Ayush Parchure

Ayush ParchureYour Guide to Choosing Between Credit Based Pricing and Usage Based Pricing

Your Guide to Choosing Between Credit Based Pricing and Usage Based Pricing

Your Guide to Choosing Between Credit Based Pricing and Usage Based Pricing

Your Guide to Choosing Between Credit Based Pricing and Usage Based Pricing

Feb 10, 2026

Feb 10, 2026

Feb 10, 2026

• 20 min read

• 20 min read

Ayush Parchure

Content Writing Intern, Flexprice

You're weeks from the launch, and your co-founder just asked you the question you've been avoiding: "Are we doing credits or usage-based pricing?"

You know this will impact your entire billing infrastructure, the decision that'll either scale your AI product or force you to rebuild everything. Your engineering team is asking which infrastructure to build. And honestly? You're not sure if credits or pure usage-based pricing fits your product.

This guide will help you break down exactly which model works for AI and SaaS products like yours. Plus, we'll show you how to launch either approach in under an hour without a custom billing infrastructure with Flexprice.

TL;DR

Flat subscription pricing is fading away as products become more dynamic, usage-driven, variable, and value-based.

Usage-based pricing charges customers after consumption, which offers transparency but often leads to unpredictable bills and harder budgeting.

Credit-based pricing lets businesses prepackage value into credits, which gives customers better clarity of spend control while keeping their pricing aligned with real usage.

Usage-based models work best for simple products with one clear usage metric, while credit-based models scale better for complex, multi-feature AI and SaaS.

Many modern SaaS teams suggest that AI companies adopt hybrid pricing, which helps in combining credits-based billing for predictability with usage-based billing for flexibility.

This blog helps in a complete breakdown of both models to help you choose the right pricing foundation based on product complexity, customer behavior, and growth stage.

What is credit-based pricing?

Credit-based pricing is a billing model where customers purchase or receive a predetermined amount of "credits" that they can spend on using various features or services within a product. Instead of paying per individual action or on a traditional subscription basis, users draw down from their credit balance as they consume resources.

How does it work?

Credits are loaded upfront so that customers begin with a pool of credits that sets a clear spending boundary before usage starts, reducing billing anxiety and simplifying budget planning.

As customers interact with different features, credits are consumed at predefined rates that reflect relative value, which allows multiple features to coexist under one pricing system.

When credits run out, access stays smooth because customers can replenish or renew the balance with features like top-up, which resolves interruptions or unexpected invoices.

If you want to see how this works in practice, learn how Segwise Shipped Credit-Based Pricing in 3 Days After Spending 3 Weeks Building It In-House

Real world examples of credit based pricing in SaaS

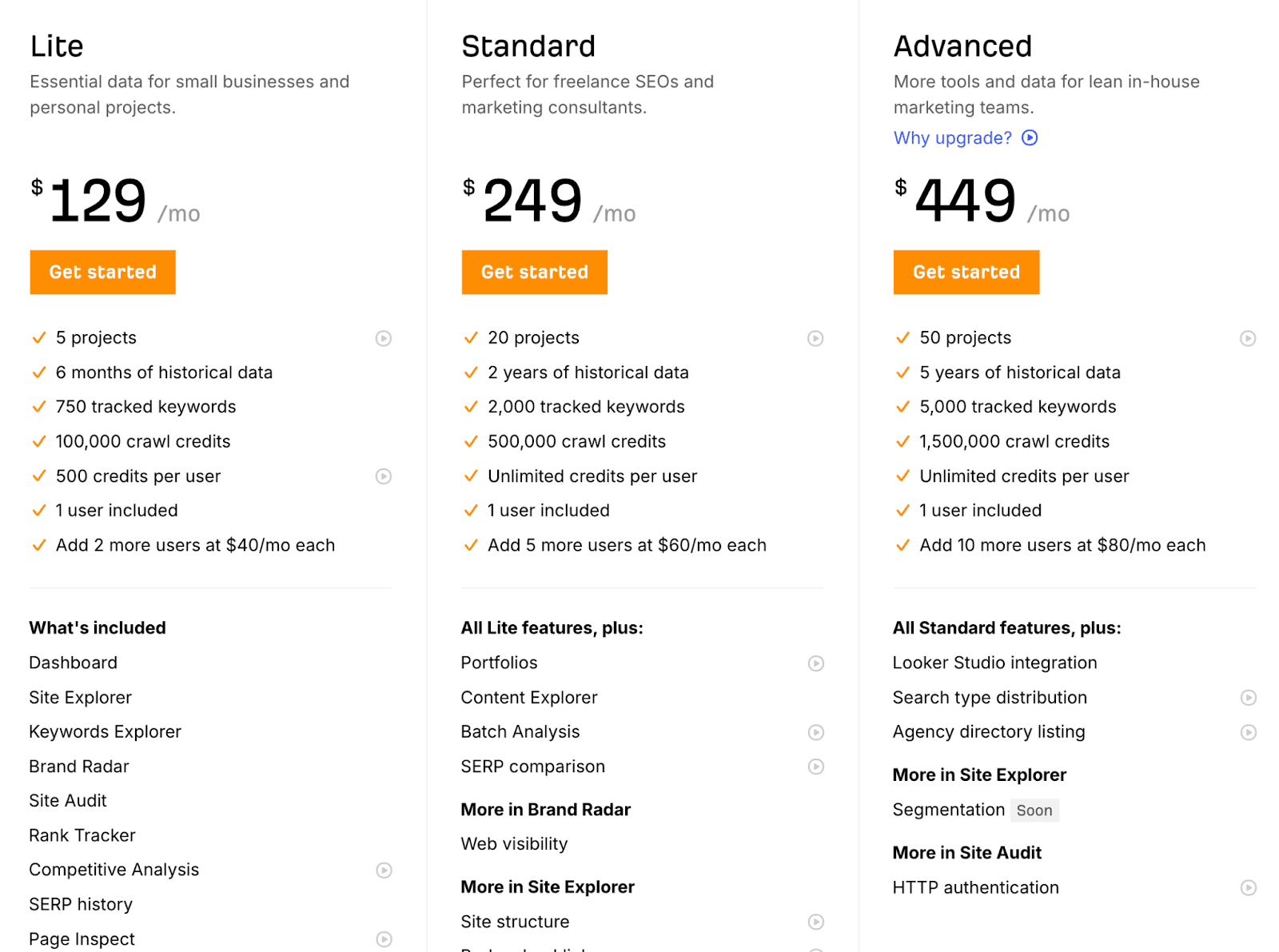

A strong example of this model can be seen in how Ahrefs structures its pricing.

Ahrefs combines subscription plans with a credit-based usage system to manage resource-intensive operations like crawling, audits, and large data queries. Each plan includes a defined monthly credit allowance that governs how much customers can consume.

For example:

Ahrefs allocates a defined number of crawl credits per month based on the customer’s plan, ranging from 100,000 to 1.5 million credits. These credits act as a shared usage pool that governs how much resource-intensive work a customer can perform.

Credits are consumed when users run Site Audits, crawl large numbers of pages, perform in-depth link analysis, or execute other data-heavy actions. More complex or larger operations burn credits faster, ensuring usage stays proportional to infrastructure cost.

Instead of charging variable overage fees, Ahrefs resets credits at the start of each billing cycle. When limits are reached, users are prompted to upgrade or wait for renewal, keeping costs predictable and avoiding surprise invoices.

This model allows Ahrefs to support SEO workflows without exposing customers to unpredictable, usage-based bills. Instead of charging per crawl or per query in real time, credits act as a guardrail that aligns infrastructure cost with plan value.

Why this works for Ahrefs:

Prevents runaway infrastructure costs

Keeps pricing simple for non-technical users

Scales across multiple features under one system

Balances predictable subscriptions with controlled usage

Types of credit in credit-based pricing

Signup Credits: Free credits given to new users during onboarding, allowing them to experience the product's core value before making any financial commitment. These credits replace traditional time-based free trials by focusing on actual usage rather than calendar days.

Why companies use them: Signup credits let users engage with real functionality immediately, which often converts better than time-limited trials, where users might procrastinate or forget to explore features.

Example: Many AI API platforms provide $5-$20 worth of free credits to new developers, enabling them to test endpoints, build prototypes, and evaluate performance before entering payment details.

Promotional Credits: Temporary credits distributed during specific marketing campaigns, product launches, seasonal promotions, or partnership initiatives. These credits create urgency and incentivize users to try new features or re-engage with the platform.

Why companies use them: Promotional credits drive time-sensitive adoption, help announce new capabilities, and provide a low-friction way to reactivate dormant accounts without permanent discounting.

Example: When an AI company launches a new model, they might offer existing customers $50 in promotional credits valid for 30 days to encourage experimentation with the new functionality.

Prepaid Credits: Credits that customers purchase upfront and consume incrementally as they use the product. This is the foundation of most credit-based pricing models, where users load funds into their account balance before accessing services.

Why companies use them: Prepaid credits guarantee revenue before delivery, eliminate billing surprises for customers, create natural spending limits, and improve cash flow predictability for the business.

Example: API-based AI platforms require customers to deposit funds that get deducted in real-time as API calls are made. A customer might load $100, which depletes gradually based on the number and type of requests they generate.

Subscription Credits: A recurring allocation of credits included with a subscription plan that refreshes at the start of each billing period. These credits don't roll over; they reset monthly or annually, creating a "use it or lose it" dynamic.

Why companies use them: Subscription credits work well in hybrid pricing models, combining predictable recurring revenue with consumption-based fairness. They set clear usage boundaries while still allowing customers to upgrade or purchase additional credits if needed.

Example: Ahrefs includes monthly crawl credits with each subscription tier. These credits govern resource intensive operations like site audits and backlink analysis, resetting on the billing renewal date regardless of whether the previous month's allocation was fully used.

Top-Up Credits: On-demand credits that customers can purchase individually when their existing balance runs low, without changing their underlying subscription plan. These act as overflow capacity for unexpected usage spikes.

Why companies use them: Top-ups provide flexibility for customers who occasionally exceed their normal usage without forcing them into a permanent plan upgrade. This maximizes revenue capture during high activity periods while keeping base plans affordable.

Example: Zapier allows users to buy additional task credits à la carte when they hit their monthly automation limit. Instead of upgrading to a higher tier permanently, users can purchase one-time credit packs to cover temporary increases in workflow volume.

Benefits of credit based pricing

1. Improved cash flow

Credits are typically purchased upfront, meaning you receive payment before delivering the service. This creates positive cash flow and reduces the risk of non-payment, especially valuable for early-stage companies or those with expensive infrastructure costs.

2. Higher revenue predictability

Prepaid credits create a buffer of committed revenue that smooths out usage fluctuations. Even if a customer doesn't use their credits immediately, you've already captured that revenue, making financial forecasting more reliable than pure pay-as-you-go models.

3. Reduced payment friction

Once customers load credits, each transaction happens seamlessly without requiring repeated payment authorizations. This eliminates micro-transaction fees, reduces failed payment incidents, and removes psychological barriers to continued usage.

4. Lower churn through commitment

Customers with unused credit balances are less likely to churn—they're financially incentivized to stay and extract value from what they've already paid for. This creates natural stickiness that pure usage-based models lack.

5. Flexible value based pricing

You can assign different credit costs to different features based on their value or resource intensity. Premium capabilities can cost more credits, while basic features cost less, allowing you to capture more value from power users without overcharging lighter users.

6. Simplified billing operations

Instead of tracking and billing hundreds of micro-transactions per customer, you bill for credit purchases and simply deduct credits as usage occurs. This reduces billing complexity, transaction costs, and disputes over individual line items.

Challenges of credit based pricing

1. Complex pricing calibration

Determining the right credit cost for each feature is difficult. Price credits are too high, and customers feel they're not getting value; too low, and you leave revenue on the table or can't cover infrastructure costs. This requires constant monitoring and adjustment, especially as your product evolves or costs change.

2. Revenue recognition complications

Prepaid credits create accounting complexity. You collect cash upfront but can only recognize revenue as credits are consumed. Unused credits sitting in customer accounts become deferred revenue liabilities on your balance sheet, complicating financial reporting and potentially impacting company valuation.

3. Credit expiration dilemmas

Should unused credits expire? If yes, when? Expiration policies can feel punitive to customers and trigger churn, but non-expiring credits create indefinite revenue recognition delays and complicate forecasting. Finding the right balance is tricky and often contentious.

4. Customer education burden

Customers need to understand what credits are, how much different actions cost, when they'll run out, and how to purchase more. This requires clear documentation, proactive notifications, and support resources, all adding to operational overhead compared to simpler "pay $X/month" models.

5. Forecasting uncertainty

While prepaid credits improve cash flow, they make usage forecasting harder. You know customers have credits, but not when they'll use them. This makes capacity planning, infrastructure scaling, and revenue timing predictions more challenging than subscription models with predictable monthly usage.

6. Fraud and abuse risk

Sign-up and promotional credits can attract bad actors who create multiple accounts to exploit free credits withouta genuine intent to become paying customers. This requires investing in fraud detection systems and abuse prevention mechanisms.

7. Support and refund complexity

Handling refunds, disputes, or credits lost due to product bugs becomes more complex. Do you refund cash or credits? How do you compensate for credits consumed during outages? These scenarios require clear policies and can create customer service headaches.

Get started with your billing today.

Get started with your billing today.

What Is usage based pricing?

Usage-based pricing, also known as consumption-based pricing, is a pricing model that allows customers to pay for a product according to their usage. The metric used to measure usage corresponds to how the customer is extracting value from the product. Usage-based pricing is becoming increasingly popular within AI and SaaS, replacing more traditional subscription- and seat-based pricing models.

How does it work?

Users start using the product without preloaded limits, and usage is tracked continuously. At the end of the billing cycle, customers receive an invoice based on the total consumption recorded during that period.

Charges are calculated using concrete units such as API calls, data stored, compute time, or events processed. As usage increases or decreases, costs scale proportionally, creating a direct link between consumption and spending.

Because billing follows usage, customers pay more during high-activity periods and less when usage drops. This makes usage-based pricing transparent, but can also introduce variability in monthly spend.

For a pure consumption model, see how Simplismart scaled to 750+ pricing features and reclaimed 30% of daily engineering bandwidth with Flexprice

Real world examples of usage based pricing in AI SaaS

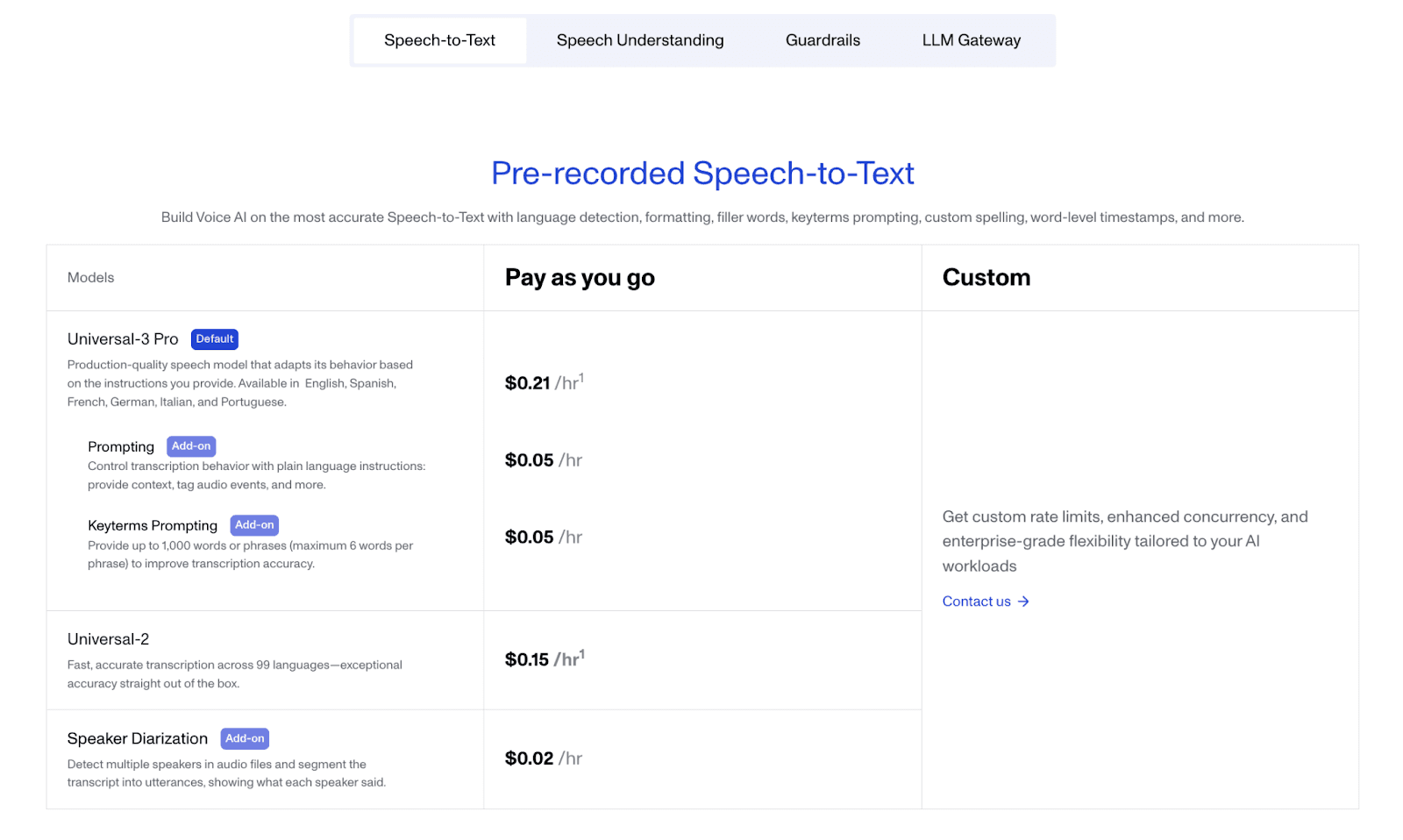

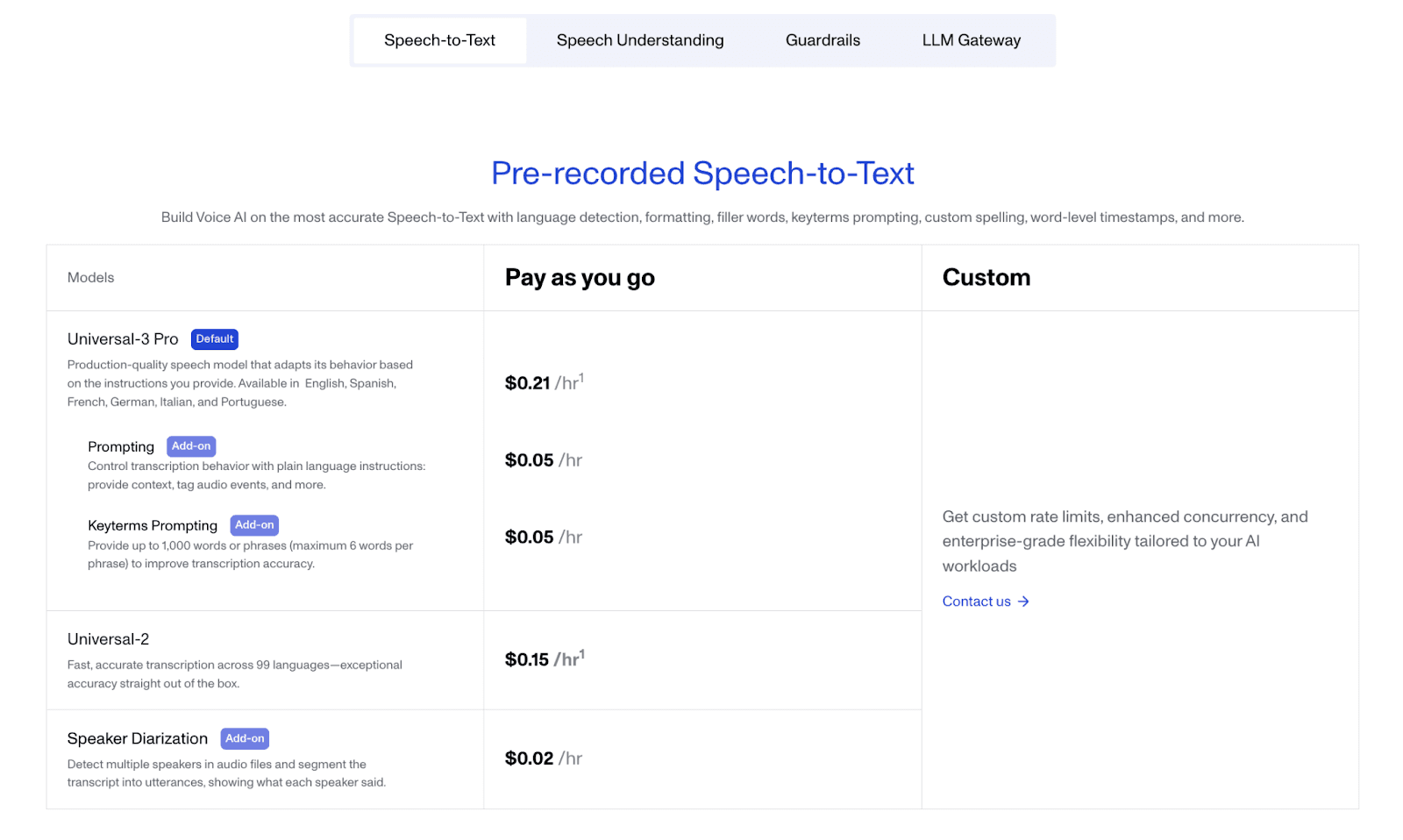

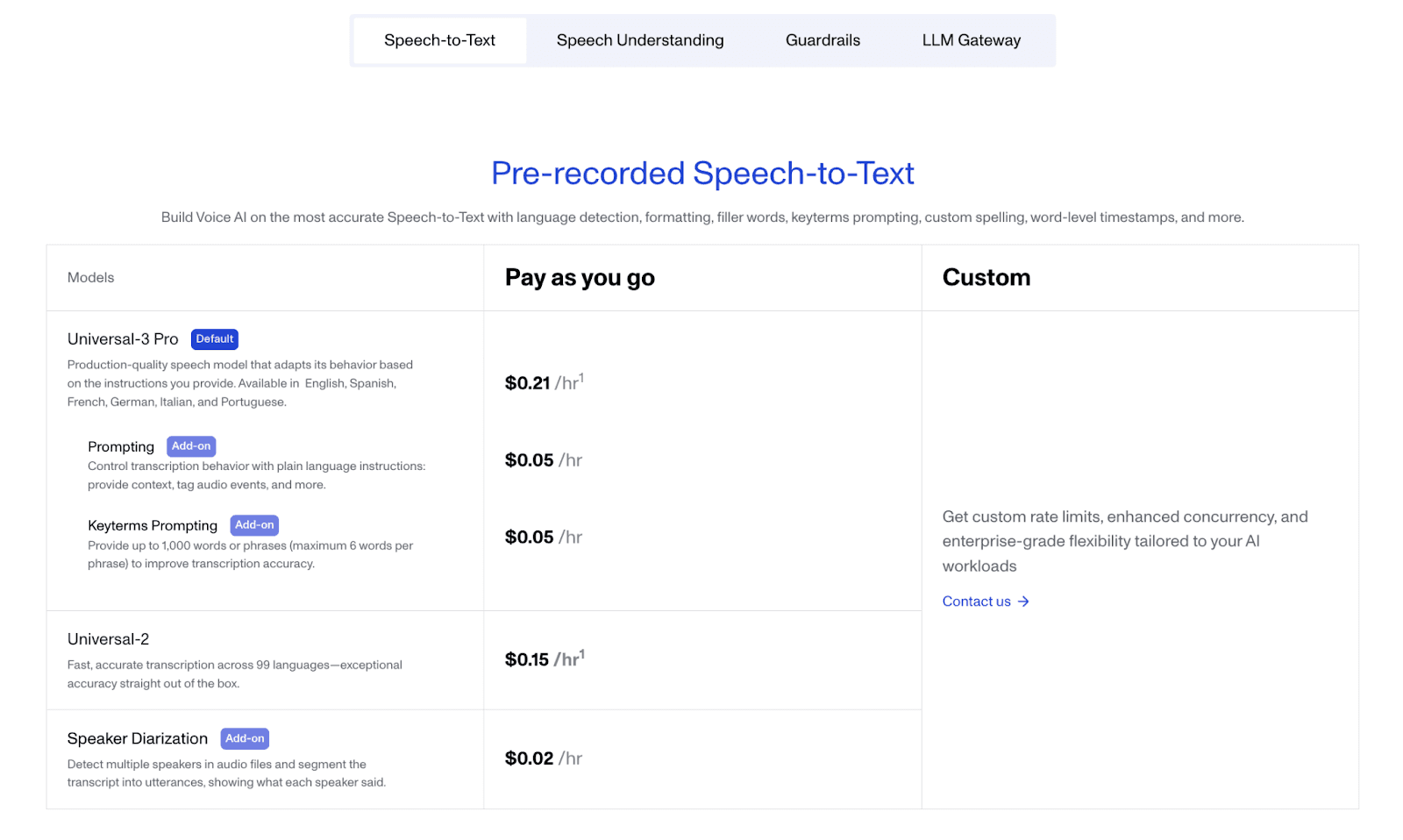

AssemblyAI follows a pay-as-you-go model with no upfront commitments or contracts. Developers can start for free and scale usage as demand grows, making pricing tightly coupled to real-world consumption.

How usage-based pricing works at AssemblyAI:

Speech-to-text is priced per hour of audio processed, starting as low as $0.15 per hour

More advanced models, like Universal-3 Pro and add-ons, increase cost based on usage intensity

Streaming and pre-recorded audio are billed separately, based on actual runtime

AI features such as speaker diarization, sentiment analysis, entity detection, and summarization are priced per hour of processing

Customers receive an invoice based on total usage during the billing period; there are no prepaid credits or fixed allowances

As usage increases, AssemblyAI offers tiered pricing and custom rates for enterprise customers processing millions of requests, while still preserving the core pay-for-what-you-use model.

Types of usage-based pricing models

Pure Pay-As-You-Go: Customers pay strictly for what they consume, with no upfront commitment, minimum spend, or bundled allowances. Billing happens after usage, and costs scale linearly with consumption. Example: Amazon Web Services (AWS) offers services like EC2, S3, and Lambda charge per second, per request, or per GB used, making it a canonical pay-as-you-go model.

Tiered Usage Pricing: Per-unit prices decrease as usage crosses predefined thresholds. Customers pay more at lower volumes and receive discounted rates as their usage grows. Example: AssemblyAI (enterprise tiers) offers lower effective rates for customers processing large volumes of audio through negotiated tiers.

Volume Pricing: A single unit price applies to all usage based on the total volume consumed in a billing period. Once a customer reaches a certain volume tier, that rate is applied uniformly. Example: Cloud storage providers where reaching a higher total usage tier lowers the per-GB rate on all consumed GBs that month.

Overage-Based: Customers receive a base allowance included in their plan. Once usage exceeds that allowance, overage charges apply on a per-unit basis. Example: Ahrefs Plans include monthly crawl credits and usage limits. When limits are reached, users must upgrade or wait for renewal rather than receiving unlimited access.

Benefits of usage based pricing

Lower barrier to entry

This model minimizes upfront costs so that customers can start small and scale according to their needs. This enables them to adopt the product without committing to high fixed fees.

Greater pricing flexibility

Because pricing scales with actual usage, companies can serve a wide range of customers from individual users to large enterprises, without forcing them into rigid plans. Usage data also helps teams continuously refine pricing to better match customer behavior.

Improved customer retention

When customers pay only for what they use, pricing feels fair and transparent. This stronger alignment between cost and value builds trust, increases satisfaction, and reduces churn over time.

Supports natural account expansion

As customers grow and derive more value from the product, usage increases organically. Revenue expands alongside adoption.

Drawbacks of usage based pricing

Unpredictable invoices

Usage-based pricing often leads to surprise bills when demand spikes or experiments run long. Even when customers get more value, sudden cost jumps feel like a loss of control. Finance teams escalate, trust erodes, and what started as “fair pricing” becomes invoice anxiety.

Harder budgeting for customers

Because spending fluctuates month to month, forecasting becomes uncertain. CFOs struggle to commit budgets, and procurement pushes back on open-ended contracts. Customers start limiting usage not because they don’t need the product, but because they need predictability.

Customers optimize against your product

When every action has a visible cost, users become defensive. Experiments are slow, features are avoided, and engineers build workarounds to reduce metered events. Instead of driving growth, pricing starts acting like a tax on innovation.

Customers optimize against your product

High usage can signal inefficiency, not success, while low usage may still power mission-critical outcomes. When pricing tracks raw consumption instead of perceived value, customers start questioning fairness.

Credit based pricing v.s usage based pricing: key differences

At a surface level, both models charge based on usage. But in practice, they create very different behaviors, risks, and growth dynamics for both customers and the business, and here are some key differences

Basis | Credit-Based Pricing | Usage-Based Pricing |

Core Mechanism | Customers pre-purchase credits, which are debited as they consume resources. Creates an abstraction layer between payment and consumption. Uses abstracted units of value (credits) rather than raw infrastructure metrics. | Customers are charged directly based on actual consumption - API calls, compute hours, tokens, and storage. Billing is reactive and tied to metering events using raw consumption metrics (tokens, calls, seconds, GB). |

Customer Bill Predictability | High - customers know their maximum spend. Creates psychological safety and spending boundaries. Spending is capped by purchased credits. | Low bills can vary significantly month-to-month based on actual usage. Usage spikes cause bill shock. Creates budget uncertainty for customers. |

Implementation Complexity | Requires a wallet/ledger system to track credit balances, expiration policies, credit grants, and debit reconciliation. Event-driven, ledger-style accounting. One unified meter handles all features. | Requires robust real-time metering infrastructure to capture, aggregate, and bill for every consumption event. Meter-driven architecture tightly coupled to product logic. Multiple meters are needed per feature or resource. |

Pricing Flexibility & Iteration | Extremely flexible - can vary credit costs by feature, offer volume discounts via credit bonuses, bundle credits with tiers. Feature costs are adjustable via configuration without code changes. Stable external pricing despite backend changes. | Limited to rate card adjustments. New features require new meters and backend logic. Discounting means reducing per-unit prices. Pricing changes ripple directly to customers, making iteration risky. |

Internal Cost Volatility Absorption | Internal conversion rates absorb infrastructure and model cost changes. You can adjust credit-to-resource mappings without changing customer-facing prices. Protects customers from backend volatility. | Cost changes directly affect customer bills. If your OpenAI costs increase or you switch models, customers see it immediately. No buffer between infrastructure costs and customer pricing. |

Best for AI Products | Excellent for AI workloads: Normalizes massive cost variance (simple query more than 100 tokens vs complex RAG query: 10,000+ tokens) Multi-model tiering is simple Handles composite AI workflows cleanly (embedding + search + generation = single credit cost) Abstracts away the token counting complexity from customers Customers experiment freely with expensive models without bill anxiety Easy to add new models without repricing the entire customer base Protects margins when switching between model providers (OpenAI → Anthropic → open-source) | Challenging for AI workloads: Creates unpredictability - token variance causes massive bill fluctuations Complex queries generate bill shock customer asks one question, sees 100x cost vs the previous query Multi-model pricing requires exposing raw token costs per model, confusing rate cards Composite workflows are hard to price. Do you charge for embeddings + retrieval + generation separately? Customers become conservative, avoiding expensive models even when they'd get better results Prices inputs (tokens processed), not outputs (value delivered) Model switches require re-pricing all customers |

Retry & Failure Handling | Charges on completed value - retries and failed attempts don't double bill customers. Can implement idempotency at the credit-debit level. Better customer experience during system issues. | Retries and partial failures risk over-charging customers. Each API call attempt may be billed even if it fails. Requires complex refund logic and dispute management. |

Customer Psychology & Experimentation | Reduces "meter anxiety" - customers feel they've already paid, encouraging product usage. Low barrier to experimentation - prepaid credits encourage trying features without immediate payment friction. Risk of "credit waste" if unused credits expire. | Can create "meter anxiety" - customers worry about costs spiraling. High barrier to experimentation - every experiment directly impacts the bill, making customers conservative in usage. Limits product exploration. |

Enterprise Sales & Procurement | Easier procurement - pre-commit budgets create predictable invoices. Finance teams can budget precisely. Revenue risk is controlled by credit balance boundaries. Buyer approval is simpler with capped exposure. | Harder procurement - variable and open-ended spend creates friction. Finance teams struggle with unpredictable monthly costs. Revenue exposure is potentially unbounded, making CFOs nervous. |

Forecasting & Capacity Planning | Credit burn rate maps cleanly to infrastructure demand. Can predict capacity needs based on credit sales and consumption patterns. Unified metric simplifies planning. | Harder due to fragmented usage metrics across multiple dimensions. Must aggregate tokens, calls, storage, and compute to understand true capacity needs. This is why teams rely on usage analytics and billing tools at scale. |

Outcome vs Input Pricing | Outcome Pricing - customers pay for value delivered (completed AI inference, successful workflow) rather than infrastructure consumed. Aligns pricing with customer success. | Price inputs - customers pay for resources consumed (tokens processed, API calls made) regardless of whether they got value. Misalignment between cost and value. |

Ideal Use Cases | AI products with variable compute costs, products with multiple feature tiers, services requiring revenue predictability, and products where experimentation drives value. Best for AI-native, API, infrastructure, and multi-feature products. | Products with clean value metrics (storage, seats, emails), services where usage directly mirrors value, and transparent pay-for-what-you-use models. Best for simple, stable, single-dimension products. |

Which pricing model is the right fit for your business?

Surprisingly, a good number of businesses leave their revenue on the table due to a lack of clarity about the right pricing model.

Data clearly shows that the pricing model directly impacts the growth rates, customer trust, and revenue predictability, especially in SaaS and AI-driven products. Get ready to transform your pricing strategy from a guessing game into a data-driven approach for growth.

1. Based on product complexity

Single feature → Simplicity → Usage-based pricing

Multiple features → Product Depth → Credit-based pricing

If your product majorly works on one dominant usage metric, usage-based pricing fits right in.

This is the reason that mostly 67% of SaaS companies now use usage-based pricing, which has increased from 52% in the last 4 years.

Products like API, cloud storage, and compute services map themselves cleanly, such as API calls, GBs processed, and compute seconds. With this customer, clearly understand what they are actually paying for.

The real question arises when the product becomes more complex.

When products offer multiple features with different cost curves, customers struggle to calculate cost across dimensions, and finance teams lose forecasting clarity. That’s where credit-based pricing becomes more effective.

Credits help in the conversion of multiple usage dimensions into a single internal currency, which allows more control over pricing. This explains why a credit-based pricing model is adopted.

2. Based on customer behaviour

Fair-pricing customers → Usage-based pricing

Budget-sensitive customers → Credit-based pricing

While usage-based models align cost with value, they introduce a post-paid uncertainty. This creates friction for finance teams, startups, and procurement-driven buyers who care deeply about spending capital.

Uncertain payments or invoices can be tackled when customers pre-commit to a budget, then consume credits in real time. This makes spending transparent and intentional, rather than a surprise; it is a critical distinction for the budget-sensitive teams.

According to market analysis, 61% of SaaS companies have adopted usage-based pricing models, indicating a broad industry movement away from flat subscriptions toward pricing that varies with consumption.

While credit-based pricing is still a minority model across SaaS overall, it is disproportionately adopted in categories with multi-dimensional usage and high infrastructure costs. Early AI and agent-based products are increasingly experimenting with credit or token-based systems to abstract complex usage and give customers predictable budget control.

This is why, when customers ask “How do I control spend?”, credit-based models consistently outperform raw usage metrics by turning unpredictable consumption into a controllable internal currency.

3. Based on growth stage

Early-stage → Credits enable experimentation

Scale-stage → Hybrid models support expansion

When a product is in its early stage, the biggest challenge is not monetization efficiency, but adoption. Credits are the key that unlocks a door for customers to start small and experiment with the product freely.

This flexibility matters because:

This trend highlights a strategic pivot by enterprises to align revenue growth directly with customer value.

However, pure usage or pure credits often fall short.

The recent data show that hybrid models are winning. Hybrid pricing models, which include usage-based subscriptions alongside traditional subscriptions, help companies win deals. Three times as many companies (46%) take a hybrid approach, by testing Usage-based price alongside traditional subscriptions

4. Based on billing infrastructure

A usage-based pricing model is simpler to start with

Credits require more tooling but offer flexibility

From an implementation perspective, usage-based pricing is often the fastest to launch, but choosing the right billing platform for AI and SaaS determines how flexible you’ll be long term. This is the main feature that attracts customers to smart billing models like usage-based, credit-based, and hybrid models

However, the market data reveal that there is under-investing in billing infrastructure:

The top SaaS and AI companies averaged 3.6 pricing changes per year in 2025

Over 1,800 pricing changes occurred across the top 500 companies alone

In this environment, a rigid billing system becomes a chokepoint for customers.

Credit-based systems require more upfront tooling like wallets, ledgers, real-time deduction, top-ups, but they make pricing far more adaptable. New features, new usage dimensions, and new price experiments can be launched without breaking existing plans or confusing customers.

Why many SaaS companies adopt hybrid pricing

Hybrid pricing didn’t become popular by accident. Teams increasingly need systems that support hybrid-based and credit-based models. It offers flexibility with predictability. In fact, 46% of AI and SaaS companies now use hybrid pricing models, which helps them to deliver the highest median revenue growth, which simply outperforms pure subscription or pay-as-you-go approaches.

Credits ensure smooth, uninterrupted access, let customers prepay and use the product without friction or surprise bills. This model is gaining traction fast. Credit-based pricing grew 126% year-over-year in 2025, especially in AI and infrastructure products where usage fluctuates and experimentation matters.

High-cost or high-value features scale best with consumption. That’s the reason why AI and SaaS companies use usage-based pricing, and 80% of customers report better value alignment when pricing increases only as usage grows.

The hybrid pricing model supports low-commitment self-serve entry while still enabling predictable enterprise contracts. This flexibility helps SaaS companies adapt faster in a market. It is the most desirable type of model in recent years, which helps in growth and stability.

Choosing the right pricing model is hard; launching it shouldn’t be

By now, the pattern should be clear.

There’s no universally “better” pricing model. There’s only what fits your product complexity, customer psychology, and growth stage right now.

If your product has:

one clean value metric

stable costs

and customers who prefer pay-for-what-you-use

→ usage-based pricing works.

If your product has:

multiple features with different cost curves

variable AI compute

budget-sensitive or procurement-led buyers

→ credit-based pricing wins.

And if you’re scaling fast, selling to both self-serve and enterprise, or iterating pricing every quarter, the answer is almost always hybrid.

The real mistake founders make isn’t choosing the “wrong” model.

It’s locking itself into the billing infrastructure that makes switching painful.

That’s why modern teams separate pricing logic from billing plumbing.

With Flexprice, launching either model doesn’t require months of custom work or irreversible decisions.

Here’s what “launch in a day” actually looks like in practice.

To launch usage-based pricing

Define your usage metric (API calls, tokens, events, seconds, etc.)

Instrument usage events once

Configure meters and rate cards

Let Flexprice aggregate, invoice, and bill automatically at the cycle end

No hard-coding prices into product logic. No custom invoicing pipelines.

To launch credit-based pricing

Create a credit wallet per customer

Define credit packs or subscription credits

Map features to credit costs

Enable real-time deduction, top-ups, and balance alerts

Credits become a configurable abstraction, not an engineering rewrite.

To go hybrid

Bundle monthly credits with plans

Allow overages via usage or top-ups

Keep customer invoices predictable while preserving usage flexibility

All without rebuilding your billing system again six months later.

The takeaway is simple.

Spend your time deciding how you want customers to experience value, not fighting billing complexity.

What Is usage based pricing?

Usage-based pricing, also known as consumption-based pricing, is a pricing model that allows customers to pay for a product according to their usage. The metric used to measure usage corresponds to how the customer is extracting value from the product. Usage-based pricing is becoming increasingly popular within AI and SaaS, replacing more traditional subscription- and seat-based pricing models.

How does it work?

Users start using the product without preloaded limits, and usage is tracked continuously. At the end of the billing cycle, customers receive an invoice based on the total consumption recorded during that period.

Charges are calculated using concrete units such as API calls, data stored, compute time, or events processed. As usage increases or decreases, costs scale proportionally, creating a direct link between consumption and spending.

Because billing follows usage, customers pay more during high-activity periods and less when usage drops. This makes usage-based pricing transparent, but can also introduce variability in monthly spend.

For a pure consumption model, see how Simplismart scaled to 750+ pricing features and reclaimed 30% of daily engineering bandwidth with Flexprice

Real world examples of usage based pricing in AI SaaS

AssemblyAI follows a pay-as-you-go model with no upfront commitments or contracts. Developers can start for free and scale usage as demand grows, making pricing tightly coupled to real-world consumption.

How usage-based pricing works at AssemblyAI:

Speech-to-text is priced per hour of audio processed, starting as low as $0.15 per hour

More advanced models, like Universal-3 Pro and add-ons, increase cost based on usage intensity

Streaming and pre-recorded audio are billed separately, based on actual runtime

AI features such as speaker diarization, sentiment analysis, entity detection, and summarization are priced per hour of processing

Customers receive an invoice based on total usage during the billing period; there are no prepaid credits or fixed allowances

As usage increases, AssemblyAI offers tiered pricing and custom rates for enterprise customers processing millions of requests, while still preserving the core pay-for-what-you-use model.

Types of usage-based pricing models

Pure Pay-As-You-Go: Customers pay strictly for what they consume, with no upfront commitment, minimum spend, or bundled allowances. Billing happens after usage, and costs scale linearly with consumption. Example: Amazon Web Services (AWS) offers services like EC2, S3, and Lambda charge per second, per request, or per GB used, making it a canonical pay-as-you-go model.

Tiered Usage Pricing: Per-unit prices decrease as usage crosses predefined thresholds. Customers pay more at lower volumes and receive discounted rates as their usage grows. Example: AssemblyAI (enterprise tiers) offers lower effective rates for customers processing large volumes of audio through negotiated tiers.

Volume Pricing: A single unit price applies to all usage based on the total volume consumed in a billing period. Once a customer reaches a certain volume tier, that rate is applied uniformly. Example: Cloud storage providers where reaching a higher total usage tier lowers the per-GB rate on all consumed GBs that month.

Overage-Based: Customers receive a base allowance included in their plan. Once usage exceeds that allowance, overage charges apply on a per-unit basis. Example: Ahrefs Plans include monthly crawl credits and usage limits. When limits are reached, users must upgrade or wait for renewal rather than receiving unlimited access.

Benefits of usage based pricing

Lower barrier to entry

This model minimizes upfront costs so that customers can start small and scale according to their needs. This enables them to adopt the product without committing to high fixed fees.

Greater pricing flexibility

Because pricing scales with actual usage, companies can serve a wide range of customers from individual users to large enterprises, without forcing them into rigid plans. Usage data also helps teams continuously refine pricing to better match customer behavior.

Improved customer retention

When customers pay only for what they use, pricing feels fair and transparent. This stronger alignment between cost and value builds trust, increases satisfaction, and reduces churn over time.

Supports natural account expansion

As customers grow and derive more value from the product, usage increases organically. Revenue expands alongside adoption.

Drawbacks of usage based pricing

Unpredictable invoices

Usage-based pricing often leads to surprise bills when demand spikes or experiments run long. Even when customers get more value, sudden cost jumps feel like a loss of control. Finance teams escalate, trust erodes, and what started as “fair pricing” becomes invoice anxiety.

Harder budgeting for customers

Because spending fluctuates month to month, forecasting becomes uncertain. CFOs struggle to commit budgets, and procurement pushes back on open-ended contracts. Customers start limiting usage not because they don’t need the product, but because they need predictability.

Customers optimize against your product

When every action has a visible cost, users become defensive. Experiments are slow, features are avoided, and engineers build workarounds to reduce metered events. Instead of driving growth, pricing starts acting like a tax on innovation.

Customers optimize against your product

High usage can signal inefficiency, not success, while low usage may still power mission-critical outcomes. When pricing tracks raw consumption instead of perceived value, customers start questioning fairness.

Credit based pricing v.s usage based pricing: key differences

At a surface level, both models charge based on usage. But in practice, they create very different behaviors, risks, and growth dynamics for both customers and the business, and here are some key differences

Basis | Credit-Based Pricing | Usage-Based Pricing |

Core Mechanism | Customers pre-purchase credits, which are debited as they consume resources. Creates an abstraction layer between payment and consumption. Uses abstracted units of value (credits) rather than raw infrastructure metrics. | Customers are charged directly based on actual consumption - API calls, compute hours, tokens, and storage. Billing is reactive and tied to metering events using raw consumption metrics (tokens, calls, seconds, GB). |

Customer Bill Predictability | High - customers know their maximum spend. Creates psychological safety and spending boundaries. Spending is capped by purchased credits. | Low bills can vary significantly month-to-month based on actual usage. Usage spikes cause bill shock. Creates budget uncertainty for customers. |

Implementation Complexity | Requires a wallet/ledger system to track credit balances, expiration policies, credit grants, and debit reconciliation. Event-driven, ledger-style accounting. One unified meter handles all features. | Requires robust real-time metering infrastructure to capture, aggregate, and bill for every consumption event. Meter-driven architecture tightly coupled to product logic. Multiple meters are needed per feature or resource. |

Pricing Flexibility & Iteration | Extremely flexible - can vary credit costs by feature, offer volume discounts via credit bonuses, bundle credits with tiers. Feature costs are adjustable via configuration without code changes. Stable external pricing despite backend changes. | Limited to rate card adjustments. New features require new meters and backend logic. Discounting means reducing per-unit prices. Pricing changes ripple directly to customers, making iteration risky. |

Internal Cost Volatility Absorption | Internal conversion rates absorb infrastructure and model cost changes. You can adjust credit-to-resource mappings without changing customer-facing prices. Protects customers from backend volatility. | Cost changes directly affect customer bills. If your OpenAI costs increase or you switch models, customers see it immediately. No buffer between infrastructure costs and customer pricing. |

Best for AI Products | Excellent for AI workloads: Normalizes massive cost variance (simple query more than 100 tokens vs complex RAG query: 10,000+ tokens) Multi-model tiering is simple Handles composite AI workflows cleanly (embedding + search + generation = single credit cost) Abstracts away the token counting complexity from customers Customers experiment freely with expensive models without bill anxiety Easy to add new models without repricing the entire customer base Protects margins when switching between model providers (OpenAI → Anthropic → open-source) | Challenging for AI workloads: Creates unpredictability - token variance causes massive bill fluctuations Complex queries generate bill shock customer asks one question, sees 100x cost vs the previous query Multi-model pricing requires exposing raw token costs per model, confusing rate cards Composite workflows are hard to price. Do you charge for embeddings + retrieval + generation separately? Customers become conservative, avoiding expensive models even when they'd get better results Prices inputs (tokens processed), not outputs (value delivered) Model switches require re-pricing all customers |

Retry & Failure Handling | Charges on completed value - retries and failed attempts don't double bill customers. Can implement idempotency at the credit-debit level. Better customer experience during system issues. | Retries and partial failures risk over-charging customers. Each API call attempt may be billed even if it fails. Requires complex refund logic and dispute management. |

Customer Psychology & Experimentation | Reduces "meter anxiety" - customers feel they've already paid, encouraging product usage. Low barrier to experimentation - prepaid credits encourage trying features without immediate payment friction. Risk of "credit waste" if unused credits expire. | Can create "meter anxiety" - customers worry about costs spiraling. High barrier to experimentation - every experiment directly impacts the bill, making customers conservative in usage. Limits product exploration. |

Enterprise Sales & Procurement | Easier procurement - pre-commit budgets create predictable invoices. Finance teams can budget precisely. Revenue risk is controlled by credit balance boundaries. Buyer approval is simpler with capped exposure. | Harder procurement - variable and open-ended spend creates friction. Finance teams struggle with unpredictable monthly costs. Revenue exposure is potentially unbounded, making CFOs nervous. |

Forecasting & Capacity Planning | Credit burn rate maps cleanly to infrastructure demand. Can predict capacity needs based on credit sales and consumption patterns. Unified metric simplifies planning. | Harder due to fragmented usage metrics across multiple dimensions. Must aggregate tokens, calls, storage, and compute to understand true capacity needs. This is why teams rely on usage analytics and billing tools at scale. |

Outcome vs Input Pricing | Outcome Pricing - customers pay for value delivered (completed AI inference, successful workflow) rather than infrastructure consumed. Aligns pricing with customer success. | Price inputs - customers pay for resources consumed (tokens processed, API calls made) regardless of whether they got value. Misalignment between cost and value. |

Ideal Use Cases | AI products with variable compute costs, products with multiple feature tiers, services requiring revenue predictability, and products where experimentation drives value. Best for AI-native, API, infrastructure, and multi-feature products. | Products with clean value metrics (storage, seats, emails), services where usage directly mirrors value, and transparent pay-for-what-you-use models. Best for simple, stable, single-dimension products. |

Which pricing model is the right fit for your business?

Surprisingly, a good number of businesses leave their revenue on the table due to a lack of clarity about the right pricing model.

Data clearly shows that the pricing model directly impacts the growth rates, customer trust, and revenue predictability, especially in SaaS and AI-driven products. Get ready to transform your pricing strategy from a guessing game into a data-driven approach for growth.

1. Based on product complexity

Single feature → Simplicity → Usage-based pricing

Multiple features → Product Depth → Credit-based pricing

If your product majorly works on one dominant usage metric, usage-based pricing fits right in.

This is the reason that mostly 67% of SaaS companies now use usage-based pricing, which has increased from 52% in the last 4 years.

Products like API, cloud storage, and compute services map themselves cleanly, such as API calls, GBs processed, and compute seconds. With this customer, clearly understand what they are actually paying for.

The real question arises when the product becomes more complex.

When products offer multiple features with different cost curves, customers struggle to calculate cost across dimensions, and finance teams lose forecasting clarity. That’s where credit-based pricing becomes more effective.

Credits help in the conversion of multiple usage dimensions into a single internal currency, which allows more control over pricing. This explains why a credit-based pricing model is adopted.

2. Based on customer behaviour

Fair-pricing customers → Usage-based pricing

Budget-sensitive customers → Credit-based pricing

While usage-based models align cost with value, they introduce a post-paid uncertainty. This creates friction for finance teams, startups, and procurement-driven buyers who care deeply about spending capital.

Uncertain payments or invoices can be tackled when customers pre-commit to a budget, then consume credits in real time. This makes spending transparent and intentional, rather than a surprise; it is a critical distinction for the budget-sensitive teams.

According to market analysis, 61% of SaaS companies have adopted usage-based pricing models, indicating a broad industry movement away from flat subscriptions toward pricing that varies with consumption.

While credit-based pricing is still a minority model across SaaS overall, it is disproportionately adopted in categories with multi-dimensional usage and high infrastructure costs. Early AI and agent-based products are increasingly experimenting with credit or token-based systems to abstract complex usage and give customers predictable budget control.

This is why, when customers ask “How do I control spend?”, credit-based models consistently outperform raw usage metrics by turning unpredictable consumption into a controllable internal currency.

3. Based on growth stage

Early-stage → Credits enable experimentation

Scale-stage → Hybrid models support expansion

When a product is in its early stage, the biggest challenge is not monetization efficiency, but adoption. Credits are the key that unlocks a door for customers to start small and experiment with the product freely.

This flexibility matters because:

This trend highlights a strategic pivot by enterprises to align revenue growth directly with customer value.

However, pure usage or pure credits often fall short.

The recent data show that hybrid models are winning. Hybrid pricing models, which include usage-based subscriptions alongside traditional subscriptions, help companies win deals. Three times as many companies (46%) take a hybrid approach, by testing Usage-based price alongside traditional subscriptions

4. Based on billing infrastructure

A usage-based pricing model is simpler to start with

Credits require more tooling but offer flexibility

From an implementation perspective, usage-based pricing is often the fastest to launch, but choosing the right billing platform for AI and SaaS determines how flexible you’ll be long term. This is the main feature that attracts customers to smart billing models like usage-based, credit-based, and hybrid models

However, the market data reveal that there is under-investing in billing infrastructure:

The top SaaS and AI companies averaged 3.6 pricing changes per year in 2025

Over 1,800 pricing changes occurred across the top 500 companies alone

In this environment, a rigid billing system becomes a chokepoint for customers.

Credit-based systems require more upfront tooling like wallets, ledgers, real-time deduction, top-ups, but they make pricing far more adaptable. New features, new usage dimensions, and new price experiments can be launched without breaking existing plans or confusing customers.

Why many SaaS companies adopt hybrid pricing

Hybrid pricing didn’t become popular by accident. Teams increasingly need systems that support hybrid-based and credit-based models. It offers flexibility with predictability. In fact, 46% of AI and SaaS companies now use hybrid pricing models, which helps them to deliver the highest median revenue growth, which simply outperforms pure subscription or pay-as-you-go approaches.

Credits ensure smooth, uninterrupted access, let customers prepay and use the product without friction or surprise bills. This model is gaining traction fast. Credit-based pricing grew 126% year-over-year in 2025, especially in AI and infrastructure products where usage fluctuates and experimentation matters.

High-cost or high-value features scale best with consumption. That’s the reason why AI and SaaS companies use usage-based pricing, and 80% of customers report better value alignment when pricing increases only as usage grows.

The hybrid pricing model supports low-commitment self-serve entry while still enabling predictable enterprise contracts. This flexibility helps SaaS companies adapt faster in a market. It is the most desirable type of model in recent years, which helps in growth and stability.

Choosing the right pricing model is hard; launching it shouldn’t be

By now, the pattern should be clear.

There’s no universally “better” pricing model. There’s only what fits your product complexity, customer psychology, and growth stage right now.

If your product has:

one clean value metric

stable costs

and customers who prefer pay-for-what-you-use

→ usage-based pricing works.

If your product has:

multiple features with different cost curves

variable AI compute

budget-sensitive or procurement-led buyers

→ credit-based pricing wins.

And if you’re scaling fast, selling to both self-serve and enterprise, or iterating pricing every quarter, the answer is almost always hybrid.

The real mistake founders make isn’t choosing the “wrong” model.

It’s locking itself into the billing infrastructure that makes switching painful.

That’s why modern teams separate pricing logic from billing plumbing.

With Flexprice, launching either model doesn’t require months of custom work or irreversible decisions.

Here’s what “launch in a day” actually looks like in practice.

To launch usage-based pricing

Define your usage metric (API calls, tokens, events, seconds, etc.)

Instrument usage events once

Configure meters and rate cards

Let Flexprice aggregate, invoice, and bill automatically at the cycle end

No hard-coding prices into product logic. No custom invoicing pipelines.

To launch credit-based pricing

Create a credit wallet per customer

Define credit packs or subscription credits

Map features to credit costs

Enable real-time deduction, top-ups, and balance alerts

Credits become a configurable abstraction, not an engineering rewrite.

To go hybrid

Bundle monthly credits with plans

Allow overages via usage or top-ups

Keep customer invoices predictable while preserving usage flexibility

All without rebuilding your billing system again six months later.

The takeaway is simple.

Spend your time deciding how you want customers to experience value, not fighting billing complexity.

What Is usage based pricing?

Usage-based pricing, also known as consumption-based pricing, is a pricing model that allows customers to pay for a product according to their usage. The metric used to measure usage corresponds to how the customer is extracting value from the product. Usage-based pricing is becoming increasingly popular within AI and SaaS, replacing more traditional subscription- and seat-based pricing models.

How does it work?

Users start using the product without preloaded limits, and usage is tracked continuously. At the end of the billing cycle, customers receive an invoice based on the total consumption recorded during that period.

Charges are calculated using concrete units such as API calls, data stored, compute time, or events processed. As usage increases or decreases, costs scale proportionally, creating a direct link between consumption and spending.

Because billing follows usage, customers pay more during high-activity periods and less when usage drops. This makes usage-based pricing transparent, but can also introduce variability in monthly spend.

For a pure consumption model, see how Simplismart scaled to 750+ pricing features and reclaimed 30% of daily engineering bandwidth with Flexprice

Real world examples of usage based pricing in AI SaaS

AssemblyAI follows a pay-as-you-go model with no upfront commitments or contracts. Developers can start for free and scale usage as demand grows, making pricing tightly coupled to real-world consumption.

How usage-based pricing works at AssemblyAI:

Speech-to-text is priced per hour of audio processed, starting as low as $0.15 per hour

More advanced models, like Universal-3 Pro and add-ons, increase cost based on usage intensity

Streaming and pre-recorded audio are billed separately, based on actual runtime

AI features such as speaker diarization, sentiment analysis, entity detection, and summarization are priced per hour of processing

Customers receive an invoice based on total usage during the billing period; there are no prepaid credits or fixed allowances

As usage increases, AssemblyAI offers tiered pricing and custom rates for enterprise customers processing millions of requests, while still preserving the core pay-for-what-you-use model.

Types of usage-based pricing models

Pure Pay-As-You-Go: Customers pay strictly for what they consume, with no upfront commitment, minimum spend, or bundled allowances. Billing happens after usage, and costs scale linearly with consumption. Example: Amazon Web Services (AWS) offers services like EC2, S3, and Lambda charge per second, per request, or per GB used, making it a canonical pay-as-you-go model.

Tiered Usage Pricing: Per-unit prices decrease as usage crosses predefined thresholds. Customers pay more at lower volumes and receive discounted rates as their usage grows. Example: AssemblyAI (enterprise tiers) offers lower effective rates for customers processing large volumes of audio through negotiated tiers.

Volume Pricing: A single unit price applies to all usage based on the total volume consumed in a billing period. Once a customer reaches a certain volume tier, that rate is applied uniformly. Example: Cloud storage providers where reaching a higher total usage tier lowers the per-GB rate on all consumed GBs that month.

Overage-Based: Customers receive a base allowance included in their plan. Once usage exceeds that allowance, overage charges apply on a per-unit basis. Example: Ahrefs Plans include monthly crawl credits and usage limits. When limits are reached, users must upgrade or wait for renewal rather than receiving unlimited access.

Benefits of usage based pricing

Lower barrier to entry

This model minimizes upfront costs so that customers can start small and scale according to their needs. This enables them to adopt the product without committing to high fixed fees.

Greater pricing flexibility

Because pricing scales with actual usage, companies can serve a wide range of customers from individual users to large enterprises, without forcing them into rigid plans. Usage data also helps teams continuously refine pricing to better match customer behavior.

Improved customer retention

When customers pay only for what they use, pricing feels fair and transparent. This stronger alignment between cost and value builds trust, increases satisfaction, and reduces churn over time.

Supports natural account expansion

As customers grow and derive more value from the product, usage increases organically. Revenue expands alongside adoption.

Drawbacks of usage based pricing

Unpredictable invoices

Usage-based pricing often leads to surprise bills when demand spikes or experiments run long. Even when customers get more value, sudden cost jumps feel like a loss of control. Finance teams escalate, trust erodes, and what started as “fair pricing” becomes invoice anxiety.

Harder budgeting for customers

Because spending fluctuates month to month, forecasting becomes uncertain. CFOs struggle to commit budgets, and procurement pushes back on open-ended contracts. Customers start limiting usage not because they don’t need the product, but because they need predictability.

Customers optimize against your product

When every action has a visible cost, users become defensive. Experiments are slow, features are avoided, and engineers build workarounds to reduce metered events. Instead of driving growth, pricing starts acting like a tax on innovation.

Customers optimize against your product

High usage can signal inefficiency, not success, while low usage may still power mission-critical outcomes. When pricing tracks raw consumption instead of perceived value, customers start questioning fairness.

Credit based pricing v.s usage based pricing: key differences

At a surface level, both models charge based on usage. But in practice, they create very different behaviors, risks, and growth dynamics for both customers and the business, and here are some key differences

Basis | Credit-Based Pricing | Usage-Based Pricing |

Core Mechanism | Customers pre-purchase credits, which are debited as they consume resources. Creates an abstraction layer between payment and consumption. Uses abstracted units of value (credits) rather than raw infrastructure metrics. | Customers are charged directly based on actual consumption - API calls, compute hours, tokens, and storage. Billing is reactive and tied to metering events using raw consumption metrics (tokens, calls, seconds, GB). |

Customer Bill Predictability | High - customers know their maximum spend. Creates psychological safety and spending boundaries. Spending is capped by purchased credits. | Low bills can vary significantly month-to-month based on actual usage. Usage spikes cause bill shock. Creates budget uncertainty for customers. |

Implementation Complexity | Requires a wallet/ledger system to track credit balances, expiration policies, credit grants, and debit reconciliation. Event-driven, ledger-style accounting. One unified meter handles all features. | Requires robust real-time metering infrastructure to capture, aggregate, and bill for every consumption event. Meter-driven architecture tightly coupled to product logic. Multiple meters are needed per feature or resource. |

Pricing Flexibility & Iteration | Extremely flexible - can vary credit costs by feature, offer volume discounts via credit bonuses, bundle credits with tiers. Feature costs are adjustable via configuration without code changes. Stable external pricing despite backend changes. | Limited to rate card adjustments. New features require new meters and backend logic. Discounting means reducing per-unit prices. Pricing changes ripple directly to customers, making iteration risky. |

Internal Cost Volatility Absorption | Internal conversion rates absorb infrastructure and model cost changes. You can adjust credit-to-resource mappings without changing customer-facing prices. Protects customers from backend volatility. | Cost changes directly affect customer bills. If your OpenAI costs increase or you switch models, customers see it immediately. No buffer between infrastructure costs and customer pricing. |

Best for AI Products | Excellent for AI workloads: Normalizes massive cost variance (simple query more than 100 tokens vs complex RAG query: 10,000+ tokens) Multi-model tiering is simple Handles composite AI workflows cleanly (embedding + search + generation = single credit cost) Abstracts away the token counting complexity from customers Customers experiment freely with expensive models without bill anxiety Easy to add new models without repricing the entire customer base Protects margins when switching between model providers (OpenAI → Anthropic → open-source) | Challenging for AI workloads: Creates unpredictability - token variance causes massive bill fluctuations Complex queries generate bill shock customer asks one question, sees 100x cost vs the previous query Multi-model pricing requires exposing raw token costs per model, confusing rate cards Composite workflows are hard to price. Do you charge for embeddings + retrieval + generation separately? Customers become conservative, avoiding expensive models even when they'd get better results Prices inputs (tokens processed), not outputs (value delivered) Model switches require re-pricing all customers |

Retry & Failure Handling | Charges on completed value - retries and failed attempts don't double bill customers. Can implement idempotency at the credit-debit level. Better customer experience during system issues. | Retries and partial failures risk over-charging customers. Each API call attempt may be billed even if it fails. Requires complex refund logic and dispute management. |

Customer Psychology & Experimentation | Reduces "meter anxiety" - customers feel they've already paid, encouraging product usage. Low barrier to experimentation - prepaid credits encourage trying features without immediate payment friction. Risk of "credit waste" if unused credits expire. | Can create "meter anxiety" - customers worry about costs spiraling. High barrier to experimentation - every experiment directly impacts the bill, making customers conservative in usage. Limits product exploration. |

Enterprise Sales & Procurement | Easier procurement - pre-commit budgets create predictable invoices. Finance teams can budget precisely. Revenue risk is controlled by credit balance boundaries. Buyer approval is simpler with capped exposure. | Harder procurement - variable and open-ended spend creates friction. Finance teams struggle with unpredictable monthly costs. Revenue exposure is potentially unbounded, making CFOs nervous. |

Forecasting & Capacity Planning | Credit burn rate maps cleanly to infrastructure demand. Can predict capacity needs based on credit sales and consumption patterns. Unified metric simplifies planning. | Harder due to fragmented usage metrics across multiple dimensions. Must aggregate tokens, calls, storage, and compute to understand true capacity needs. This is why teams rely on usage analytics and billing tools at scale. |

Outcome vs Input Pricing | Outcome Pricing - customers pay for value delivered (completed AI inference, successful workflow) rather than infrastructure consumed. Aligns pricing with customer success. | Price inputs - customers pay for resources consumed (tokens processed, API calls made) regardless of whether they got value. Misalignment between cost and value. |

Ideal Use Cases | AI products with variable compute costs, products with multiple feature tiers, services requiring revenue predictability, and products where experimentation drives value. Best for AI-native, API, infrastructure, and multi-feature products. | Products with clean value metrics (storage, seats, emails), services where usage directly mirrors value, and transparent pay-for-what-you-use models. Best for simple, stable, single-dimension products. |

Which pricing model is the right fit for your business?

Surprisingly, a good number of businesses leave their revenue on the table due to a lack of clarity about the right pricing model.

Data clearly shows that the pricing model directly impacts the growth rates, customer trust, and revenue predictability, especially in SaaS and AI-driven products. Get ready to transform your pricing strategy from a guessing game into a data-driven approach for growth.

1. Based on product complexity

Single feature → Simplicity → Usage-based pricing

Multiple features → Product Depth → Credit-based pricing

If your product majorly works on one dominant usage metric, usage-based pricing fits right in.

This is the reason that mostly 67% of SaaS companies now use usage-based pricing, which has increased from 52% in the last 4 years.

Products like API, cloud storage, and compute services map themselves cleanly, such as API calls, GBs processed, and compute seconds. With this customer, clearly understand what they are actually paying for.

The real question arises when the product becomes more complex.

When products offer multiple features with different cost curves, customers struggle to calculate cost across dimensions, and finance teams lose forecasting clarity. That’s where credit-based pricing becomes more effective.

Credits help in the conversion of multiple usage dimensions into a single internal currency, which allows more control over pricing. This explains why a credit-based pricing model is adopted.

2. Based on customer behaviour

Fair-pricing customers → Usage-based pricing

Budget-sensitive customers → Credit-based pricing

While usage-based models align cost with value, they introduce a post-paid uncertainty. This creates friction for finance teams, startups, and procurement-driven buyers who care deeply about spending capital.

Uncertain payments or invoices can be tackled when customers pre-commit to a budget, then consume credits in real time. This makes spending transparent and intentional, rather than a surprise; it is a critical distinction for the budget-sensitive teams.

According to market analysis, 61% of SaaS companies have adopted usage-based pricing models, indicating a broad industry movement away from flat subscriptions toward pricing that varies with consumption.

While credit-based pricing is still a minority model across SaaS overall, it is disproportionately adopted in categories with multi-dimensional usage and high infrastructure costs. Early AI and agent-based products are increasingly experimenting with credit or token-based systems to abstract complex usage and give customers predictable budget control.

This is why, when customers ask “How do I control spend?”, credit-based models consistently outperform raw usage metrics by turning unpredictable consumption into a controllable internal currency.

3. Based on growth stage

Early-stage → Credits enable experimentation

Scale-stage → Hybrid models support expansion

When a product is in its early stage, the biggest challenge is not monetization efficiency, but adoption. Credits are the key that unlocks a door for customers to start small and experiment with the product freely.

This flexibility matters because:

This trend highlights a strategic pivot by enterprises to align revenue growth directly with customer value.

However, pure usage or pure credits often fall short.

The recent data show that hybrid models are winning. Hybrid pricing models, which include usage-based subscriptions alongside traditional subscriptions, help companies win deals. Three times as many companies (46%) take a hybrid approach, by testing Usage-based price alongside traditional subscriptions

4. Based on billing infrastructure

A usage-based pricing model is simpler to start with

Credits require more tooling but offer flexibility

From an implementation perspective, usage-based pricing is often the fastest to launch, but choosing the right billing platform for AI and SaaS determines how flexible you’ll be long term. This is the main feature that attracts customers to smart billing models like usage-based, credit-based, and hybrid models

However, the market data reveal that there is under-investing in billing infrastructure:

The top SaaS and AI companies averaged 3.6 pricing changes per year in 2025

Over 1,800 pricing changes occurred across the top 500 companies alone

In this environment, a rigid billing system becomes a chokepoint for customers.

Credit-based systems require more upfront tooling like wallets, ledgers, real-time deduction, top-ups, but they make pricing far more adaptable. New features, new usage dimensions, and new price experiments can be launched without breaking existing plans or confusing customers.

Why many SaaS companies adopt hybrid pricing

Hybrid pricing didn’t become popular by accident. Teams increasingly need systems that support hybrid-based and credit-based models. It offers flexibility with predictability. In fact, 46% of AI and SaaS companies now use hybrid pricing models, which helps them to deliver the highest median revenue growth, which simply outperforms pure subscription or pay-as-you-go approaches.

Credits ensure smooth, uninterrupted access, let customers prepay and use the product without friction or surprise bills. This model is gaining traction fast. Credit-based pricing grew 126% year-over-year in 2025, especially in AI and infrastructure products where usage fluctuates and experimentation matters.

High-cost or high-value features scale best with consumption. That’s the reason why AI and SaaS companies use usage-based pricing, and 80% of customers report better value alignment when pricing increases only as usage grows.

The hybrid pricing model supports low-commitment self-serve entry while still enabling predictable enterprise contracts. This flexibility helps SaaS companies adapt faster in a market. It is the most desirable type of model in recent years, which helps in growth and stability.

Choosing the right pricing model is hard; launching it shouldn’t be

By now, the pattern should be clear.

There’s no universally “better” pricing model. There’s only what fits your product complexity, customer psychology, and growth stage right now.

If your product has:

one clean value metric

stable costs

and customers who prefer pay-for-what-you-use

→ usage-based pricing works.

If your product has:

multiple features with different cost curves

variable AI compute

budget-sensitive or procurement-led buyers

→ credit-based pricing wins.

And if you’re scaling fast, selling to both self-serve and enterprise, or iterating pricing every quarter, the answer is almost always hybrid.

The real mistake founders make isn’t choosing the “wrong” model.

It’s locking itself into the billing infrastructure that makes switching painful.

That’s why modern teams separate pricing logic from billing plumbing.

With Flexprice, launching either model doesn’t require months of custom work or irreversible decisions.

Here’s what “launch in a day” actually looks like in practice.

To launch usage-based pricing

Define your usage metric (API calls, tokens, events, seconds, etc.)

Instrument usage events once

Configure meters and rate cards

Let Flexprice aggregate, invoice, and bill automatically at the cycle end

No hard-coding prices into product logic. No custom invoicing pipelines.

To launch credit-based pricing

Create a credit wallet per customer

Define credit packs or subscription credits

Map features to credit costs

Enable real-time deduction, top-ups, and balance alerts

Credits become a configurable abstraction, not an engineering rewrite.

To go hybrid

Bundle monthly credits with plans

Allow overages via usage or top-ups

Keep customer invoices predictable while preserving usage flexibility

All without rebuilding your billing system again six months later.

The takeaway is simple.

Spend your time deciding how you want customers to experience value, not fighting billing complexity.

Frequently Asked Questions

Frequently Asked Questions

Frequently Asked Questions

What is usage based pricing?

What is usage based pricing?

What is usage based pricing?

What is usage based pricing?

What is usage based pricing?

What is credit based pricing?

What is credit based pricing?

What is credit based pricing?

What is credit based pricing?

What is credit based pricing?

What’s the difference between usage based and credit based pricing?

What’s the difference between usage based and credit based pricing?

What’s the difference between usage based and credit based pricing?

What’s the difference between usage based and credit based pricing?

What’s the difference between usage based and credit based pricing?

What are the advantages and disadvantages of usage based pricing?

What are the advantages and disadvantages of usage based pricing?

What are the advantages and disadvantages of usage based pricing?

What are the advantages and disadvantages of usage based pricing?

What are the advantages and disadvantages of usage based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

Ayush Parchure

Ayush Parchure

Ayush Parchure

Ayush is part of the content team at Flexprice, with a strong interest in AI, SaaS, and pricing. He loves breaking down complex systems and spends his free time gaming and experimenting with new cooking lessons.

Ayush is part of the content team at Flexprice, with a strong interest in AI, SaaS, and pricing. He loves breaking down complex systems and spends his free time gaming and experimenting with new cooking lessons.

Share it on: