, Orb, Metronome, Maxio, and Zuora are purpose-built for usage-based pricing with real-time metering and enterprise-grade finance workflows.

Across 50+ enterprise customers, the most common reasons teams adopt dedicated billing infrastructure are vendor lock-in, slow product launches, manual RevOps, limited pricing flexibility, and lack of visibility into customer usage.

Embrace enterprise billing software to protect your growth trajectory and ensure your billing system is an asset, not an obstacle.

What is enterprise billing software?

Enterprise billing software is a system that sits at the center of your revenue stack, handling custom contracts, hybrid pricing models, regional tax rules, revenue recognition, credits, refunds, and everything else that comes with monetizing at scale.

It automates the financial operations that would otherwise require constant engineering work, and gives product and finance teams the flexibility to launch new pricing models without filing tickets.

Why does it matter now more than ever? Because enterprise billing isn't just about sending invoices anymore, it's about running revenue as a core operational function.

Once a SaaS or AI company starts landing larger customers, billing quietly becomes one of the hardest problems to manage. You're juggling usage tracking, contract-specific terms, credit systems, and compliance across regions all at once. Without purpose-built infrastructure, cracks start showing up as revenue leakage, delayed launches, and engineering bottlenecks.

This is exactly why modern teams are moving toward usage-based billing infrastructure instead of hardcoded pricing logic. And it's not a niche shift, over 60% of SaaS companies are actively moving from static subscription models to more dynamic ones like usage-based, credit-based, and hybrid pricing.

In short, enterprise billing software exists to help you scale revenue with the same maturity as your product without the operational exhaustion that usually comes with it.

Advantages of an enterprise billing software

1. Support complex billing models

Let’s be honest, today's companies don't want to run that regular flat subscription model anymore.

And when you’re dealing with hybrid pricing, base plans, usage meters, bundled credits, add-ons, and custom enterprise contracts. A true enterprise billing system must support all of this without engineering workarounds, which reduces load across teams.

This type of model lets you launch flexible pricing faster within hours, and avoid manual reconciliation when pricing evolves.

Why it matters for AI and SaaS: This is the foundation of monetizing AI products properly.

2. Automated enterprise Invoicing with near-zero billing errors

That traditional billing system starts to break the moment complexity is involved. This is where enterprise billing software helps by automating invoice generation, applying pricing rules consistently, and eliminating human error across thousands of customers.

Accurate invoices mean fewer disputes, faster payments, and higher customer trust.

Which finally contributes to increasing the revenue of the organization.

3. Built to scale with high-growth

Your billing system must grow with your product. Good billing software doesn’t just support growth, but enables it.

That means supporting:

Thousands of customers

Millions of usage events

Global currencies

Enterprise contracts

CRM + ERP integrations

All this should work without performance degradation. Why is it essential? Because you don't want to choose a new billing platform during hypergrowth.

4. Real-Time revenue analytics and usage visibility

At current market conditions, buyers deeply care about visibility. They need real-time dashboards for:

Usage trends

Credit burn

Outstanding invoices

Expansion revenue

Forecasted consumption

This transforms billing from a back-office function into a strategic revenue system. Finance and product teams finally operate from the same data, which results in optimum productivity.

5. Compliance-ready billing with built-in audit trails

Enterprise buyers operate across regions, industries, and regulations. They want their billing system to be capable of operating on its own when it requires. The parameters that it should handle are :

Revenue recognition

Audit trails

Compliance documentation

Cross-border reporting

Without any human intervention or manual spreadsheets

6. Enterprise-grade security & data protection

Billing systems store your most sensitive data, like customer contracts, usage, and revenue. This is the stage where security must include encrypted storage, role-based access, audit logs, and proactive threat protection to avoid any kind of data breach.

For an enterprise organization, this isn’t just a nice-to-have; it is crucial because deals are on stakes for the enterprise business. And it truly matters because security posture directly affects enterprise sales velocity.

Top 7 enterprise billing software for AI and saas in 2026

Flexprice

Orb

Metronome

Chargebee

Stripe billing

Maxio

Zuora

Basis | Flexprice | Orb | Metronome | Chargebee | Stripe Billing | Maxio | Zuora |

Core positioning | Open-source,usage-first enterprise billing built for AI and SaaS monetization | Engineering-first real-time usage billing for API-driven SaaS products | Usage-based enterprise billing is tightly integrated within the Stripe ecosystem | Subscription-first SaaS billing with revenue operations and reporting capabilities | Programmable subscription billing is deeply embedded in Stripe Payments | Finance-led subscription billing with strong revenue recognition controls | Legacy enterprise monetization platform focused on subscription governance and compliance |

Best suited for | AI-native SaaS needing hybrid pricing, credits, and fast iteration | Developer-led SaaS monetizing APIs, compute, or infrastructure usage | Stripe-native companies monetizing infrastructure and postpaid usage models | Traditional SaaS businesses operating with predictable recurring subscription revenue | SaaS teams are fully committed to Stripe for payments and billing | B2B SaaS organizations prioritizing financial reporting and compliance workflows | Large enterprises prioritizing compliance, governance, and global operations |

Billing system of record | Usage events and billing configuration serve as the primary revenue source | Usage ingestion pipeline drives billing calculations and invoice generation | Stripe subscription and metering objects act as a system of record | Subscription catalog and recurring contracts define revenue logic | Stripe objects, including subscriptions, meters, and invoices, define billing logic | Subscription contracts and financial records define billing workflows | Subscription agreements and finance rules control billing operations |

Real-time usage metering | Native high-throughput metering supporting granular AI usage tracking | Real-time event ingestion optimized for developer-centric architectures | Real-time metering is available but limited to Stripe ecosystem boundaries | Usage tracking is available, but secondary to subscription workflows | Basic metering suitable for simple consumption-based pricing models | Limited native metering capabilities compared to usage-native platforms | Not designed primarily for real-time consumption-heavy workloads |

Hybrid pricing support | Native support for subscriptions, credits, usage, and overages in one model | Supports hybrid models via APIs and configuration layers | Hybrid billing is possible, but often requires Stripe-based orchestration | Hybrid supported through add-ons layered over subscriptions | Subscription plus usage supported; credits require custom modeling | Supports tiered and hybrid models within a subscription framework | Supports subscription and usage, but rigid contract structures |

Credit wallets / prepaid usage | First-class wallet abstraction with balances, expiration, and burn rules | Limited wallet-style support; mostly subscription-based usage charges | Prepaid constructs are possible through enterprise contract configurations | Credits modeled via adjustments, not native wallet ledger | No native wallet abstraction; handled through invoice logic | No dedicated wallet abstraction for prepaid consumption billing | No first-class wallet or prepaid credit abstraction |

Entitlements & feature gating | Billing-native entitlements control access, quotas, and feature limits | Feature enforcement is typically handled in application logic | Entitlements managed externally within product infrastructure | Strong plan-based entitlements tied to subscription tiers | Entitlements exist, but enforcement resides in application code | Feature gating is generally handled outside the billing layer | Entitlements and gating are typically managed through external systems |

Enterprise contracts support | Built-in support for commitments, ramps, and true-up billing structures | Enterprise contracts are possible, but require configuration effort | Supports minimum commitments and complex postpaid usage agreements | Enterprise contracts supported through catalog and pricing controls | Contract modeling achievable but operationally complex at scale | Designed for structured enterprise subscription agreements | Strong enterprise contract engine with compliance oversight |

Parent–child billing | Native hierarchical accounts with consolidated billing and shared usage | Partial support requiring custom modeling for shared usage | Parent-child structures are supported within the Stripe-based hierarchy | Account hierarchies are supported mainly for invoicing purposes | No native consolidated parent-child billing support | Supports hierarchies within financial reporting workflows | Robust multi-entity and global consolidated billing support |

Pricing changes without engineering | Finance and product teams configure pricing without developer dependency | Most pricing adjustments require engineering involvement | Pricing logic changes require engineering configuration in Stripe | Business teams can manage subscriptions; complex pricing needs engineering | Developers must update billing objects via code | Some pricing is configurable; advanced scenarios require operational workarounds | Pricing changes often require specialized administrators or consultants |

Auditability & traceability | Event-level traceability linking usage directly to invoice line items | Usage traceable to invoices via event logs | Stripe invoices link to metered usage, but have limited context | Invoice totals clear; deep event traceability requires internal telemetry | Invoice line items visible; raw usage context external | Invoice reporting is strong; usage-level traceability is limited | Audit-ready invoicing aligned with compliance reporting standards |

Revenue recognition | Supports enterprise-grade revenue reporting and compliance workflows | Revenue recognition is typically handled via external finance systems | Revenue recognition managed within Stripe’s broader ecosystem | Built-in revenue recognition aligned with SaaS accounting standards | Stripe ecosystem supports revenue tooling and tax compliance | Strong GAAP and ASC 606-compliant revenue recognition | Comprehensive revenue recognition and IFRS/ASC compliance support |

Gateway flexibility | Billing logic decoupled from processors; integrates multiple gateways | Gateway-agnostic billing with external payment integrations | Fully dependent on Stripe Payments infrastructure | Supports multiple payment gateways across regions | Deeply integrated and restricted to Stripe Payments | Multi-gateway support across major processors | Multi-gateway support for global enterprise operations |

Implementation speed | Production-ready deployment is achievable within hours to weeks | Implementation typically requires an engineering-led setup over weeks | Sales-led onboarding with engineering configuration timeline | Moderate implementation effort depending on contract complexity | Fast setup if already using Stripe infrastructure | Implementation can require structured onboarding and data migration | Long enterprise implementations often span several months |

Vendor lock-in risk | Open-source foundation minimizes long-term vendor dependency risk | Low lock-in risk due to flexible integration architecture | High dependency on the Stripe ecosystem for billing and payments | Moderate dependency tied to subscription-centric workflows | High dependency within the Stripe ecosystem | Moderate vendor reliance due to proprietary architecture | High switching cost due to enterprise-grade customization |

Primary user persona | Product, finance, and RevOps teams collaborating on monetization | Engineering teams owning pricing and usage infrastructure | Engineering-driven organizations operating within Stripe | RevOps and finance teams managing recurring revenue | Developer-first teams are comfortable building billing logic | Finance-led organizations requiring structured financial governance | Enterprise finance and operations leaders overseeing compliance |

Pricing transparency | Transparent, usage-aligned pricing without percentage revenue fees | Pricing disclosed via sales engagement | Pricing undisclosed; structured around usage and Stripe fees | Tiered pricing based on revenue and feature access | Percentage-based billing plus Stripe processing fees | Tiered subscription pricing with enterprise customization | Enterprise pricing model negotiated through sales contracts |

1. Flexprice

Flexprice is an open source enterprise billing platform built for SaaS and AI companies that monetize through usage, credits, or hybrid pricing models. Instead of forcing your business into rigid subscription workflows, Flexprice offers teams a configurable billing foundation designed for dynamic consumption and enterprise contracts.

It ingests product usage in real time and converts it into billable revenue through automated metering, customer wallets, entitlements, and invoicing. Here, finance and product teams have the freedom to define pricing rules, credit packs, and usage tiers directly from the dashboard, without relying on engineers for every change.

This makes Flexprice especially valuable for AI-native platforms where costs fluctuate and pricing evolves quickly. Enterprise features like multi-entity accounts, detailed audit trails, and payment-gateway independence help support complex customer structures while avoiding long-term vendor lock-in, which is a major issue customers face with other enterprise billing software.

For growing companies that need accurate usage billing, pricing agility, and operational scale, Flexprice is a must-choice because it acts as a revenue layer that adapts as fast as your product does.

For example, see how Segwise brought their enterprise billing stack live in just a few weeks without prolonged engineering cycles.

Key features

1. Core usage-based pricing

Flexprice supports core usage-based billing while extending far beyond simple meters. Teams can combine usage pricing with hybrid plans, committed volumes, and multiple usage metrics in a single billing flow, without building custom aggregation logic in their backend.

This allows AI and SaaS companies to move past basic pay-as-you-go and support production-grade pricing models from day one.

2. Core credit-based workflows

Flexprice covers foundational credit workflows, like:

Prepaid balances

Promotional credits

Recurring grants

Rollover rules

Real-time wallet synchronization

Automated top-ups.

Credits are tracked through a ledger-backed system, giving finance teams full auditability while customers get predictable spend controls and balance visibility.

3. Ramped contracts

Flexprice natively supports ramped contracts, allowing teams to define phased pricing timelines that automatically update over time.

Instead of manually creating multiple plans or managing backend logic, enterprises can model pilot-to-scale contracts directly in billing, reducing operational overhead and pricing errors.

4. Quotes & renewals

Flexprice includes built-in quoting with pricing lock-ins, approvals, and automatic synchronization with billing and revenue workflows.

Sales teams can generate enterprise quotes confidently, while finance and RevOps maintain a single source of truth across contracts, renewals, and invoicing.

5. Committed usage & credit pooling

Flexprice lets organizations define usage commitments and pool credits across teams or accounts. You can:

Set organization-level usage commitments (e.g., 1M API calls per month)

Share credits across multiple teams or workspaces

Track pooled consumption in real time

Bill accurately without backend reconciliation work

This supports enterprise buying behavior where budgets are centralized, but usage is distributed.

6. Parent–child accounts

Flexprice supports hierarchical account structures with unified billing and shared consumption models. You can:

Roll up usage from child accounts to a parent account

Share credit balances across departments

Maintain visibility into team-level usage

Centralize invoicing while preserving internal accountability

This is ideal for cross-department expansion and multi-team enterprise deployments.

7. Granular usage filtering

Flexprice directly supports filtering within usage events, allowing pricing logic to be applied using metadata inside a single stream. You can price it based on:

Model type (e.g., premium vs standard models)

Token category or workload class

Region or infrastructure zone

Any custom metadata attached to events

This avoids schema explosion and keeps multi-dimensional AI pricing operationally manageable.

8. Feature entitlements

Flexprice integrates feature gating and billing logic through entitlement management. You can:

Define feature access by plan tier

Enforce usage limits automatically

Reset quotas on billing cycles

Align feature access with credit balances

This reduces reliance on custom product-side enforcement logic and keeps feature access synchronized with contract terms.

9. Recurring & rollover credits

Flexprice supports recurring credit grants with rollover caps, automated top-ups, balance thresholds, and multiple credit types. Wallets stay synchronized in real time, giving customers predictable consumption while ensuring finance teams maintain revenue control.

10. Custom credit values by feature

Flexprice allows assigning different credit costs to features based on internal cost models. You can:

Protect margins on GPU-intensive workloads

Assign higher credit burn rates for premium models

Adjust internal economics without confusing customers

Maintain transparent external pricing units

This separation between internal cost logic and external pricing simplicity is critical for AI-native products.

11. Contract amendments

Flexprice maintains full contract version history across the customer lifecycle. You can:

Track upgrades and downgrades

Capture renegotiations

Maintain historical pricing records

Audit revenue changes over time

This improves revenue accuracy, supports compliance needs, and builds trust in long-running enterprise agreements.

12. Custom pricing units

Flexprice lets you sell in credits, tokens, or any custom unit, while billing and storing everything internally in real base currencies like USD or INR.

Example:

1 Credit = $0.01

If a customer buys 100 Credits, Flexprice automatically calculates and records it as $1 internally, no manual math, no accounting confusion. Custom units can be applied across:

Plans

Usage-based pricing

Tiered pricing

Wallets

For usage-first AI products, this abstraction allows customer-friendly pricing externally while preserving clean accounting and revenue reporting internally.

13. Credits and Wallet Management

Prepaid and promotional credit grants

Issue one-time credits for trials or support adjustments

Recurring credit packages that auto-renew monthly or annually

Automatically charge the payment method when credits run out

Block usage when the customer hits the spend cap

Notify users when the wallet balance drops below thresholds

Wallet auto top-up functionality

Wallet transactions history

14. Billing Models and Pricing Flexibility

Support for prepaid and postpaid billing models

Plan overrides per customer

Price localization and bundles

Discounts fixed or a percentage as part of pricing

15. Invoicing and Payments

Generate invoices from usage, subscriptions, or credits

Partial invoice payments

One-time invoices outside normal billing

16. Enterprise Controls and Integrations

Feature management and gating per customer

Webhook support for enterprise workflows

17. Compliance

Flexprice follows all the required regulations and is completely compliant with SOC II. You can check more about the same here.

Pros

Open-source billing with full transparency and extensibility

No vendor lock-in with payment gateways

Minimized engineering dependency for pricing and packaging changes

Developer-first APIs enabling fast production integration

Built specifically for AI billing and API-first SaaS billing

Native support for real-time usage metering, credit wallets, and entitlements

Strong fit for product-led growth and fast pricing iteration

Enterprise hierarchies and audit-ready consolidated billing

Cons

Newer ecosystem compared to legacy enterprise billing platforms

Teams opting for self-hosting must manage infrastructure themselves (managed cloud available)

Pricing

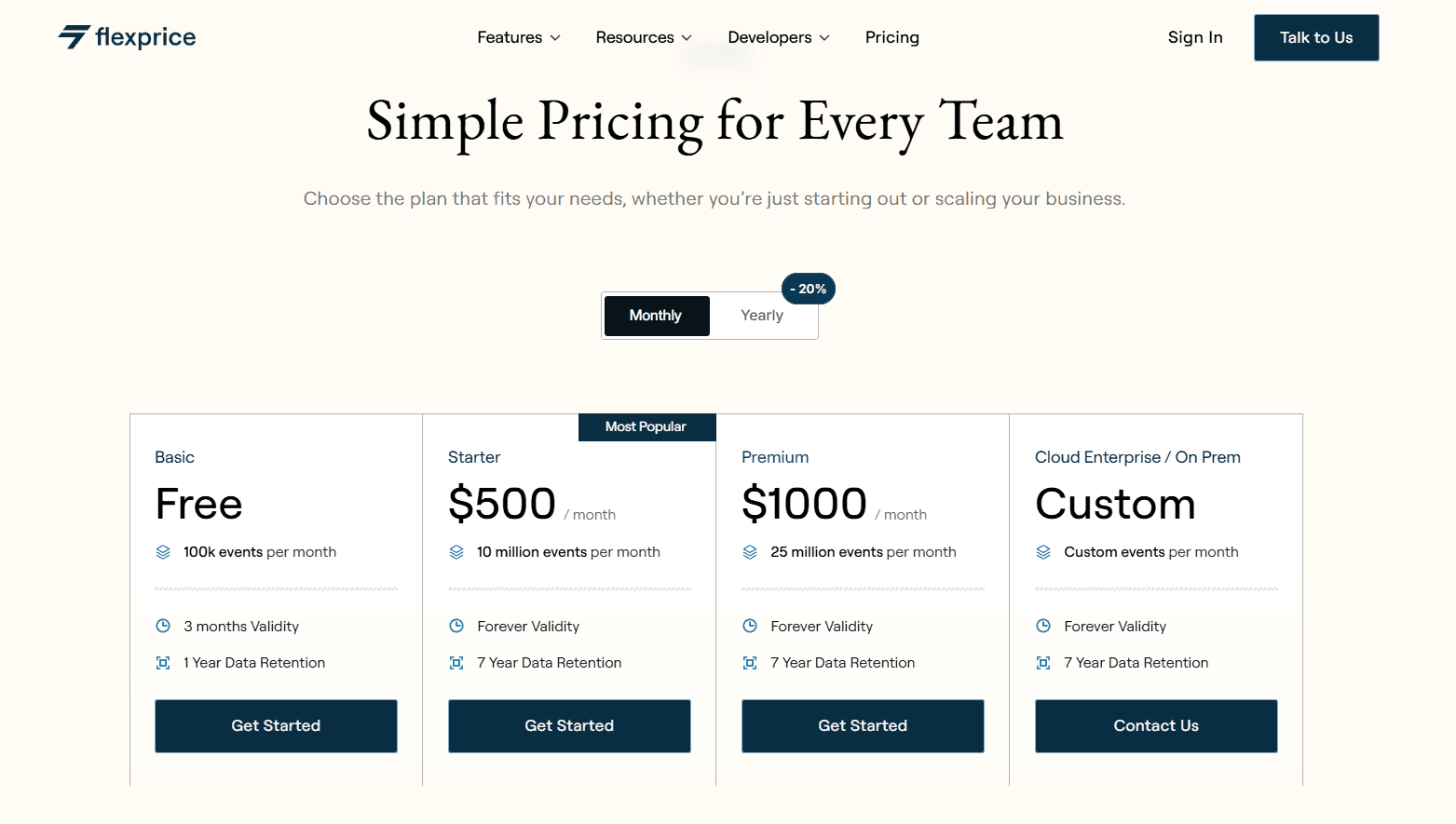

Flexprice offers 4 different pricing options apart from open source, which are:

Basic, which offers 100k events per month and is free

Starter, which offers 10 million events per month, is priced at $500/month

Premium, which offers 25 million events per month, is priced at $1000/month

Cloud/OnPrem, you can customize events per month

Flexprice made it super easy for us to create and sell custom plans based on usage in minutes & has eliminated our reliance on in-house hacks. —Aradhya Shandilya, Head of Product Management, Nurturev”

Best suited for

AI platforms billing tokens, inference, or compute at scale

SaaS products using hybrid subscription + usage pricing

Teams needing entitlement control without hardcoded logic

Companies avoiding payment gateway lock-in

Products with high-variance or unpredictable consumption

Get started with your billing today.

Get started with your billing today.

2. Orb

Orb is a usage-based billing platform focused on metered pricing, event-driven billing, and invoice generation for modern SaaS and API-first companies.

Orb positions itself as an engineering-first billing system, designed to ingest large volumes of usage events and translate them directly into billable revenue. It’s commonly adopted by developer-heavy teams building consumption-based products, especially in AI and infrastructure SaaS.

The platform centers around real-time event ingestion, flexible pricing logic, and usage-backed invoicing, acting as a billing layer between your product and payment systems.

Key features

Usage metering: Orb ingests product usage events in real time and converts them into billable metrics. Teams define pricing based on custom usage dimensions such as API calls, compute, tokens, or storage.

Pricing flexibility: Supports subscriptions, usage-based pricing, tiered rates, and hybrid models combining base plans with consumption overages. Pricing rules are configured via APIs and dashboards, allowing companies to model complex enterprise contracts.

Subscription management: Handles plan lifecycle changes, including upgrades, downgrades, prorations, and renewals, which are suitable for SaaS products transitioning from seat-based to usage-based revenue.

Usage-linked invoicing: Invoices are generated directly from metered usage and subscription charges, with line items traceable back to underlying events, helping finance teams validate charges and reduce disputes.

Data pipeline integrations: Orb integrates with modern data stacks and warehouses, allowing engineering teams to push usage data from existing analytics pipelines into billing.

Pros

Strong real-time usage billing foundation

Designed for API-first and consumption-based products

Flexible pricing logic for subscriptions + usage hybrids

Usage-backed invoicing improves revenue traceability

Works well for engineering-led billing workflows

Suitable for mid-market and enterprise SaaS contracts

Cons

An engineering-heavy setup and usage modeling typically require developer involvement

Limited no-code controls for finance and RevOps teams

Less focus on credit-based pricing and prepaid wallet models compared to newer AI-first platforms

No native entitlement layer for feature gating; it is often handled externally.

Pricing experimentation can be slower due to API-driven configuration

Less emphasis on business-user workflows like contract packaging.

Pricing

Orb uses a usage-based pricing model tied to metered revenue volume. Exact pricing is not publicly listed and requires speaking with sales.

Best suited for

Developer-first SaaS and API products monetizing directly from usage events

Engineering teams that prefer API/SQL-driven pricing over no-code tools

Companies handling large volumes of real-time consumption data (APIs, infra, AI)

Businesses transitioning from flat subscriptions to usage-led or hybrid billing

Teams that need highly traceable, usage-backed invoices for finance accuracy

3. Metronome

Metronome is an enterprise usage-based billing platform originally built to help SaaS and infrastructure companies convert high-volume consumption data into revenue.

Founded by former engineers from Dropbox, Metronome was designed around event-driven billing, transforming raw product usage like API calls, tokens, and compute minutes into billable metrics and supporting complex enterprise contracts.

In early 2026, Metronome became part of Stripe’s billing stack following its acquisition, meaning Metronome now operates inside Stripe Billing rather than as an independent platform.

Today, Metronome primarily serves engineering-led organizations selling usage-heavy products who are already committed to Stripe’s ecosystem.

Key features

Event-based usage metering: Metronome ingests raw usage events and aggregates them into billable metrics. Teams define how consumption is measured across dimensions like API volume, compute, or tokens, enabling postpaid billing for infrastructure-style products.

Enterprise account hierarchies: This supports parent–child account structures, which allow organizations to manage billing across multiple business units or customers with complex organizational setups.

Postpaid consumption billing: It is built primarily for billing after usage occurs, making it well-suited for API platforms, cloud services, and AI infrastructure charging by volume.

Contract complexity management: Handles enterprise constructs such as minimum commitments, prepaid credits, usage overages, and negotiated thresholds, which are common in SaaS deals.

Dimensional pricing: Allows pricing to vary based on customer attributes like region, tier, or segment, supporting differentiated enterprise contracts.

Pros

Strong high-volume usage metering infrastructure

Designed for consumption-heavy AI and infrastructure platforms

Supports enterprise contracts with commitments, minimums, and overages

Well-suited for engineering-driven billing implementations

Cons

Locked into Stripe for billing and payments

Stripe fees added on top of Metronome costs

Sales-led onboarding, no self-serve setup

Engineering is required for the pricing configuration

No non-code tools for finance teams

Hybrid pricing needs custom workarounds

Pricing

Metronome does not publish pricing publicly. So to learn more, you will need to contact their sales team from their website.

Best suited for enterprise teams that

Already use Stripe as their primary payment processor

Monetize infrastructure, APIs, or AI workloads via postpaid usage

Have strong internal engineering resources to manage billing logic

Need support for large enterprise contracts with minimum commitments

4. Chargebee

Chargebee is an enterprise subscription billing and revenue operations platform built primarily for SaaS companies managing recurring revenue, invoicing, and subscription lifecycles.

Chargebee is widely adopted by mid-market and enterprise SaaS teams that operate on subscription-first models and need packaged billing workflows, revenue reporting, and integrations with CRMs and accounting systems.

While Chargebee has expanded into usage-based billing, its core architecture remains optimized for traditional SaaS subscriptions rather than AI-native, high-variance consumption models.

Key features

Subscription lifecycle management: Chargebee handles trials, upgrades, downgrades, prorations, renewals, and cancellations, making it well-suited for companies running seat-based or plan-based SaaS offerings.

Hybrid billing: Supports metered add-ons layered on top of subscriptions. Teams can charge for usage, but consumption models typically operate as extensions of subscription plans rather than as first-class primitives.

Enterprise invoicing & revenue operations: Provides automated invoicing, tax handling, dunning, and integrations for revenue workflows. Commonly used alongside CRMs and accounting systems for quote-to-cash operations.

Customer account management: Supports customer records, billing profiles, and payment methods, with tooling aimed at finance and RevOps teams managing recurring contracts.

Integrations ecosystem: Native integrations with Stripe, CRMs like Salesforce, and accounting platforms such as NetSuite make it a familiar choice for enterprise RevOps stacks.

Pros

Mature subscription billing workflows

Strong ecosystem for SaaS revenue operations

Finance-friendly UI for managing plans, invoices, and customers

Good fit for traditional SaaS businesses with predictable recurring revenue

Extensive integrations with CRM and accounting systems

Cons

Subscription-first architecture, usage-based billing is secondary.

Limited native support for credit wallets and prepaid usage

Pricing experimentation is constrained by plan-based structures

Entitlement management is often handled outside of billing

High-variance usage scenarios require custom implementations

Can become operationally complex as pricing models evolve

Pricing

Chargebee pricing is tiered based on revenue and feature access, with enterprise plans negotiated through sales.

Best suited for enterprise teams that

Operate primarily on subscription-based SaaS models

Need mature invoicing and RevOps workflows

Rely heavily on CRM + accounting integrations

Run sales-led SaaS with predictable recurring revenue

5. Stripe billing

Stripe Billing is the subscription and invoicing layer inside Stripe’s payments ecosystem. It’s most commonly adopted by SaaS companies already processing payments with Stripe who want to add recurring billing and basic usage charging without introducing another vendor.

It supports flexible pricing so that you can define tiered, volume‑based, and usage‑based models, and combine them into hybrid plans. Usage is tracked via meters, so you can send events as they happen and have Stripe aggregate and bill them accurately. Stripe Billing also offers strong multi‑currency support, so you can operate globally with seamless billing in local currencies.

Stripe Billing is best suited for traditional SaaS businesses with straightforward subscription plans and pricing needs, especially those with strong engineering bandwidth and a preference for code‑first, programmable billing tightly coupled to Stripe Payments.

Key features

Subscription and plan lifecycle management: Stripe Billing handles recurring plans, upgrades, downgrades, prorations, and renewals as part of its core subscription workflows, a strong fit for classic SaaS models.

Basic usage billing: Supports simple usage-based charges on top of subscriptions, suitable for early-stage or low-complexity consumption scenarios. Complex, multi-metric metering often requires additional engineering or workaround logic.

Invoicing and collections: Native invoicing integrates tightly with Stripe Payments, including automatic tax calculation, payment retries, and dunning workflows.

CRM + financial integrations: Stripe’s ecosystem provides broad integrations with payment rails and marketplaces, though complex revenue operations may require additional tooling.

Pros

Seamless fit for Stripe payment users

Reliable global payments infrastructure that leverages Stripe’s mature payments stack.

Strong support for standard subscription, which is excellent for recurring SaaS billing.

Quickest onboarding path for basic billing, if already in the Stripe ecosystem.

Cons

Architecture tied to the Stripe ecosystem is inseparable.

Usage billing is limited, only capable of simple usage charges.

No native enterprise metering primitives, lacks granular usage filtering.

No built-in support for feature entitlements or shared quotas.

Hybrid pricing and credit models often require workarounds.

Limited hierarchical account structures, no parent-child billing, or shared usage pools

Pricing

Stripe Billing pricing is not disclosed publicly; you can check their website.

Best Suited For

Enterprise teams that already use Stripe as their sole payments platform.

Organizations with subscription-centric billing and minimal usage complexity.

Companies are comfortable with engineering-led custom usage logic.

Teams are prioritizing Stripe’s payment ecosystem over billing autonomy.

6. Maxio

Maxio is a financial operations and enterprise billing platform designed for mid-market and larger SaaS companies. It combined the strengths of Chargify for flexible billing workflows and SaaSOptics for financial reporting, compliance, and revenue recognition to offer a unified system for subscription billing, revenue management, and billing analytics.

As businesses scale, Maxio positions itself for companies that need deep financial reporting, revenue compliance, and complex subscription management beyond simple recurring billing.

Because Maxio is designed for B2B SaaS, the workflows match the way subscription companies actually operate, so teams spend less time maintaining processes and more time reviewing clean, reliable data.

Key features

Financially aware subscription billing: Maxio automates subscription life cycles, invoicing, and billing operations for SaaS businesses. It supports mix-and-match pricing models, including flat, tiered, usage-based, and hybrid configurations, enabling companies to align billing structures with business goals.

Revenue recognition and compliance: Built-in support for GAAP/ASC 606 and IFRS 15 ensures revenue reporting and forecasts are audit-ready, a key requirement for finance and accounting teams in larger organizations.

Advanced financial analytics: Real-time dashboards and drill-down reporting for metrics like ARR, MRR, churn, cohort trends, and revenue waterfalls help enterprise teams make data-driven decisions and monitor financial health.

Collections & multi-gateway support: Maxio streamlines automated collections, payment retries, and dunning workflows across multiple payment gateways while tying collection events back to customer accounts for finance visibility.

Integrations with financial systems: Deep integrations with CRM and accounting systems like Salesforce, QuickBooks, and Avalara for tax automation help unify billing and financial operations.

Pros

Comprehensive subscription and revenue automation.

Built-in compliance and audit are crucial for enterprise finance and accounting.

Supports hybrid pricing strategies: flat, usage, tiered, and combo models.

Strong analytics and KPI tracking, real-time financial reporting for executive visibility.

Multi-entity and financial integrations that fit complex enterprise tech stacks.

Cons

A steeper learning curve setup and adoption require more time and training.

Data migration and configuration for large enterprises can be resource-intensive.

Invoice and reporting limitations.

Merged legacy components

Enterprise sales process onboarding and pricing require sales engagement rather than instant self-serve.

Pricing

Maxio offers tiered plans that reward growth, starting around $599/month for standard billing and rising to custom enterprise pricing for high volume and advanced revenue operations.

Best suited for enterprise teams that:

Operate complex subscription billing and revenue recognition workflows

Require audit-ready financial reporting and compliance

Need deep integration with CRM and accounting systems

Seek a unified platform that ties billing, revenue, and analytics together

7. Zuora

Enterprises today need a billing system designed to keep pace with rapidly evolving business models. Zuora can help.

As a monetization platform, Zuora supports your recurring revenue growth across pricing and packaging, billing, customer acquisition, and quote-to-cash, whether you monetize through subscriptions, usage, or optimize across a full range of pricing strategies.

It is widely used by established enterprises that require deep governance over billing, revenue recognition (ASC 606 / IFRS 15), and global financial operations. Unlike newer systems built for high-variance usage billing or API-first products, Zuora’s architecture was originally engineered for enterprise subscription and contract billing.

Key features

Comprehensive subscription and contract management: Zuora manages the full lifecycle of enterprise contracts, including renewals, amendments, upgrades, downgrades, and multi-year agreements with flexible billing terms.

Enterprise invoicing and billing automation: Zuora automates large-volume invoice generation across thousands of accounts, with support for tax engines, billing schedules, and consolidated statements for multi-entity customers.

Revenue recognition & compliance: Built-in revenue recognition tools help meet ASC 606 and IFRS 15 standards, enabling audit-ready reporting for finance and accounting teams.

Billing analytics & forecasting: Enterprise dashboards and reporting allow finance leaders to track MRR, churn, bookings, cash flow, and scenario modeling across product lines and geographies.

Multi-entity & global support: Designed for multinational organizations, Zuora handles multiple billing currencies, entities, and compliance requirements across regions.

Pros

Enterprise-grade governance and controls.

Strong revenue recognition and compliance tooling.

High scalability for large account volumes, which supports millions of subscribers.

Global billing and tax support that is built for multinational operations.

Flexible contract engine handles long-term negotiated deals and tiered entitlements.

Cons

Long implementation cycles often take months.

Less agile for usage-heavy AI billing,n ot designed natively for real-time consumption.

Complex configuration and governance overhead.

Limited real-time metering primitives usage billing.

Higher total cost of ownership, expensive professional services, and license fees.

Pricing

Zuora does not publicly list pricing; contact their sales team for more information.

Best suited for enterprise teams that:

Require audit-ready finance controls and compliance

Operate large subscription bases with complex contract terms

Need global billing, multi-entity support, and tax governance

Have dedicated implementation and revenue operations teams

Why do you need an enterprise billing software?

In today's evolving financial tech stack, Enterprise billing software is a must because it is essential for automating complex, high-volume, and recurring revenue processes, which significantly reduce manual errors and operational costs.

Across 50+ enterprise customers, we consistently see the same challenges emerge as companies scale beyond basic subscription billing:

Vendor lock-in slows the growth. Pricing logic tied directly to payment providers makes it difficult to switch gateways, negotiate better rates, or expand globally.

Billing becomes a product bottleneck. Every pricing change requires engineering involvement, blocking teams from moving fast or experimenting with new monetization models.

Usage-based revenue turns operationally fragile. Spreadsheets and batch pipelines can’t keep up with real-time AI and API consumption, leading to reconciliation gaps and delayed visibility.

Enterprise contracts introduce complexity that legacy systems weren’t built for. Hybrid pricing, custom terms, committed usage, and parent–child accounts quickly overwhelm traditional billing tools.

Finance teams operate reactively. Delayed usage data leads to lagging revenue reporting, margin blind spots, and surprise invoices for customers.

Pricing experimentation feels risky. Without safe environments to test changes, teams avoid iteration because billing mistakes directly impact revenue and trust.

To summarize this, we can say that enterprise billing software exists to remove these bottlenecks by giving product, finance, and RevOps teams control over pricing, revenue, and scale without rebuilding infrastructure every time.

How to choose the right enterprise billing software for your AI and SaaS product in 2026

Based on what we’ve seen across several scaling SaaS and AI companies, these are the 5 considerations that you should look for before choosing the right enterprise billing software:

1. Can it support hybrid pricing models out of the box?

Modern products usually don’t monetize with subscriptions alone. Look for platforms that natively support subscriptions, usage-based pricing, credits, and overages, without custom engineering. Your billing system should adapt as your pricing evolves, not force you into rigid plan structures.

2. Does it provide real-time usage and revenue visibility?

If your product runs on tokens, API calls, or compute, delayed billing data creates blind spots. Enterprise billing software should offer real-time usage metering and instant revenue visibility, so finance and product teams can monitor consumption, forecast growth, and prevent surprise invoices.

3. Can finance and RevOps operate without engineering?

Every pricing change shouldn’t require a developer. The right platform allows finance and RevOps teams to manage plans, entitlements, credits, and contracts independently — freeing engineering to focus on product, not billing workflows.

4. Does it avoid payment gateway lock-in?

Many billing tools tightly couple pricing logic to payment processors. Prioritize platforms that keep billing infrastructure separate from payments. This gives you flexibility to negotiate rates, expand globally, or switch gateways without rebuilding your pricing stack.

5. Is it built to scale with enterprise complexity?

As you grow your business, you’ll need support for that, like:

Parent–child accounts

Custom enterprise contracts

Usage-linked invoices

Audit-ready reporting

Why is Flexprice the perfect enterprise billing software for you?

Now the question comes to mind: why does Flexprice make sense for my business and product? What parameters does it provide that others lack? Here is the answer to all your questions:

Open-source

Flexprice is an open-source platform that is designed to provide full transparency into your billing infrastructure, with the freedom to customize, self-host, or extend the platform without being locked into proprietary systems.

Active community and continuous innovation

Flexprice has an active community that not only talks about problems that customers face, but also responds within minutes and solves them in no time.

Pricing transparency

It is a critical parameter where other legacy enterprise billing vendors rely on opaque contracts or percentage-of-revenue fees; Flexprice offers clear and usage-aligned pricing.

Which, in the end, helps the finance team to get:

Predictable cost modeling

No hidden revenue share

Clear scaling economics as transaction volume grows

For enterprise buyers, pricing transparency reduces procurement friction and long-term cost surprises.

Built specifically for AI and API-first monetization

Flexprice isn’t just retrofitted for usage-based billing; it was designed for it. It natively supports:

Real-time usage metering

Credit wallets and prepaid models

Entitlement governance

Hybrid subscription + usage pricing

This makes it a natural fit for companies monetizing tokens, inference calls, compute, or high-variance consumption.

Freedom from payment gateway lock-in

Flexprice keeps the billing infrastructure decoupled from payment processors.

That means:

You can negotiate better processing rates

Expand into new regions without re-platforming

Switch gateways without rewriting pricing logic

For growing enterprises, that flexibility compounds over time.

Wrapping up

Enterprise billing is no longer just a finance function; it’s the core infrastructure for AI and SaaS companies. As pricing models shift toward usage, credits, and hybrid contracts, billing becomes tightly coupled with product velocity, revenue accuracy, and customer experience.

But trying to manage this complexity with legacy subscription tools or homegrown workflows creates friction fast. Hardcoded pricing logic, spreadsheet-based usage tracking, delayed invoices, and payment-provider lock-in lead to revenue leakage, billing disputes, and engineering bottlenecks that slow your entire organization.

The platforms covered in this guide take very different approaches to solving these challenges. Some are optimized for traditional subscriptions. Others focus on engineering-led usage pipelines. And a few are built specifically for modern, consumption-driven products.

For AI companies, API-first platforms, and usage-heavy SaaS businesses that need real-time metering, credit-based pricing, entitlement governance, fast experimentation, and freedom from vendor lock-in, Flexprice delivers the best billing infrastructure required to monetize at scale, without constraining how your product or pricing changes.

The right enterprise billing software doesn’t just process invoices. It enables your pricing strategy, protects your revenue, and lets your teams move fast. You should choose infrastructure built for the volatility, complexity, and experimentation that modern products demand.

2. Orb

Orb is a usage-based billing platform focused on metered pricing, event-driven billing, and invoice generation for modern SaaS and API-first companies.

Orb positions itself as an engineering-first billing system, designed to ingest large volumes of usage events and translate them directly into billable revenue. It’s commonly adopted by developer-heavy teams building consumption-based products, especially in AI and infrastructure SaaS.

The platform centers around real-time event ingestion, flexible pricing logic, and usage-backed invoicing, acting as a billing layer between your product and payment systems.

Key features

Usage metering: Orb ingests product usage events in real time and converts them into billable metrics. Teams define pricing based on custom usage dimensions such as API calls, compute, tokens, or storage.

Pricing flexibility: Supports subscriptions, usage-based pricing, tiered rates, and hybrid models combining base plans with consumption overages. Pricing rules are configured via APIs and dashboards, allowing companies to model complex enterprise contracts.

Subscription management: Handles plan lifecycle changes, including upgrades, downgrades, prorations, and renewals, which are suitable for SaaS products transitioning from seat-based to usage-based revenue.

Usage-linked invoicing: Invoices are generated directly from metered usage and subscription charges, with line items traceable back to underlying events, helping finance teams validate charges and reduce disputes.

Data pipeline integrations: Orb integrates with modern data stacks and warehouses, allowing engineering teams to push usage data from existing analytics pipelines into billing.

Pros

Strong real-time usage billing foundation

Designed for API-first and consumption-based products

Flexible pricing logic for subscriptions + usage hybrids

Usage-backed invoicing improves revenue traceability

Works well for engineering-led billing workflows

Suitable for mid-market and enterprise SaaS contracts

Cons

An engineering-heavy setup and usage modeling typically require developer involvement

Limited no-code controls for finance and RevOps teams

Less focus on credit-based pricing and prepaid wallet models compared to newer AI-first platforms

No native entitlement layer for feature gating; it is often handled externally.

Pricing experimentation can be slower due to API-driven configuration

Less emphasis on business-user workflows like contract packaging.

Pricing

Orb uses a usage-based pricing model tied to metered revenue volume. Exact pricing is not publicly listed and requires speaking with sales.

Best suited for

Developer-first SaaS and API products monetizing directly from usage events

Engineering teams that prefer API/SQL-driven pricing over no-code tools

Companies handling large volumes of real-time consumption data (APIs, infra, AI)

Businesses transitioning from flat subscriptions to usage-led or hybrid billing

Teams that need highly traceable, usage-backed invoices for finance accuracy

3. Metronome

Metronome is an enterprise usage-based billing platform originally built to help SaaS and infrastructure companies convert high-volume consumption data into revenue.

Founded by former engineers from Dropbox, Metronome was designed around event-driven billing, transforming raw product usage like API calls, tokens, and compute minutes into billable metrics and supporting complex enterprise contracts.

In early 2026, Metronome became part of Stripe’s billing stack following its acquisition, meaning Metronome now operates inside Stripe Billing rather than as an independent platform.

Today, Metronome primarily serves engineering-led organizations selling usage-heavy products who are already committed to Stripe’s ecosystem.

Key features

Event-based usage metering: Metronome ingests raw usage events and aggregates them into billable metrics. Teams define how consumption is measured across dimensions like API volume, compute, or tokens, enabling postpaid billing for infrastructure-style products.

Enterprise account hierarchies: This supports parent–child account structures, which allow organizations to manage billing across multiple business units or customers with complex organizational setups.

Postpaid consumption billing: It is built primarily for billing after usage occurs, making it well-suited for API platforms, cloud services, and AI infrastructure charging by volume.

Contract complexity management: Handles enterprise constructs such as minimum commitments, prepaid credits, usage overages, and negotiated thresholds, which are common in SaaS deals.

Dimensional pricing: Allows pricing to vary based on customer attributes like region, tier, or segment, supporting differentiated enterprise contracts.

Pros

Strong high-volume usage metering infrastructure

Designed for consumption-heavy AI and infrastructure platforms

Supports enterprise contracts with commitments, minimums, and overages

Well-suited for engineering-driven billing implementations

Cons

Locked into Stripe for billing and payments

Stripe fees added on top of Metronome costs

Sales-led onboarding, no self-serve setup

Engineering is required for the pricing configuration

No non-code tools for finance teams

Hybrid pricing needs custom workarounds

Pricing

Metronome does not publish pricing publicly. So to learn more, you will need to contact their sales team from their website.

Best suited for enterprise teams that

Already use Stripe as their primary payment processor

Monetize infrastructure, APIs, or AI workloads via postpaid usage

Have strong internal engineering resources to manage billing logic

Need support for large enterprise contracts with minimum commitments

4. Chargebee

Chargebee is an enterprise subscription billing and revenue operations platform built primarily for SaaS companies managing recurring revenue, invoicing, and subscription lifecycles.

Chargebee is widely adopted by mid-market and enterprise SaaS teams that operate on subscription-first models and need packaged billing workflows, revenue reporting, and integrations with CRMs and accounting systems.

While Chargebee has expanded into usage-based billing, its core architecture remains optimized for traditional SaaS subscriptions rather than AI-native, high-variance consumption models.

Key features

Subscription lifecycle management: Chargebee handles trials, upgrades, downgrades, prorations, renewals, and cancellations, making it well-suited for companies running seat-based or plan-based SaaS offerings.

Hybrid billing: Supports metered add-ons layered on top of subscriptions. Teams can charge for usage, but consumption models typically operate as extensions of subscription plans rather than as first-class primitives.

Enterprise invoicing & revenue operations: Provides automated invoicing, tax handling, dunning, and integrations for revenue workflows. Commonly used alongside CRMs and accounting systems for quote-to-cash operations.

Customer account management: Supports customer records, billing profiles, and payment methods, with tooling aimed at finance and RevOps teams managing recurring contracts.

Integrations ecosystem: Native integrations with Stripe, CRMs like Salesforce, and accounting platforms such as NetSuite make it a familiar choice for enterprise RevOps stacks.

Pros

Mature subscription billing workflows

Strong ecosystem for SaaS revenue operations

Finance-friendly UI for managing plans, invoices, and customers

Good fit for traditional SaaS businesses with predictable recurring revenue

Extensive integrations with CRM and accounting systems

Cons

Subscription-first architecture, usage-based billing is secondary.

Limited native support for credit wallets and prepaid usage

Pricing experimentation is constrained by plan-based structures

Entitlement management is often handled outside of billing

High-variance usage scenarios require custom implementations

Can become operationally complex as pricing models evolve

Pricing

Chargebee pricing is tiered based on revenue and feature access, with enterprise plans negotiated through sales.

Best suited for enterprise teams that

Operate primarily on subscription-based SaaS models

Need mature invoicing and RevOps workflows

Rely heavily on CRM + accounting integrations

Run sales-led SaaS with predictable recurring revenue

5. Stripe billing

Stripe Billing is the subscription and invoicing layer inside Stripe’s payments ecosystem. It’s most commonly adopted by SaaS companies already processing payments with Stripe who want to add recurring billing and basic usage charging without introducing another vendor.

It supports flexible pricing so that you can define tiered, volume‑based, and usage‑based models, and combine them into hybrid plans. Usage is tracked via meters, so you can send events as they happen and have Stripe aggregate and bill them accurately. Stripe Billing also offers strong multi‑currency support, so you can operate globally with seamless billing in local currencies.

Stripe Billing is best suited for traditional SaaS businesses with straightforward subscription plans and pricing needs, especially those with strong engineering bandwidth and a preference for code‑first, programmable billing tightly coupled to Stripe Payments.

Key features

Subscription and plan lifecycle management: Stripe Billing handles recurring plans, upgrades, downgrades, prorations, and renewals as part of its core subscription workflows, a strong fit for classic SaaS models.

Basic usage billing: Supports simple usage-based charges on top of subscriptions, suitable for early-stage or low-complexity consumption scenarios. Complex, multi-metric metering often requires additional engineering or workaround logic.

Invoicing and collections: Native invoicing integrates tightly with Stripe Payments, including automatic tax calculation, payment retries, and dunning workflows.

CRM + financial integrations: Stripe’s ecosystem provides broad integrations with payment rails and marketplaces, though complex revenue operations may require additional tooling.

Pros

Seamless fit for Stripe payment users

Reliable global payments infrastructure that leverages Stripe’s mature payments stack.

Strong support for standard subscription, which is excellent for recurring SaaS billing.

Quickest onboarding path for basic billing, if already in the Stripe ecosystem.

Cons

Architecture tied to the Stripe ecosystem is inseparable.

Usage billing is limited, only capable of simple usage charges.

No native enterprise metering primitives, lacks granular usage filtering.

No built-in support for feature entitlements or shared quotas.

Hybrid pricing and credit models often require workarounds.

Limited hierarchical account structures, no parent-child billing, or shared usage pools

Pricing

Stripe Billing pricing is not disclosed publicly; you can check their website.

Best Suited For

Enterprise teams that already use Stripe as their sole payments platform.

Organizations with subscription-centric billing and minimal usage complexity.

Companies are comfortable with engineering-led custom usage logic.

Teams are prioritizing Stripe’s payment ecosystem over billing autonomy.

6. Maxio

Maxio is a financial operations and enterprise billing platform designed for mid-market and larger SaaS companies. It combined the strengths of Chargify for flexible billing workflows and SaaSOptics for financial reporting, compliance, and revenue recognition to offer a unified system for subscription billing, revenue management, and billing analytics.

As businesses scale, Maxio positions itself for companies that need deep financial reporting, revenue compliance, and complex subscription management beyond simple recurring billing.

Because Maxio is designed for B2B SaaS, the workflows match the way subscription companies actually operate, so teams spend less time maintaining processes and more time reviewing clean, reliable data.

Key features

Financially aware subscription billing: Maxio automates subscription life cycles, invoicing, and billing operations for SaaS businesses. It supports mix-and-match pricing models, including flat, tiered, usage-based, and hybrid configurations, enabling companies to align billing structures with business goals.

Revenue recognition and compliance: Built-in support for GAAP/ASC 606 and IFRS 15 ensures revenue reporting and forecasts are audit-ready, a key requirement for finance and accounting teams in larger organizations.

Advanced financial analytics: Real-time dashboards and drill-down reporting for metrics like ARR, MRR, churn, cohort trends, and revenue waterfalls help enterprise teams make data-driven decisions and monitor financial health.

Collections & multi-gateway support: Maxio streamlines automated collections, payment retries, and dunning workflows across multiple payment gateways while tying collection events back to customer accounts for finance visibility.

Integrations with financial systems: Deep integrations with CRM and accounting systems like Salesforce, QuickBooks, and Avalara for tax automation help unify billing and financial operations.

Pros

Comprehensive subscription and revenue automation.

Built-in compliance and audit are crucial for enterprise finance and accounting.

Supports hybrid pricing strategies: flat, usage, tiered, and combo models.

Strong analytics and KPI tracking, real-time financial reporting for executive visibility.

Multi-entity and financial integrations that fit complex enterprise tech stacks.

Cons

A steeper learning curve setup and adoption require more time and training.

Data migration and configuration for large enterprises can be resource-intensive.

Invoice and reporting limitations.

Merged legacy components

Enterprise sales process onboarding and pricing require sales engagement rather than instant self-serve.

Pricing

Maxio offers tiered plans that reward growth, starting around $599/month for standard billing and rising to custom enterprise pricing for high volume and advanced revenue operations.

Best suited for enterprise teams that:

Operate complex subscription billing and revenue recognition workflows

Require audit-ready financial reporting and compliance

Need deep integration with CRM and accounting systems

Seek a unified platform that ties billing, revenue, and analytics together

7. Zuora

Enterprises today need a billing system designed to keep pace with rapidly evolving business models. Zuora can help.

As a monetization platform, Zuora supports your recurring revenue growth across pricing and packaging, billing, customer acquisition, and quote-to-cash, whether you monetize through subscriptions, usage, or optimize across a full range of pricing strategies.

It is widely used by established enterprises that require deep governance over billing, revenue recognition (ASC 606 / IFRS 15), and global financial operations. Unlike newer systems built for high-variance usage billing or API-first products, Zuora’s architecture was originally engineered for enterprise subscription and contract billing.

Key features

Comprehensive subscription and contract management: Zuora manages the full lifecycle of enterprise contracts, including renewals, amendments, upgrades, downgrades, and multi-year agreements with flexible billing terms.

Enterprise invoicing and billing automation: Zuora automates large-volume invoice generation across thousands of accounts, with support for tax engines, billing schedules, and consolidated statements for multi-entity customers.

Revenue recognition & compliance: Built-in revenue recognition tools help meet ASC 606 and IFRS 15 standards, enabling audit-ready reporting for finance and accounting teams.

Billing analytics & forecasting: Enterprise dashboards and reporting allow finance leaders to track MRR, churn, bookings, cash flow, and scenario modeling across product lines and geographies.

Multi-entity & global support: Designed for multinational organizations, Zuora handles multiple billing currencies, entities, and compliance requirements across regions.

Pros

Enterprise-grade governance and controls.

Strong revenue recognition and compliance tooling.

High scalability for large account volumes, which supports millions of subscribers.

Global billing and tax support that is built for multinational operations.

Flexible contract engine handles long-term negotiated deals and tiered entitlements.

Cons

Long implementation cycles often take months.

Less agile for usage-heavy AI billing,n ot designed natively for real-time consumption.

Complex configuration and governance overhead.

Limited real-time metering primitives usage billing.

Higher total cost of ownership, expensive professional services, and license fees.

Pricing

Zuora does not publicly list pricing; contact their sales team for more information.

Best suited for enterprise teams that:

Require audit-ready finance controls and compliance

Operate large subscription bases with complex contract terms

Need global billing, multi-entity support, and tax governance

Have dedicated implementation and revenue operations teams

Why do you need an enterprise billing software?

In today's evolving financial tech stack, Enterprise billing software is a must because it is essential for automating complex, high-volume, and recurring revenue processes, which significantly reduce manual errors and operational costs.

Across 50+ enterprise customers, we consistently see the same challenges emerge as companies scale beyond basic subscription billing:

Vendor lock-in slows the growth. Pricing logic tied directly to payment providers makes it difficult to switch gateways, negotiate better rates, or expand globally.

Billing becomes a product bottleneck. Every pricing change requires engineering involvement, blocking teams from moving fast or experimenting with new monetization models.

Usage-based revenue turns operationally fragile. Spreadsheets and batch pipelines can’t keep up with real-time AI and API consumption, leading to reconciliation gaps and delayed visibility.

Enterprise contracts introduce complexity that legacy systems weren’t built for. Hybrid pricing, custom terms, committed usage, and parent–child accounts quickly overwhelm traditional billing tools.

Finance teams operate reactively. Delayed usage data leads to lagging revenue reporting, margin blind spots, and surprise invoices for customers.

Pricing experimentation feels risky. Without safe environments to test changes, teams avoid iteration because billing mistakes directly impact revenue and trust.

To summarize this, we can say that enterprise billing software exists to remove these bottlenecks by giving product, finance, and RevOps teams control over pricing, revenue, and scale without rebuilding infrastructure every time.

How to choose the right enterprise billing software for your AI and SaaS product in 2026

Based on what we’ve seen across several scaling SaaS and AI companies, these are the 5 considerations that you should look for before choosing the right enterprise billing software:

1. Can it support hybrid pricing models out of the box?

Modern products usually don’t monetize with subscriptions alone. Look for platforms that natively support subscriptions, usage-based pricing, credits, and overages, without custom engineering. Your billing system should adapt as your pricing evolves, not force you into rigid plan structures.

2. Does it provide real-time usage and revenue visibility?

If your product runs on tokens, API calls, or compute, delayed billing data creates blind spots. Enterprise billing software should offer real-time usage metering and instant revenue visibility, so finance and product teams can monitor consumption, forecast growth, and prevent surprise invoices.

3. Can finance and RevOps operate without engineering?

Every pricing change shouldn’t require a developer. The right platform allows finance and RevOps teams to manage plans, entitlements, credits, and contracts independently — freeing engineering to focus on product, not billing workflows.

4. Does it avoid payment gateway lock-in?

Many billing tools tightly couple pricing logic to payment processors. Prioritize platforms that keep billing infrastructure separate from payments. This gives you flexibility to negotiate rates, expand globally, or switch gateways without rebuilding your pricing stack.

5. Is it built to scale with enterprise complexity?

As you grow your business, you’ll need support for that, like:

Parent–child accounts

Custom enterprise contracts

Usage-linked invoices

Audit-ready reporting

Why is Flexprice the perfect enterprise billing software for you?

Now the question comes to mind: why does Flexprice make sense for my business and product? What parameters does it provide that others lack? Here is the answer to all your questions:

Open-source

Flexprice is an open-source platform that is designed to provide full transparency into your billing infrastructure, with the freedom to customize, self-host, or extend the platform without being locked into proprietary systems.

Active community and continuous innovation

Flexprice has an active community that not only talks about problems that customers face, but also responds within minutes and solves them in no time.

Pricing transparency

It is a critical parameter where other legacy enterprise billing vendors rely on opaque contracts or percentage-of-revenue fees; Flexprice offers clear and usage-aligned pricing.

Which, in the end, helps the finance team to get:

Predictable cost modeling

No hidden revenue share

Clear scaling economics as transaction volume grows

For enterprise buyers, pricing transparency reduces procurement friction and long-term cost surprises.

Built specifically for AI and API-first monetization

Flexprice isn’t just retrofitted for usage-based billing; it was designed for it. It natively supports:

Real-time usage metering

Credit wallets and prepaid models

Entitlement governance

Hybrid subscription + usage pricing

This makes it a natural fit for companies monetizing tokens, inference calls, compute, or high-variance consumption.

Freedom from payment gateway lock-in

Flexprice keeps the billing infrastructure decoupled from payment processors.

That means:

You can negotiate better processing rates

Expand into new regions without re-platforming

Switch gateways without rewriting pricing logic

For growing enterprises, that flexibility compounds over time.

Wrapping up

Enterprise billing is no longer just a finance function; it’s the core infrastructure for AI and SaaS companies. As pricing models shift toward usage, credits, and hybrid contracts, billing becomes tightly coupled with product velocity, revenue accuracy, and customer experience.

But trying to manage this complexity with legacy subscription tools or homegrown workflows creates friction fast. Hardcoded pricing logic, spreadsheet-based usage tracking, delayed invoices, and payment-provider lock-in lead to revenue leakage, billing disputes, and engineering bottlenecks that slow your entire organization.

The platforms covered in this guide take very different approaches to solving these challenges. Some are optimized for traditional subscriptions. Others focus on engineering-led usage pipelines. And a few are built specifically for modern, consumption-driven products.

For AI companies, API-first platforms, and usage-heavy SaaS businesses that need real-time metering, credit-based pricing, entitlement governance, fast experimentation, and freedom from vendor lock-in, Flexprice delivers the best billing infrastructure required to monetize at scale, without constraining how your product or pricing changes.

The right enterprise billing software doesn’t just process invoices. It enables your pricing strategy, protects your revenue, and lets your teams move fast. You should choose infrastructure built for the volatility, complexity, and experimentation that modern products demand.

2. Orb

Orb is a usage-based billing platform focused on metered pricing, event-driven billing, and invoice generation for modern SaaS and API-first companies.

Orb positions itself as an engineering-first billing system, designed to ingest large volumes of usage events and translate them directly into billable revenue. It’s commonly adopted by developer-heavy teams building consumption-based products, especially in AI and infrastructure SaaS.

The platform centers around real-time event ingestion, flexible pricing logic, and usage-backed invoicing, acting as a billing layer between your product and payment systems.

Key features

Usage metering: Orb ingests product usage events in real time and converts them into billable metrics. Teams define pricing based on custom usage dimensions such as API calls, compute, tokens, or storage.

Pricing flexibility: Supports subscriptions, usage-based pricing, tiered rates, and hybrid models combining base plans with consumption overages. Pricing rules are configured via APIs and dashboards, allowing companies to model complex enterprise contracts.

Subscription management: Handles plan lifecycle changes, including upgrades, downgrades, prorations, and renewals, which are suitable for SaaS products transitioning from seat-based to usage-based revenue.

Usage-linked invoicing: Invoices are generated directly from metered usage and subscription charges, with line items traceable back to underlying events, helping finance teams validate charges and reduce disputes.

Data pipeline integrations: Orb integrates with modern data stacks and warehouses, allowing engineering teams to push usage data from existing analytics pipelines into billing.

Pros

Strong real-time usage billing foundation

Designed for API-first and consumption-based products

Flexible pricing logic for subscriptions + usage hybrids

Usage-backed invoicing improves revenue traceability

Works well for engineering-led billing workflows

Suitable for mid-market and enterprise SaaS contracts

Cons

An engineering-heavy setup and usage modeling typically require developer involvement

Limited no-code controls for finance and RevOps teams

Less focus on credit-based pricing and prepaid wallet models compared to newer AI-first platforms

No native entitlement layer for feature gating; it is often handled externally.

Pricing experimentation can be slower due to API-driven configuration

Less emphasis on business-user workflows like contract packaging.

Pricing

Orb uses a usage-based pricing model tied to metered revenue volume. Exact pricing is not publicly listed and requires speaking with sales.

Best suited for

Developer-first SaaS and API products monetizing directly from usage events

Engineering teams that prefer API/SQL-driven pricing over no-code tools

Companies handling large volumes of real-time consumption data (APIs, infra, AI)

Businesses transitioning from flat subscriptions to usage-led or hybrid billing

Teams that need highly traceable, usage-backed invoices for finance accuracy

3. Metronome

Metronome is an enterprise usage-based billing platform originally built to help SaaS and infrastructure companies convert high-volume consumption data into revenue.

Founded by former engineers from Dropbox, Metronome was designed around event-driven billing, transforming raw product usage like API calls, tokens, and compute minutes into billable metrics and supporting complex enterprise contracts.