How Segwise Shipped Credit-Based Pricing in 3 Days After Spending 3 Weeks Building It In-House

100+

Enterprise Customers Tracked with 0 Manual intervention

Annual Cost Savings

0 Engineers

Needed for Credit Infrastructure

Data Interportability

100%

Visibility into Customer Credit Usage and Burn Rates

Faster Pricing Iteration

Company

Industry

Creative Analytics & AI-Powered Ad Generation

Size

Early-stage AI startup

Customers

Hunch, Traya

The Challenge

Segwise was facing a critical issue: their pricing model didn't match their cost structure, and they had no way to track what customers actually consumed.

The Solution

A credit-based metering platform that automated usage tracking across AI analysis workloads, gave sales and CS teams self-service controls, and scaled from free trials to enterprise contracts—all without maintaining billing infrastructure.

Company

Industry

Creative Analytics & AI-Powered Ad Generation

Size

Early-stage AI startup

Customers

Hunch, Traya

“Our core product isn’t credits. We build ad analysis and ad generation technology, not billing infrastructure and that’s where my focus needs to be.”

“Our core product isn’t credits. We build ad analysis and ad generation technology, not billing infrastructure and that’s where my focus needs to be.”

— Kush Daga, Founding Engineer, Segwise

Segwise is a creative analytics platform that uses AI to analyze every ad creative and tell marketing teams what works, understanding elements like background colors, messaging, and visual composition that drive performance.

Their customers are mobile app and D2C companies running performance marketing campaigns at scale. These teams need to know which of their 10,000+ ad variations are working and why insights that require analyzing every single creative with AI.

But as Segwise scaled from monitoring to AI-powered analysis and generation, their pricing infrastructure couldn't keep pace.

"Very initially, we were deciding pricing on the go for a lot of clients. Like the first problem to solve was getting clients; once we got clients, then we were thinking of how to price them,"

recalls Kush.

This ad-hoc approach worked when Segwise was small. But once they moved to credit-based pricing for AI workloads, they had zero visibility into what customers were actually consuming. For a platform where every ad analysis costs AI credits, selling packages based on assumptions wasn't sustainable.

When Segwise's AI creative analytics platform shifted to usage-based pricing, they faced a choice: spend months maintaining DIY billing infrastructure or ship fast with a solution built for their exact problem.

Segwise is a creative analytics platform that uses AI to analyze every ad creative and tell marketing teams what works, understanding elements like background colors, messaging, and visual composition that drive performance.

Their customers are mobile app and D2C companies running performance marketing campaigns at scale. These teams need to know which of their 10,000+ ad variations are working and why insights that require analyzing every single creative with AI.

But as Segwise scaled from monitoring to AI-powered analysis and generation, their pricing infrastructure couldn't keep pace.

"Very initially, we were deciding pricing on the go for a lot of clients. Like the first problem to solve was getting clients; once we got clients, then we were thinking of how to price them,"

recalls Kush.

This ad-hoc approach worked when Segwise was small. But once they moved to credit-based pricing for AI workloads, they had zero visibility into what customers were actually consuming. For a platform where every ad analysis costs AI credits, selling packages based on assumptions wasn't sustainable.

When Segwise's AI creative analytics platform shifted to usage-based pricing, they faced a choice: spend months maintaining DIY billing infrastructure or ship fast with a solution built for their exact problem.

Segwise is a creative analytics platform that uses AI to analyze every ad creative and tell marketing teams what works, understanding elements like background colors, messaging, and visual composition that drive performance.

Their customers are mobile app and D2C companies running performance marketing campaigns at scale. These teams need to know which of their 10,000+ ad variations are working and why insights that require analyzing every single creative with AI.

But as Segwise scaled from monitoring to AI-powered analysis and generation, their pricing infrastructure couldn't keep pace.

"Very initially, we were deciding pricing on the go for a lot of clients. Like the first problem to solve was getting clients; once we got clients, then we were thinking of how to price them,"

recalls Kush.

This ad-hoc approach worked when Segwise was small. But once they moved to credit-based pricing for AI workloads, they had zero visibility into what customers were actually consuming. For a platform where every ad analysis costs AI credits, selling packages based on assumptions wasn't sustainable.

When Segwise's AI creative analytics platform shifted to usage-based pricing, they faced a choice: spend months maintaining DIY billing infrastructure or ship fast with a solution built for their exact problem.

Start Building for Free

Get started with our open-source platform

The Challenges

Segwise didn’t falter at pricing because of bad intent. It was because their monetization stack couldn’t keep up with product reality:

Ad-spend-based pricing collapsed the moment AI creative analysis entered the picture. Spend no longer mapped to cost, value, or usage.

Credits were sold before they were measurable. Sales promised credit packages without any real metering. Customers asked about usage, and the team had no answers.

Building credits infrastructure became an engineering side-quest.

Three weeks of work produced something fragile and incomplete, missing UI, load testing, operational confidence, and documentation.There was zero visibility into burn, cost, or intent.

Free trials and backfills burned thousands of credits silently. High-intent buyers and tire-kickers were indistinguishable.Every credit decision bottlenecked on engineering.

One person controlled credits, trials, and balances. Sales and CS were blocked. Every adjustment meant a ticket.Open-source “savings” turned into an infra tax.

Open Meter and Lago demanded Kafka, custom infra, and constant maintenance. Lago’s slow, email-only support made things worse.

Segwise didn’t falter at pricing because of bad intent. It was because their monetization stack couldn’t keep up with product reality:

Ad-spend-based pricing collapsed the moment AI creative analysis entered the picture. Spend no longer mapped to cost, value, or usage.

Credits were sold before they were measurable. Sales promised credit packages without any real metering. Customers asked about usage, and the team had no answers.

Building credits infrastructure became an engineering side-quest.

Three weeks of work produced something fragile and incomplete, missing UI, load testing, operational confidence, and documentation.There was zero visibility into burn, cost, or intent.

Free trials and backfills burned thousands of credits silently. High-intent buyers and tire-kickers were indistinguishable.Every credit decision bottlenecked on engineering.

One person controlled credits, trials, and balances. Sales and CS were blocked. Every adjustment meant a ticket.Open-source “savings” turned into an infra tax.

Open Meter and Lago demanded Kafka, custom infra, and constant maintenance. Lago’s slow, email-only support made things worse.

Segwise didn’t falter at pricing because of bad intent. It was because their monetization stack couldn’t keep up with product reality:

Ad-spend-based pricing collapsed the moment AI creative analysis entered the picture. Spend no longer mapped to cost, value, or usage.

Credits were sold before they were measurable. Sales promised credit packages without any real metering. Customers asked about usage, and the team had no answers.

Building credits infrastructure became an engineering side-quest.

Three weeks of work produced something fragile and incomplete, missing UI, load testing, operational confidence, and documentation.There was zero visibility into burn, cost, or intent.

Free trials and backfills burned thousands of credits silently. High-intent buyers and tire-kickers were indistinguishable.Every credit decision bottlenecked on engineering.

One person controlled credits, trials, and balances. Sales and CS were blocked. Every adjustment meant a ticket.Open-source “savings” turned into an infra tax.

Open Meter and Lago demanded Kafka, custom infra, and constant maintenance. Lago’s slow, email-only support made things worse.

Support That Unblocked Decisions

Flexible Architecture

Production-Grade Reliability

Built for AI Companies

Why Segwise Chose Flexprice?

Why Segwise Chose Flexprice?

Having already spent three weeks building their own credit system, SegWise's team knew exactly what they needed and what they didn't want to maintain.

When Kush's co-founder discovered FlexPrice on Hacker News, the evaluation was different from a typical vendor assessment. Kush had literally architected the alternative himself.

Kush had tried reaching Lago's team during his evaluation. The experience was frustrating.

"I tried connecting with Lago's team, but it was always a slow email exchange — they'd respond after two days with generic answers like 'you can do it this way.' When I asked for help, there was never an offer to jump on a call and actually solve the problem together."

Flexprice worked differently. When Kush hit roadblocks during integration, the team jumped on calls immediately.

"I got on a call with Nikhil and Manish from Flexprice right away. They took the time to understand our specific requirements and walked me through the entire system. Nikhil explained exactly how we could make it work for our use case, and they even set up a custom demo for us."

The pattern continued after deployment and for a founding engineer building mission-critical infrastructure, responsive support wasn't a nice-to-have it determined whether the system would ship on time.

Segwise had a requirement that broke most billing platforms: give customers a year's worth of credits upfront, but charge them monthly.

Traditional billing tools like ChargeBee and Stripe Billing assumed self-serve payment flows with automated invoicing. Segwise needed usage tracking decoupled from payment processing they were handling invoicing manually.

"We give each customer a wallet with credits as soon as they are onboard. We don't need complex entitlement systems or all the extra features just usage-based pricing and a way to allocate free credits to their wallets."

Flexprice supported their exact model out of the box.

"We needed the core infrastructure in place without connecting all the payment automation, so we could maintain some manual control over invoicing."

When Kush explained their unique setup on the first call, Flexprice configured it immediately.

"Nikhil walked me through exactly how to set it up and created a custom demo based on our requirements. Having someone actually understand our use case and show us how to implement it was incredibly helpful.

For Segwise, credit tracking isn't just a feature it's the foundation of their entire business model. If metering fails, revenue breaks.

"Credit tracking is critical to our infrastructure. Even though it's not Segwise's core product, we can't afford for it to be unreliable. That was non-negotiable for us."

Before going to production, Kush stress-tested FlexPrice aggressively:

"I built a test script that simulated real-world load sending 10 events per second to FlexPrice and pushing it beyond our expected scale to see if it would hold up."

The test ran for 1-2 weeks before Kush trusted it with paying customers.

"We needed confidence that every event we sent to FlexPrice would get registered accurately. After weeks of testing, we had that confidence."

Flexprice passed. Zero dropped events. Zero downtime. Production deployment followed immediately.

The fundamental difference is that Flexprice understood AI workloads from the ground up.

Kush's recommendation to other founders reflected this:

"I'd tell any AI company, don't build a credit system yourself. You need to track token usage, measure spending on every LLM call, and monitor costs across your AI infrastructure but you shouldn't waste engineering time building that from scratch."

Flexprice wasn't retrofitting SaaS billing for AI economics. It was purpose-built for:

High-cardinality usage events (thousands of ads analyzed per customer)

Variable costs per action (video vs. static analysis)

Credit wallets for AI consumption

Real-time metering at scale

"Even for basic customer billing, you shouldn't spend your time building metering infrastructure. Use something like Flexprice that solves credits and usage tracking for you out of the box."

Having already spent three weeks building their own credit system, SegWise's team knew exactly what they needed and what they didn't want to maintain.

When Kush's co-founder discovered FlexPrice on Hacker News, the evaluation was different from a typical vendor assessment. Kush had literally architected the alternative himself.

Kush had tried reaching Lago's team during his evaluation. The experience was frustrating.

"I tried connecting with Lago's team, but it was always a slow email exchange — they'd respond after two days with generic answers like 'you can do it this way.' When I asked for help, there was never an offer to jump on a call and actually solve the problem together."

Flexprice worked differently. When Kush hit roadblocks during integration, the team jumped on calls immediately.

"I got on a call with Nikhil and Manish from Flexprice right away. They took the time to understand our specific requirements and walked me through the entire system. Nikhil explained exactly how we could make it work for our use case, and they even set up a custom demo for us."

The pattern continued after deployment and for a founding engineer building mission-critical infrastructure, responsive support wasn't a nice-to-have it determined whether the system would ship on time.

Segwise had a requirement that broke most billing platforms: give customers a year's worth of credits upfront, but charge them monthly.

Traditional billing tools like ChargeBee and Stripe Billing assumed self-serve payment flows with automated invoicing. Segwise needed usage tracking decoupled from payment processing they were handling invoicing manually.

"We give each customer a wallet with credits as soon as they are onboard. We don't need complex entitlement systems or all the extra features just usage-based pricing and a way to allocate free credits to their wallets."

Flexprice supported their exact model out of the box.

"We needed the core infrastructure in place without connecting all the payment automation, so we could maintain some manual control over invoicing."

When Kush explained their unique setup on the first call, Flexprice configured it immediately.

"Nikhil walked me through exactly how to set it up and created a custom demo based on our requirements. Having someone actually understand our use case and show us how to implement it was incredibly helpful.

For Segwise, credit tracking isn't just a feature it's the foundation of their entire business model. If metering fails, revenue breaks.

"Credit tracking is critical to our infrastructure. Even though it's not Segwise's core product, we can't afford for it to be unreliable. That was non-negotiable for us."

Before going to production, Kush stress-tested FlexPrice aggressively:

"I built a test script that simulated real-world load sending 10 events per second to FlexPrice and pushing it beyond our expected scale to see if it would hold up."

The test ran for 1-2 weeks before Kush trusted it with paying customers.

"We needed confidence that every event we sent to FlexPrice would get registered accurately. After weeks of testing, we had that confidence."

Flexprice passed. Zero dropped events. Zero downtime. Production deployment followed immediately.

The fundamental difference is that Flexprice understood AI workloads from the ground up.

Kush's recommendation to other founders reflected this:

"I'd tell any AI company, don't build a credit system yourself. You need to track token usage, measure spending on every LLM call, and monitor costs across your AI infrastructure but you shouldn't waste engineering time building that from scratch."

Flexprice wasn't retrofitting SaaS billing for AI economics. It was purpose-built for:

High-cardinality usage events (thousands of ads analyzed per customer)

Variable costs per action (video vs. static analysis)

Credit wallets for AI consumption

Real-time metering at scale

"Even for basic customer billing, you shouldn't spend your time building metering infrastructure. Use something like Flexprice that solves credits and usage tracking for you out of the box."

Having already spent three weeks building their own credit system, SegWise's team knew exactly what they needed and what they didn't want to maintain.

When Kush's co-founder discovered FlexPrice on Hacker News, the evaluation was different from a typical vendor assessment. Kush had literally architected the alternative himself.

Kush had tried reaching Lago's team during his evaluation. The experience was frustrating.

"I tried connecting with Lago's team, but it was always a slow email exchange — they'd respond after two days with generic answers like 'you can do it this way.' When I asked for help, there was never an offer to jump on a call and actually solve the problem together."

Flexprice worked differently. When Kush hit roadblocks during integration, the team jumped on calls immediately.

"I got on a call with Nikhil and Manish from Flexprice right away. They took the time to understand our specific requirements and walked me through the entire system. Nikhil explained exactly how we could make it work for our use case, and they even set up a custom demo for us."

The pattern continued after deployment and for a founding engineer building mission-critical infrastructure, responsive support wasn't a nice-to-have it determined whether the system would ship on time.

Segwise had a requirement that broke most billing platforms: give customers a year's worth of credits upfront, but charge them monthly.

Traditional billing tools like ChargeBee and Stripe Billing assumed self-serve payment flows with automated invoicing. Segwise needed usage tracking decoupled from payment processing they were handling invoicing manually.

"We give each customer a wallet with credits as soon as they are onboard. We don't need complex entitlement systems or all the extra features just usage-based pricing and a way to allocate free credits to their wallets."

Flexprice supported their exact model out of the box.

"We needed the core infrastructure in place without connecting all the payment automation, so we could maintain some manual control over invoicing."

When Kush explained their unique setup on the first call, Flexprice configured it immediately.

"Nikhil walked me through exactly how to set it up and created a custom demo based on our requirements. Having someone actually understand our use case and show us how to implement it was incredibly helpful.

For Segwise, credit tracking isn't just a feature it's the foundation of their entire business model. If metering fails, revenue breaks.

"Credit tracking is critical to our infrastructure. Even though it's not Segwise's core product, we can't afford for it to be unreliable. That was non-negotiable for us."

Before going to production, Kush stress-tested FlexPrice aggressively:

"I built a test script that simulated real-world load sending 10 events per second to FlexPrice and pushing it beyond our expected scale to see if it would hold up."

The test ran for 1-2 weeks before Kush trusted it with paying customers.

"We needed confidence that every event we sent to FlexPrice would get registered accurately. After weeks of testing, we had that confidence."

Flexprice passed. Zero dropped events. Zero downtime. Production deployment followed immediately.

The fundamental difference is that Flexprice understood AI workloads from the ground up.

Kush's recommendation to other founders reflected this:

"I'd tell any AI company, don't build a credit system yourself. You need to track token usage, measure spending on every LLM call, and monitor costs across your AI infrastructure but you shouldn't waste engineering time building that from scratch."

Flexprice wasn't retrofitting SaaS billing for AI economics. It was purpose-built for:

High-cardinality usage events (thousands of ads analyzed per customer)

Variable costs per action (video vs. static analysis)

Credit wallets for AI consumption

Real-time metering at scale

"Even for basic customer billing, you shouldn't spend your time building metering infrastructure. Use something like Flexprice that solves credits and usage tracking for you out of the box."

Schedule a Demo

Talk to our team about your billing challenges

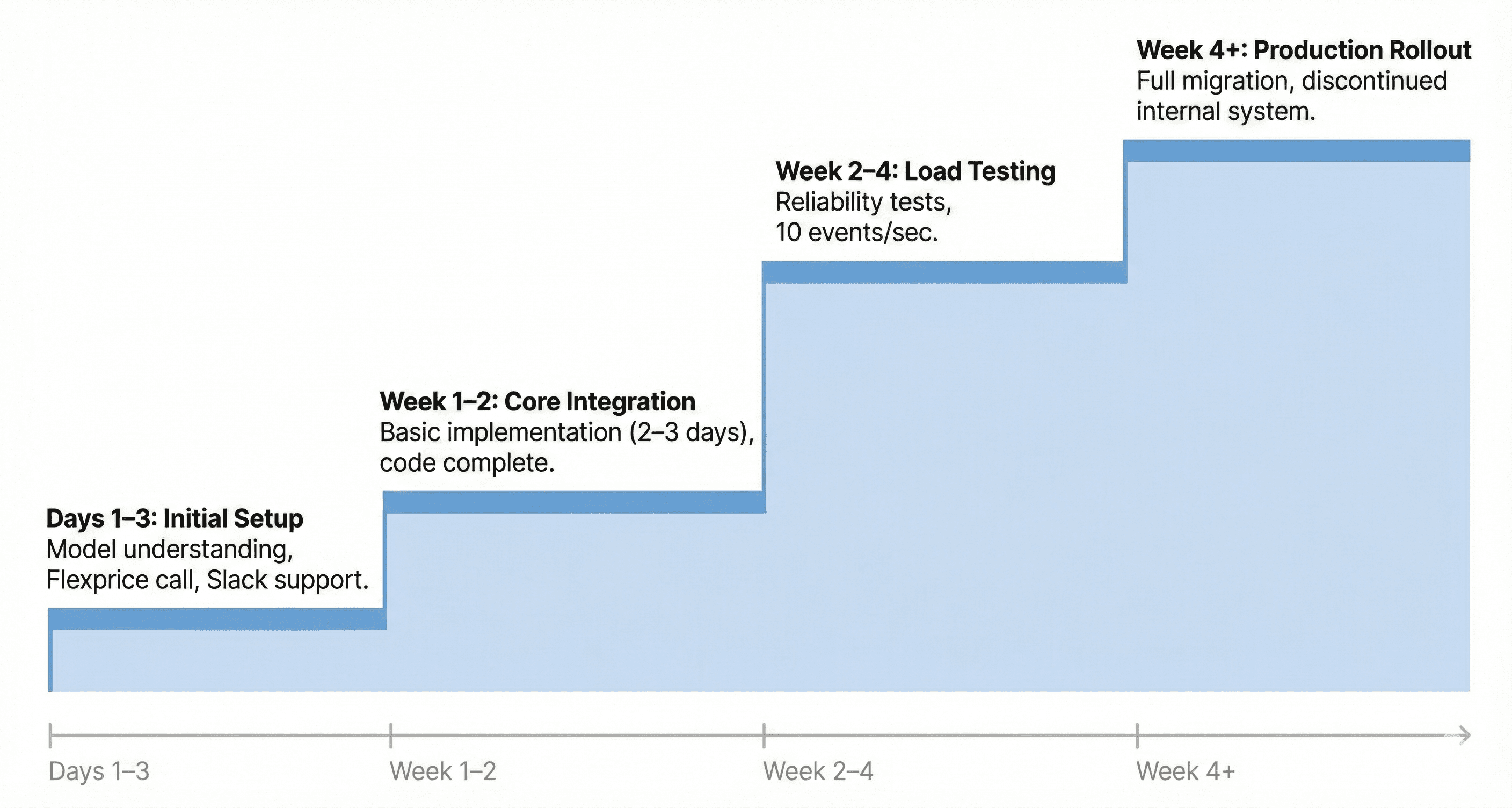

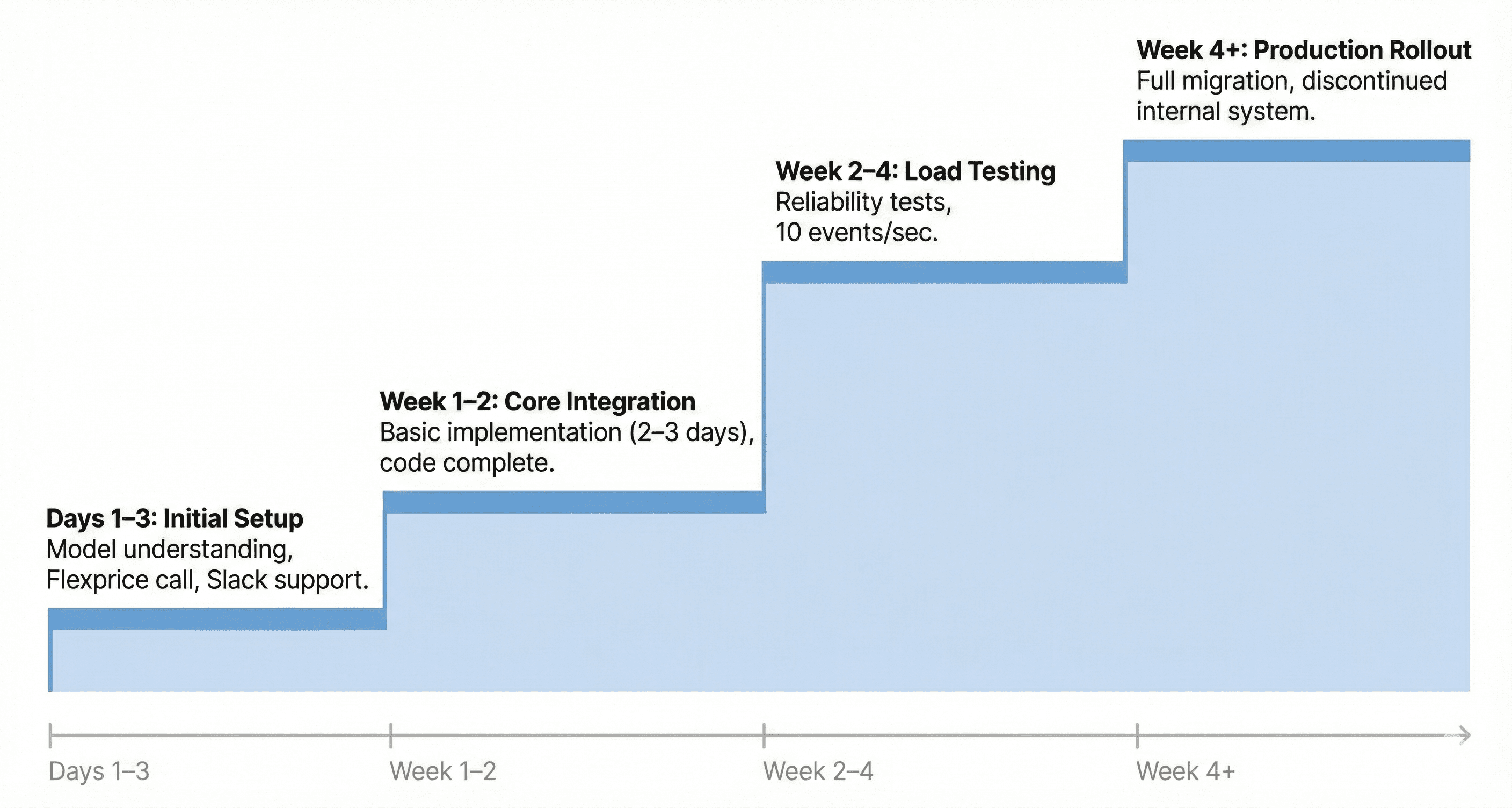

Implementation Timeline & Technical Rollout

Implementation Timeline & Technical Rollout

Segwise moved from evaluation to production in under three weeks. The engineering lift was minimal; most of the time was spent validating reliability at scale.

Segwise now runs 100+ enterprise customers on Flexprice with zero ongoing engineering maintenance. GTM teams manage credits, conversions, and customer workflows without engineering involvement.

Kush Daga said:

Segwise moved from evaluation to production in under three weeks. The engineering lift was minimal; most of the time was spent validating reliability at scale.

Segwise now runs 100+ enterprise customers on Flexprice with zero ongoing engineering maintenance. GTM teams manage credits, conversions, and customer workflows without engineering involvement.

Kush Daga said:

"The core implementation was completed in around 2 weeks, the rest was just us doing load testing and finishing our full migration!"

Credit Wallets

Reliable Usage Metering

Daily Slack Alerts

Backfill Cost Visibility

Real-Time Usage Transparency for Customers

Faster Expansion Into New Pricing Surfaces

The Solution

The Solution

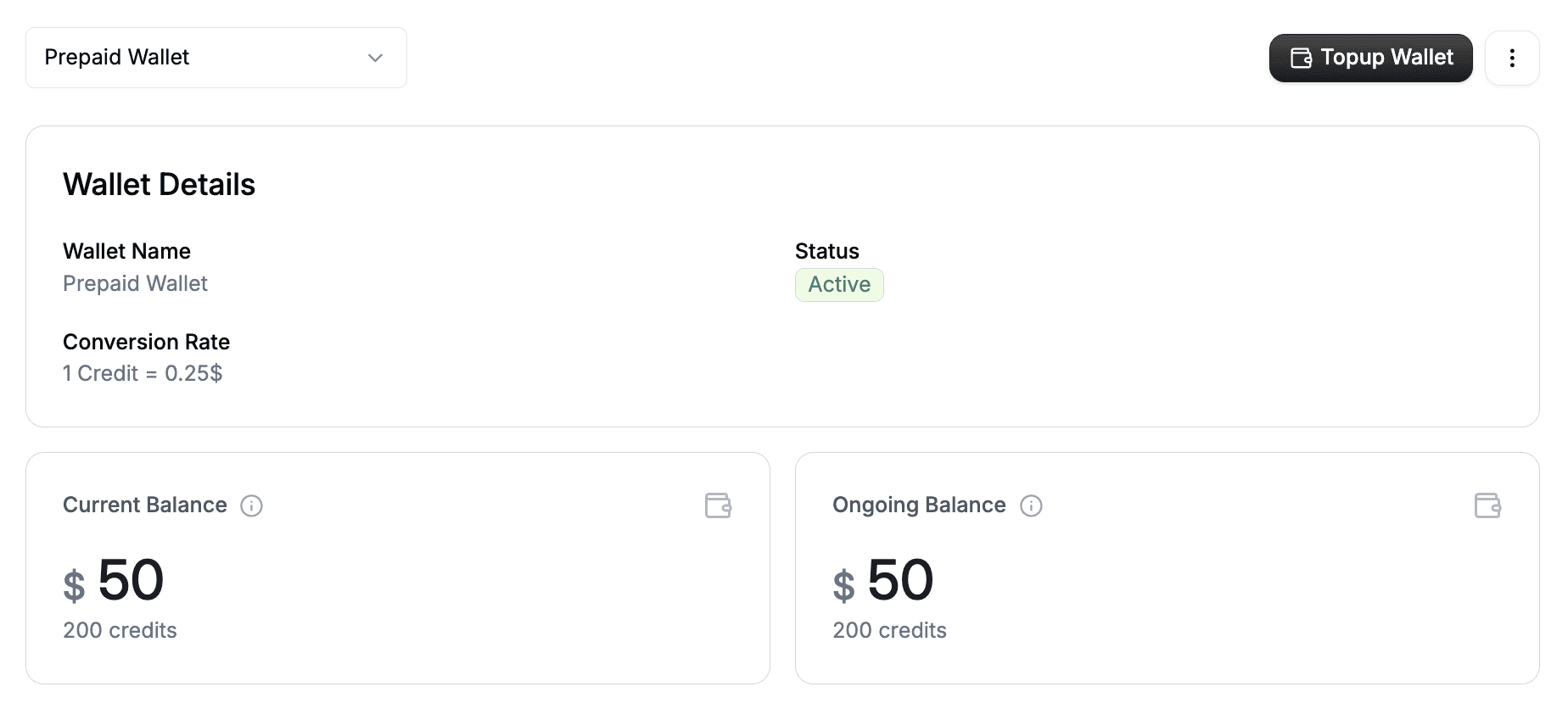

1. Credit Wallets

Segwise needed a pricing model that reflected actual compute cost not ad spend or campaign count, but the true intensity of analyzing and generating creatives.

Flexprice gave them a credits architecture that mapped directly to LLM usage.

Flexprice enabled Segwise to:

Issue 1,000 free credits to every new customer automatically

Allocate annual credit bundles while billing monthly

Top up credits instantly for high-value accounts

Support free trials without requiring a payment provider

Give CS and Sales the ability to manage credit extensions during onboarding and negotiation

These capabilities matched Segwise’s GTM reality: customers evaluate value through usage, not forecasts.

“Every new customer starts with 1,000 free credits. We also needed to issue a year’s worth of credits but bill monthly and Flexprice showed us exactly how to structure it.”

Flexprice turned Segwise’s pricing model from improvised to intentional.

2. Reliable Usage Metering Across Every AI Operation

Segwise processes tens of thousands of creatives through AI models, and every request has a cost profile. Their internal system couldn’t guarantee event durability, order, or reliability.

Flexprice delivered a stable ingestion pipeline with:

Deterministic event processing

Real-time usage collection

No loss under sustained load

Compatibility across analysis, tagging, and ad-generation workloads

Segwise aggressively validated the ingestion layer using internal load scripts:

“I wrote a script to send 10 events per second and load-tested Flexprice for one to two weeks before we deployed it in production.”

This replaced a fragile internal build with a metering backbone that Segwise could trust at scale.

3. Daily Slack Alerts for Proactive Account Management

When Segwise reflects on their Flexprice implementation, one capability consistently stands out:

Automated Daily Alerts.

"We have connected a webhook to Flexprice which sends us every day at the end of the day on our Slack how much credits are left for each org."

Before Flexprice, Segwise ran free trials blindly, no idea which prospects were engaged or when credits would expire.

Today, Segwise's team sees a daily Slack message showing:

Alert Type | What They See |

|---|---|

Green | Customer has a healthy credit balance |

Yellow | Customer has <200 credits remaining — contact soon |

Red | Customer is out of credits — action required immediately |

Org-level tracking | Remaining balance and burn rate for every customer |

Failed processes | Alerts when daily processing fails due to insufficient credits |

Before: "We used to assume it's a big client, they'll probably convert later. But we didn't have any visibility on how much money we are burning on them."

After: "Now we know, okay, this is a big client, so we should get them on a call and talk to them. We should give them more credits on our own and not just let them use up all that infra without knowing."

For an AI platform selling into mobile apps and D2C companies, this level of visibility directly influences conversions, renewals, and customer acquisition costs.

Estimate Before Action: Backfill Cost Visibility

One of Segwise's most expensive operations is backfilling customer data — running AI analysis on 30 days of historical ads.

After Flexprice: Segwise created an estimation step before running backfills:

System calculates: "This backfill will consume 1,000 credits"

CS sees: "Customer has 400 credits remaining"

Decision point: "Is this customer worth the $600+ subsidy?"

"Now our CS team knows — this would require a thousand credits. They only have 400. Do we want to do a backfill or should we push back on this request? Are they big enough for us to support this?"

5. Real-Time Usage Transparency for Customers

Segwise’s customers previously operated blind—they consumed AI workloads without understanding how usage translated to credits. That created friction in billing and limited trial-to-paid conversion.

Flexprice enabled Segwise to expose:

Usage per creative

Total credits consumed

Breakdown across analysis, tagging, and generation

Cost impact of high-volume operations

Customers now have full visibility inside Segwise’s dashboard. “Customers can now know how much they’re using and where they’re spending it.”

This transparency reduces billing disputes and increases willingness to upgrade.

6. Faster Expansion Into New Pricing Surfaces

Segwise’s product roadmap is expanding from analysis into generation and competitor intelligence each with distinct cost curves. Their internal system wasn’t built to model multiple pricing surfaces or multiple wallets.

Flexprice allowed Segwise to:

Add new meters in half a day

Integrate tagging, then generation, then competitor data

Maintain independent cost centers for each workload

Prepare for multi-wallet support (e.g., tagging wallet + generation wallet)

This lets Segwise evolve product pricing without refactoring infrastructure.

“Adding a new type of billing takes me half a day.”

“We’ve already integrated generation events—sending zero credits right now.”

Flexibility became a strategic advantage.

1. Credit Wallets

Segwise needed a pricing model that reflected actual compute cost not ad spend or campaign count, but the true intensity of analyzing and generating creatives.

Flexprice gave them a credits architecture that mapped directly to LLM usage.

Flexprice enabled Segwise to:

Issue 1,000 free credits to every new customer automatically

Allocate annual credit bundles while billing monthly

Top up credits instantly for high-value accounts

Support free trials without requiring a payment provider

Give CS and Sales the ability to manage credit extensions during onboarding and negotiation

These capabilities matched Segwise’s GTM reality: customers evaluate value through usage, not forecasts.

“Every new customer starts with 1,000 free credits. We also needed to issue a year’s worth of credits but bill monthly and Flexprice showed us exactly how to structure it.”

Flexprice turned Segwise’s pricing model from improvised to intentional.

2. Reliable Usage Metering Across Every AI Operation

Segwise processes tens of thousands of creatives through AI models, and every request has a cost profile. Their internal system couldn’t guarantee event durability, order, or reliability.

Flexprice delivered a stable ingestion pipeline with:

Deterministic event processing

Real-time usage collection

No loss under sustained load

Compatibility across analysis, tagging, and ad-generation workloads

Segwise aggressively validated the ingestion layer using internal load scripts:

“I wrote a script to send 10 events per second and load-tested Flexprice for one to two weeks before we deployed it in production.”

This replaced a fragile internal build with a metering backbone that Segwise could trust at scale.

3. Daily Slack Alerts for Proactive Account Management

When Segwise reflects on their Flexprice implementation, one capability consistently stands out:

Automated Daily Alerts.

"We have connected a webhook to Flexprice which sends us every day at the end of the day on our Slack how much credits are left for each org."

Before Flexprice, Segwise ran free trials blindly, no idea which prospects were engaged or when credits would expire.

Today, Segwise's team sees a daily Slack message showing:

Alert Type | What They See |

|---|---|

Green | Customer has a healthy credit balance |

Yellow | Customer has <200 credits remaining — contact soon |

Red | Customer is out of credits — action required immediately |

Org-level tracking | Remaining balance and burn rate for every customer |

Failed processes | Alerts when daily processing fails due to insufficient credits |

Before: "We used to assume it's a big client, they'll probably convert later. But we didn't have any visibility on how much money we are burning on them."

After: "Now we know, okay, this is a big client, so we should get them on a call and talk to them. We should give them more credits on our own and not just let them use up all that infra without knowing."

For an AI platform selling into mobile apps and D2C companies, this level of visibility directly influences conversions, renewals, and customer acquisition costs.

Estimate Before Action: Backfill Cost Visibility

One of Segwise's most expensive operations is backfilling customer data — running AI analysis on 30 days of historical ads.

After Flexprice: Segwise created an estimation step before running backfills:

System calculates: "This backfill will consume 1,000 credits"

CS sees: "Customer has 400 credits remaining"

Decision point: "Is this customer worth the $600+ subsidy?"

"Now our CS team knows — this would require a thousand credits. They only have 400. Do we want to do a backfill or should we push back on this request? Are they big enough for us to support this?"

5. Real-Time Usage Transparency for Customers

Segwise’s customers previously operated blind—they consumed AI workloads without understanding how usage translated to credits. That created friction in billing and limited trial-to-paid conversion.

Flexprice enabled Segwise to expose:

Usage per creative

Total credits consumed

Breakdown across analysis, tagging, and generation

Cost impact of high-volume operations

Customers now have full visibility inside Segwise’s dashboard. “Customers can now know how much they’re using and where they’re spending it.”

This transparency reduces billing disputes and increases willingness to upgrade.

6. Faster Expansion Into New Pricing Surfaces

Segwise’s product roadmap is expanding from analysis into generation and competitor intelligence each with distinct cost curves. Their internal system wasn’t built to model multiple pricing surfaces or multiple wallets.

Flexprice allowed Segwise to:

Add new meters in half a day

Integrate tagging, then generation, then competitor data

Maintain independent cost centers for each workload

Prepare for multi-wallet support (e.g., tagging wallet + generation wallet)

This lets Segwise evolve product pricing without refactoring infrastructure.

“Adding a new type of billing takes me half a day.”

“We’ve already integrated generation events—sending zero credits right now.”

Flexibility became a strategic advantage.

Scaling New Product Lines on Autopilot

Siloed Credit Wallets for Multi-Product Billing

Flexprice as the Long-Term "Metering OS" for AI Products

What's Next in Billing For Segwise?

Segwise's monetization strategy is evolving faster, and Flexprice will be the billing backbone as they scale deeper into AI-powered ad generation.

Three priorities already in motion:

1. Scaling New Product Lines on Autopilot

Segwise is expanding beyond creative analytics into ad generation—creating ads automatically based on AI insights.

"Generation will need like half a day to integrate. We've already started sending zero credits right now because we are giving it for free, but we have integrated that system."

Every new product line (generation, competitor data, tagging) introduces new credit types. With Flexprice, adding new billing models takes half a day instead of weeks of engineering work.

2. Siloed Credit Wallets for Multi-Product Billing

As Segwise launches multiple product lines, they need separate credit buckets per feature:

One wallet for creative tagging (analysis)

One wallet for ad generation (creation)

One wallet for competitor data (benchmarking)

"One customer can have two wallets... so that when we use credits for generation, we don't want it to get cut from their tagging balance."

This ensures customers can scale one product without accidentally draining credits from another.

3. Flexprice as the Long-Term "Metering OS" for AI Products

Segwise sees Flexprice not as a vendor, but as core infrastructure. The decision was shaped by two realities:

Billing is the business for AI companies—every ad analyzed, every video generated, every API call is revenue

Building billing infrastructure internally diverts engineering from product—AI models, generation quality, and customer acquisition

With the combination of:

Real-time metering for high-cardinality AI usage

Credit wallets for free trials and enterprise contracts

Self-service controls for non-technical teams

Daily alerts that drive proactive account management

Flexprice is expected to serve as a permanent layer in Segwise's product architecture, not just an operational add-on.

Segwise's monetization strategy is evolving faster, and Flexprice will be the billing backbone as they scale deeper into AI-powered ad generation.

Three priorities already in motion:

1. Scaling New Product Lines on Autopilot

Segwise is expanding beyond creative analytics into ad generation—creating ads automatically based on AI insights.

"Generation will need like half a day to integrate. We've already started sending zero credits right now because we are giving it for free, but we have integrated that system."

Every new product line (generation, competitor data, tagging) introduces new credit types. With Flexprice, adding new billing models takes half a day instead of weeks of engineering work.

2. Siloed Credit Wallets for Multi-Product Billing

As Segwise launches multiple product lines, they need separate credit buckets per feature:

One wallet for creative tagging (analysis)

One wallet for ad generation (creation)

One wallet for competitor data (benchmarking)

"One customer can have two wallets... so that when we use credits for generation, we don't want it to get cut from their tagging balance."

This ensures customers can scale one product without accidentally draining credits from another.

3. Flexprice as the Long-Term "Metering OS" for AI Products

Segwise sees Flexprice not as a vendor, but as core infrastructure. The decision was shaped by two realities:

Billing is the business for AI companies—every ad analyzed, every video generated, every API call is revenue

Building billing infrastructure internally diverts engineering from product—AI models, generation quality, and customer acquisition

With the combination of:

Real-time metering for high-cardinality AI usage

Credit wallets for free trials and enterprise contracts

Self-service controls for non-technical teams

Daily alerts that drive proactive account management

Flexprice is expected to serve as a permanent layer in Segwise's product architecture, not just an operational add-on.

Scaling New Product Lines on Autopilot

Siloed Credit Wallets for Multi-Product Billing

Flexprice as the Long-Term "Metering OS" for AI Products

What's Next in Billing For Segwise?

Segwise's monetization strategy is evolving faster, and Flexprice will be the billing backbone as they scale deeper into AI-powered ad generation.

Three priorities already in motion:

1. Scaling New Product Lines on Autopilot

Segwise is expanding beyond creative analytics into ad generation—creating ads automatically based on AI insights.

"Generation will need like half a day to integrate. We've already started sending zero credits right now because we are giving it for free, but we have integrated that system."

Every new product line (generation, competitor data, tagging) introduces new credit types. With Flexprice, adding new billing models takes half a day instead of weeks of engineering work.

2. Siloed Credit Wallets for Multi-Product Billing

As Segwise launches multiple product lines, they need separate credit buckets per feature:

One wallet for creative tagging (analysis)

One wallet for ad generation (creation)

One wallet for competitor data (benchmarking)

"One customer can have two wallets... so that when we use credits for generation, we don't want it to get cut from their tagging balance."

This ensures customers can scale one product without accidentally draining credits from another.

3. Flexprice as the Long-Term "Metering OS" for AI Products

Segwise sees Flexprice not as a vendor, but as core infrastructure. The decision was shaped by two realities:

Billing is the business for AI companies—every ad analyzed, every video generated, every API call is revenue

Building billing infrastructure internally diverts engineering from product—AI models, generation quality, and customer acquisition

With the combination of:

Real-time metering for high-cardinality AI usage

Credit wallets for free trials and enterprise contracts

Self-service controls for non-technical teams

Daily alerts that drive proactive account management

Flexprice is expected to serve as a permanent layer in Segwise's product architecture, not just an operational add-on.

Ready to transform your billing infrastructure?

Ready to transform your billing infrastructure?

If you're spending valuable engineering time on billing instead of your core product or if you need to scale complex usage-based pricing without the overhead, Flexprice can help.

If you're spending valuable engineering time on billing instead of your core product or if you need to scale complex usage-based pricing without the overhead, Flexprice can help.

Join our Community

Join our Community

Join our Community

Connect with other teams solving similar challenges

Connect with other teams solving similar challenges

Connect with other teams solving similar challenges