Ayush Parchure

Ayush ParchureWhat Features To Look for Before Adopting Credit Based Pricing For AI and SaaS

What Features To Look for Before Adopting Credit Based Pricing For AI and SaaS

What Features To Look for Before Adopting Credit Based Pricing For AI and SaaS

What Features To Look for Before Adopting Credit Based Pricing For AI and SaaS

Feb 13, 2026

Feb 13, 2026

Feb 13, 2026

• 19 min read

• 19 min read

Ayush Parchure

Content Writing Intern, Flexprice

You've decided that credit-based pricing makes sense for your product. But your AI features have different compute costs, your customers want flexibility, and subscriptions feel too rigid.

But now you're staring at a spreadsheet at the 11th hour, trying to figure out: What should 1 credit actually cost? What happens when you need to adjust pricing in six months? Do existing credits stay valid forever?

You've talked to your engineering team. They estimate weeks to build a wallet system, balance tracking, and expiration logic. Your CFO wants revenue projections you can't possibly model yet. And every founder you ask has a different horror story about credit pricing gone wrong.

In 2026, for AI companies evaluating credit-based pricing infrastructure, newer platforms like Flexprice focus on real-time usage tracking, credit wallets, and pricing experimentation instead of subscription-centric billing systems.

This guide breaks down exactly what to look for in credit-based pricing and how to launch your model in an hour instead of two months.

TL;DR

Credit-based pricing shows strong core infrastructure dependency on wallets, ledgers, top-ups, debits, grants, and APIs that must work properly as usage scales.

Product teams want flexible packaging tools like prepaid credits, auto top-ups, and usage alerts to get an understanding without engineering bottlenecks.

Finance and RevOps require reconciliation-ready systems with auditable transactions, invoiced top-ups, and partial credit payments to avoid month-end chaos.

Customer portals and session APIs give end users real-time visibility into balances and usage, reducing support overhead.

Enterprise sales demand advanced pricing controls, automated quotes, renewals, amendments, and CRM integration so complex deals don’t break billing.

Reporting, integrations, automation, and fraud controls ensure visibility into revenue, seamless system connectivity, and secure operations at scale.

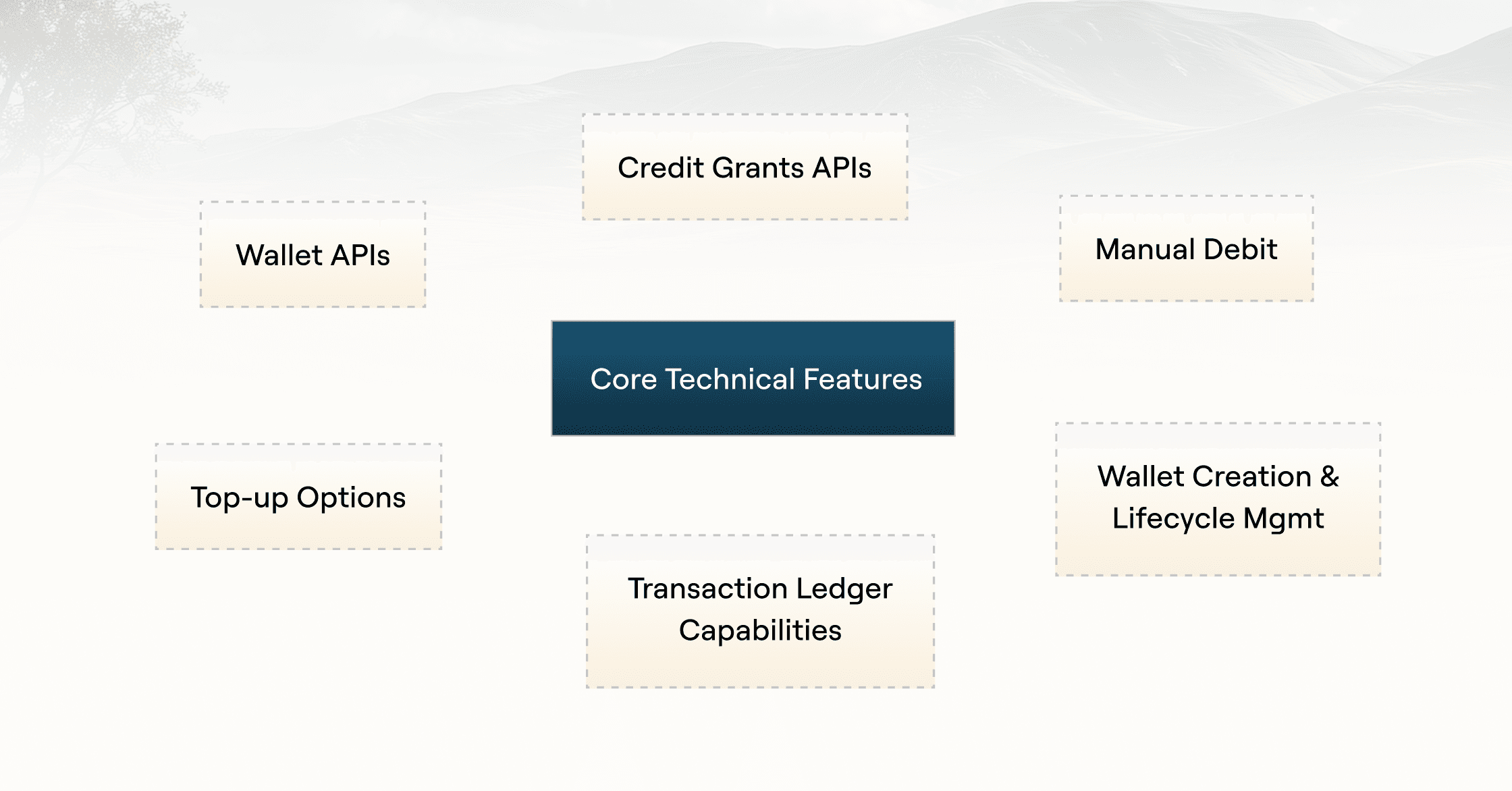

Core technical features

Think of this as the operating system for your credit-based pricing model. It manages wallets, tracks every transaction, automates top-ups, and exposes APIs so your product can safely consume credits.

With the basics in place, the next question becomes how these foundational components come together to support real-world billing flows and product flexibility.

Wallet creation & lifecycle management

This feature focuses on how customer credit balances are created, maintained, upgraded, suspended, or closed over time.

This is not just a generic balance container; it represents an account’s financial state across environments. If you want to explore real-world implementations of credit billing infrastructure for AI applications.

With proper lifecycle management, customers can ensure that wallets:

Initialize on signup

Moment where a wallet becomes part of your product. As soon as a workspace is created, the system initialises a wallet with a unique ID, assigns an initial status, and applies any starting credits.

Example:

It's more like when you sign up for a 14-day trial, and a wallet is automatically created with initial 1,000 trial credits, which are marked as non-billable, and configured to expire at the end of the trial window.

Reset or roll over on plan changes.

This is the stage where most of the metered billing system starts to break, when any customisation, like an upgrade, downgrade, or switching plans, is implemented wallet must handle the remaining balance, new credit allocations, and pricing rules smartly

Example:

When a customer wants to upgrade their system halfway through the month, and they still have 300 credits left, those credits are carried forward. 2000 new credits are added under the new plan. Now, any future usage is charged at the higher tier’s credit rate.

Freeze on payment failure

Think of it as a controlled pause, not a complete shutdown. When a payment attempt fails, the wallet transitions into a frozen state, where all debit operations are put on hold. Customers can still retry for payments or add funds accordingly, and once the payment succeeds wallet will automatically resume its normal operation.

Example:

We can think of it as Google autopay if your card fails, your subscription is put on hold, and services are paused. As soon as you update your payment method and the charge goes through, everything unlocks again without needing support intervention.

Transaction ledger capabilities

A transaction ledger is a journal that notes down every credit movement that happens.

This is critical because, without a ledger, you only know “this customer has 500 credits,” but with a ledger, you know where those credits came from when they were spent, what feature consumed them, and why balances changed

Financial reconciliation

After the ledger is updated with every credit movement that happened, the financial team matches each wallet transaction with its respective invoices and payments so they can confidently close books.

Example: Your system shows 10 customers bought credits worth $500 total. Finance checks the payment system and confirms $500 was actually collected; only then they close the books.

Usage audits

For instance, a ledger just stores the total transaction that happened, but having a usage audit means you have detailed, step-by-step records of how exactly the credits are used.

Which ultimately helps the team to investigate spikes or unusual patterns instead of guessing.

Example: Imagine your mobile data bill suddenly doubled this month. Instead of just seeing how much data is used, you get a detailed usage log that shows you which apps or activities caused the extra usage

Customer dispute resolution

Why did my balance change? Is a question that needs to be answered with pure facts and honesty to retain customer trust. This is where the transaction ledger plays a main role by keeping a complete timeline of every credit movement. Which turns emotional billing conversations into factual ones.

Example: When a customer complains, “I lost 500 credits overnight.”Support checks the ledger and shows them that 200 credits were used by API calls at 2:14 AM, and 300 credits were consumed by a batch job at 2:18 AM. Problem solved within minutes, no back-and-forth, and no trust issues.

Top-up options

A simple way to understand Top-up is to visualise it as the fuel that keeps usage flowing. In a credit-based system, top-ups aren’t just payments; they’re tightly connected to wallets, ledgers, alerts, and product access.

A mature platform provides customers with auto and manual types of top-up, because different customers at different growth rates require a system that supports their use case

Auto top-up

In this option, top-up is automated. This removes friction by refilling credits before the customer runs out. Instead of waiting for the financial team to notice a low balance, the system monitors wallet levels and triggers a purchase automatically when a threshold is reached.

Example: When a company runs background AI jobs overnight. When credits fall below 200, the system automatically adds more. The jobs never fail, and finance still controls spend via caps.

Manual top-up

This option provides the customer with simplicity by letting the customer decide when and how much to buy. They go to a dashboard and choose an amount pay, and credits are added to their wallet. The ledger records the transaction, and its balance updates immediately.

Example: A startup runs low on credits. The admin logs in, buys 1,000 credits, and continues using the product. No automation, just a manual refill, like recharging a prepaid mobile balance.

Manual debit with audit trails

Think of it like a security camera for your billing system. Every time someone manually adjusts a customer's credit balance, the system automatically records who did it, when, why, and exactly what changed, which creates a permanent, tamper-proof receipt.

How these changes affect teams:

Finance/operations teams

You can safely make manual billing adjustments without worrying about errors or fraud. Every change is automatically documented with full context, who, what, when, and why.

So you always know exactly what happened

Example: When a customer was underbilled by 1,000 credits last week. The finance team adjusts the balance, adds the reason for that, and later exports the audit log during month-end reconciliation, which prevents hours of digging through emails or spreadsheets.

Engineering teams:

Built-in idempotency and immutable logs prevent duplicate debits and preserve complete transaction history, so you can adjust balances programmatically or through the dashboard without risking duplicate charges or losing transaction history.

Example: When the API accidentally sends the same debit twice. This is where idempotency blocks the duplicate automatically, and engineers can see the full request + balance change in logs.

Legal teams

Manual debit audit trails meet regulatory requirements, RBI, and SOX by creating digital, timestamped records for every balance adjustment. You get full traceability and transparency for internal controls and external audits.

Example: When an audit is taking place, compliance pulls a report showing every manual adjustment, like who approved it, when it happened, and why.

Credit grants API

Generally, customers ask why this is, and in what ways it helps me. The credit grants API lets you automate credit distribution at scale while maintaining full control over it. Its is automated because doing it manually means slow, error-prone, and doesn't scale.

Faster time-to-value

You can start using your product immediately without waiting for manual provisioning. Credits are granted automatically at signup, removing friction from onboarding and accelerating activation.

Example: A customer signs up for your AI platform. The credit grants API instantly adds 1,000 free trial credits to their account within seconds of signup, with no human intervention required.

Self-service credit purchases

Customers can buy credit packages directly without contacting sales. This removes dependency on sales or support teams and keeps usage uninterrupted. Self-serve top-ups also improve conversion and expansion revenue

Example: Your customer needs more credits mid-month. They click "buy 10,000 credits for $500" in your dashboard. The payment processor triggers your credit grants API, and credits appear instantly in their account.

Automated promotions and incentives

You can run growth campaigns like promotions and incentives without any manual work. Credit grants let you automate referrals and onboarding rewards, at scale. This enables faster experimentation while keeping incentives consistent and trackable.

Example:

"Refer 3 friends → automatically receive 2,000 bonus credits."

"Black Friday: Double credits on all purchases" API grants 2x automatically

"Complete onboarding tutorial → unlock 500 credits."

Wallet APIs

If you’re evaluating credit-based pricing, Wallet APIs are non-negotiable.

A wallet API gives you programmatic control over your customers’ credit balances. Think of it like a bank account API for credits. You can check balances, track transactions, set spending limits, manage expirations, and even separate paid vs promotional credits, all in real time.

Real-Time balance visibility

Customers should always have instant access to their current credit balance. Without real-time visibility, they risk unexpected service interruptions and budget overruns. A strong wallet system makes balance data accessible via API and dashboard, so users never operate in the dark. Transparency here directly reduces support dependency and increases trust.

Example: A customer embeds wallet data directly into their product dashboard, like:

Current balance: 8,247 credits

Estimated days remaining: 12

Usage analytics & forecasting

Visibility alone isn’t enough for customers; they need insights. Wallet APIs should allow teams to analyse historical consumption, identify usage spikes, and forecast future credit needs. This enables proactive planning instead of reactive top-ups. Predictability improves budgeting accuracy and ensures uninterrupted product usage.

Example: A team checks their burn rate:

Last 7 days: 15,000 credits

Average daily usage: 2,143 credits

Projection: top-up needed in ~4 days

To expand on real-time usage tracking and billing analytics tools, see Best Tools for Usage Analytics and Billing in 2025.

Automated alerts & workflows

Modern teams automate everything, and billing should be no exception. Wallet APIs should integrate seamlessly with monitoring tools, internal systems, and workflows. When balances hit thresholds, actions should trigger automatically without manual intervention. This reduces operational stress and eliminates last-minute scrambling.

Example:

When the balance drops below 1,000 credits:

Send Slack alert

Trigger auto top-up

Prevent service interruption

How these core technical features help in customer success:

“Credit-based pricing transformed how we scale usage and visibility in our product. Wallets and real-time balances removed billing surprises and made expansion smoother.”

Launch Credit Based Pricing For Your Product in Hours

Launch Credit Based Pricing For Your Product in Hours

Product & growth packaging

In 2026, SaaS and AI companies don’t grow on static pricing. They grow by testing, learning, and iterating their product. The real question customers ask is whether this credit system helps me experiment with pricing and packaging, or drags me down?

Here is the solution to this doubt:

Prepaid vs promotional credits

What buyers need to understand about credit pricing is that not all credit serves the same purpose. A mature system always differentiates between prepaid credit and promotional credits, and this actually matters far more than founders initially realise

Basis | Prepaid Credits | Promotional Credits |

Source and purpose | Purchased by a customer with real money, and the purpose of this is revenue generation and budget control | Issued for free by the company, and it serves in growth, trials, and user activation |

Real-world example | Startup buys $500 worth of credits, like 50,000 credits upfront, for their AI API usage over Q1 | New signups get 1,000 free credits to test the product before buying |

Actual users | Enterprises with fixed budgets, teams needing predictable spend, and customers wanting volume discounts | Trial users, PLG signups, beta testers, event attendees, referral programs |

What founders look for | ARR/MRR contribution, revenue recognition schedule, prepayment conversion rate | Trial-to-paid conversion rate, cost per activated user, promotional ROI |

Expiration policy | 6-12 months, which is flexible for enterprise deals; creates urgency for renewals without being aggressive | 30-90 days; creates urgency to experience value quickly and convert |

Common mistake | Not setting clear expiration terms, leading to customers sitting on unused balances indefinitely | Giving too many promo credits that customers never convert, or too few that they can't experience real value |

What customers complain about | I paid for this and haven't used it yet. Can I get a refund?" or my credits will expire before I can use them. | I ran out of free credits too quickly, or free credits weren't enough to test properly. |

Red flag to watch out for | Large unused prepaid balances = customers aren't getting value = churn risk | High promo usage but zero conversion = you're funding tire-kickers, not real customers |

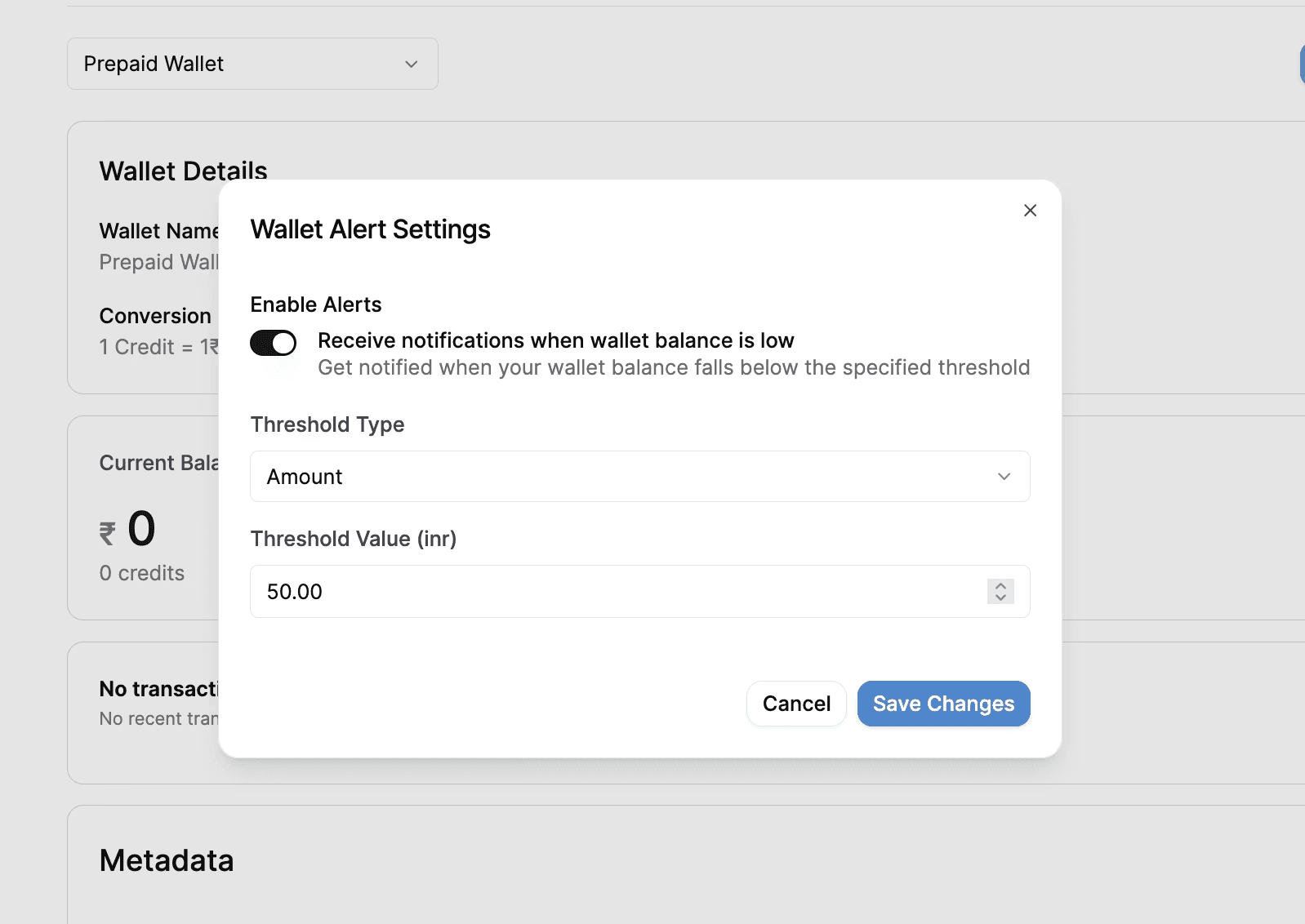

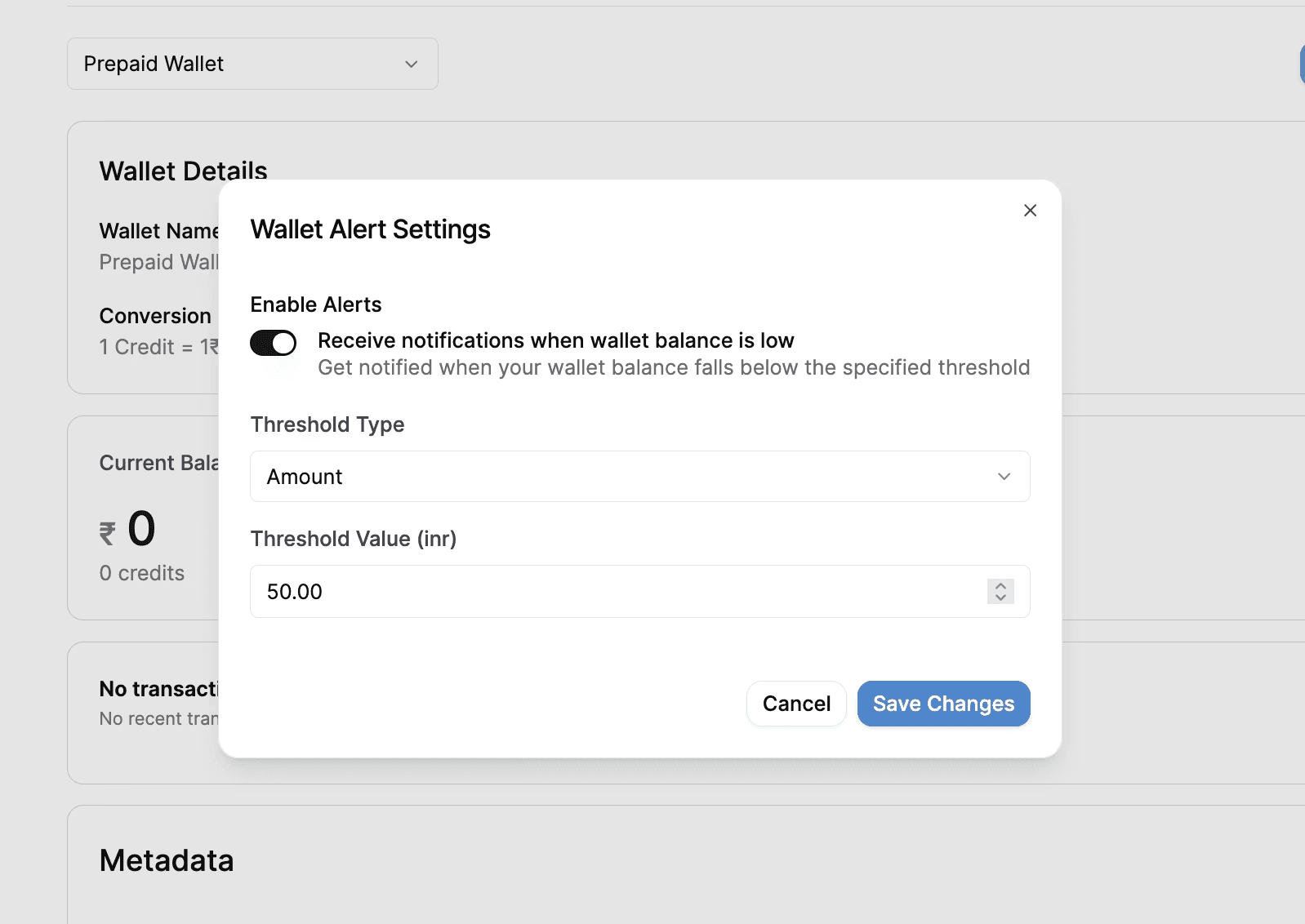

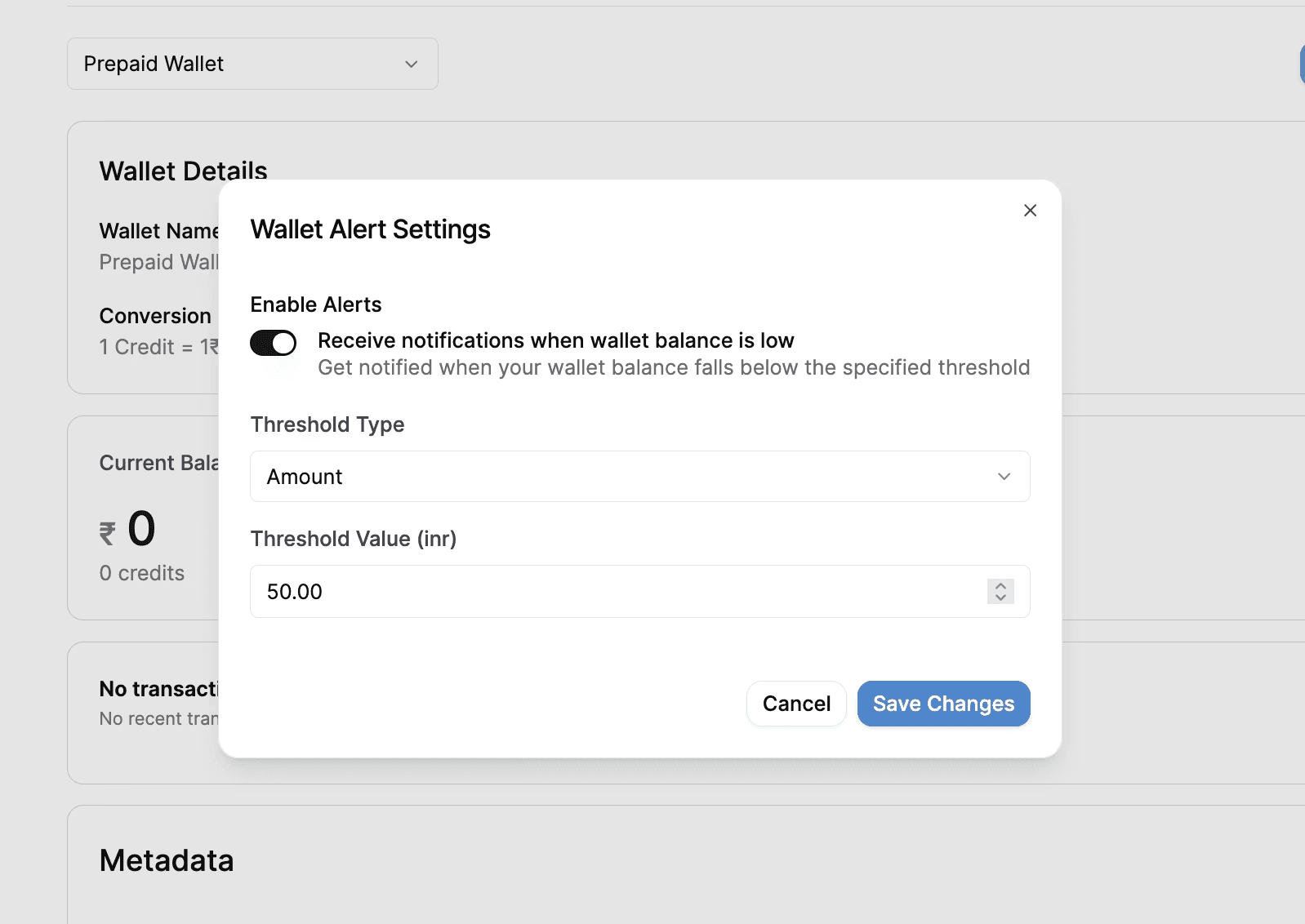

Low balance alerts: preventing chaos before it happens

Most of the time, auto top-up is not enabled, especially for the enterprise customer who requires manual approvals or strict spending controls. And this is where low balance alerts prevent critical situations.

Low balance alerts proactively notify users or administrators when credit levels fall below a predefined threshold. Instead of discovering the problem after services stop working, teams get a warning and can purchase a plan accordingly.

Key features and functionality

Threshold setting: Users can define a specific credit amount, which, when reached or dropped below, triggers an alert that informs teams that the threshold is reached.

Automated Monitoring: Modern AI and SaaS software, such as Flexprice or Vonage API, helps in tracking consumption in real-time and at frequent intervals to detect low balances.

Notification Methods: Alerts are typically delivered via email, but some platforms also support SMS, which is preferred, especially for critical thresholds.

Frequency Limits: To avoid spamming and disturbing flow, alerts are often limited to once per day or per breach. With this, teams get notified on time and don't get bothered again and again

Automated Actions: Advanced systems can trigger automatic, pre-configured top-ups when a low balance is detected. This keeps the flow of work unstoppable, which gives the customer a smooth experience.

Source: flexprice docs

Enterprise pricing control and flexibility

Enterprise organisations need a flexible, hybrid, and prepaid usage model that bridges the gap between predictable, fixed-cost subscriptions and variable pay-as-you-go models.

It provides a control that large organisations need over budgets while enabling flexibility in how they consume services.

Enhanced control for enterprises

Budget predictability: Customers purchase a set amount of credits in advance, making it easier to forecast spending compared to unpredictable monthly usage fees. The result is fewer surprises and much stronger financial control.

Reduced overages: Many systems include built-in dashboards, low-credit alerts like, 50%, 10% remaining, and configurable pausing usage when limits are hit. This dramatically reduces billing disputes, emergency approvals, and last-minute budget escalations.

Centralised purchasing: Enterprises can buy large credit wallets that are pooled across different teams or users. It creates organisation-wide visibility and control without slowing down day-to-day operations.

Transparent ROI: Because credits are tied directly to actions like an AI generation or API call, enterprises can easily measure cost against value. This transparency transforms billing data into product insight, helping leaders connect spend directly to value delivered.

High flexibility for shifting needs

Volume-based discounts: Similar to enterprise software, buying credits in bulk allows for negotiating lower per-unit rates, providing cost efficiency for high-volume users. For customers, it means spending less as they grow, without needing to renegotiate pricing every time usage increases.

Unified metric: A single, abstract credit can cover various services, for example, storage, compute, and API calls, allowing customers to switch between products without renegotiating contracts. It helps in turning complex infrastructure costs into one clear unit of value.

Burstable usage: Credits allow for high-volume, short-duration bursts of activity, making it ideal for fluctuating demand. This flexibility is especially valuable for AI workloads and event-driven usage. Customers pay only for what they need and when they need.

Flexible expiration policies: While some credits expire at the end of a contract, many enterprise agreements offer flexible roll-over policies to ensure value is not lost. This protects customers from losing value when usage fluctuates across quarters, and also allows for creating a fairer, long-term partnership between vendor and customer.

Implementing flexibility

Hybrid models: Pairing a low-cost subscription with a credit pool provides a blend of stability and flexibility. Meanwhile, finance teams benefit from a fixed baseline expense, and product teams retain the freedom to experiment and scale usage as needed. It creates the right balance between recurring revenue predictability and consumption-driven growth.

True-Up mechanism: Annual true-up is a contract that allows enterprises to commit to a base volume while permitting extra consumption with regular, transparent adjustments. Using this approach gives predictable revenue commitments while protecting customers from overcommitting upfront. It ensures alignment between actual usage and contract value without constant renegotiation.

Dynamic rebalancing: Vendors can adjust how many credits specific features consume over time without requiring a full contract renegotiation. It ensures long-term adaptability while avoiding disruptive pricing resets for customers.

Sales integration with CRM and opportunity management

Integrating CRM and opportunity management with credit-based pricing requires a shift from tracking flat-rate subscriptions to managing consumption-based wallets. In this model, customers purchase credits upfront, which are then consumed in real-time as services like API calls, compute time, and AI tokens.

This means billing and usage data must flow back into the CRM in near real time. Without that loop, sales teams operate blindly, closing deals without understanding burn rate, expansion signals, and churn risk.

Real-time consumption visibility

A production-ready CRM integration should surface credit balance, historical usage, and consumption velocity directly on the customer profile. Sales reps shouldn’t need to jump between dashboards or ask finance how much a customer has left.

When sales reps can see these options clearly:

Remaining credits

Weekly or monthly burn rate

Which features are driving spend

They gain immediate context for renewals and expansions. Instead of generic check-ins, conversations become data-driven:

Example: You’ve consumed 70% of your credits in three weeks, let’s plan your next package before you hit limits. This transforms sales from reactive account management into proactive revenue orchestration.

Automated triggers for expansion and retention

Static CRM data isn’t enough. Modern credit systems should push real-time events into the CRM using automated workflows.

Examples include:

Alerting reps when a customer drops below 20% credit balance

Flagging sudden usage spikes that signal strong product adoption

Notifying account owners when consumption slows, indicating churn risk

These triggers turn usage signals into sales actions. Instead of discovering expansion opportunities during quarterly reviews, teams can engage customers at exactly the moment value is being realised.

This is especially critical in AI and usage-based products, where growth happens through consumption, not seat upgrades.

Advanced reporting and forecasting

Credit-based pricing smartly changes the foundation of revenue planning.

In credit-based and usage-based pricing models, revenue is driven by consumption behaviour, which is dynamic, non-linear, and often unpredictable.

Without an advanced reporting infrastructure, finance teams are forced to forecast using outdated assumptions, and sales teams operate without clear expansion signals.

That’s where advanced reporting becomes non-negotiable.

Real-time usage and credit consumption reports

In a mature system, credit usage reporting isn’t a monthly CSV export. It’s a live operational layer that guides teams through.

Sales, finance, and ops teams should be able to see:

Remaining credit balance per customer

Daily and weekly burn rate

Historical consumption trends

Feature-level usage breakdown

Prepaid vs promotional vs overage consumption

This visibility allows companies to move from reactive billing to proactive revenue management.

Example:

If a customer’s burn rate accelerates unexpectedly, it may indicate product-market fit expansion, but it also signals timing sensitivity. A rising burn rate often precedes budget exhaustion, which creates both opportunity and risk.

If usage suddenly slows, it could signal churn risk, shifting priorities, technical integration issues, or internal budget freezes. Consumption-based models amplify this signal because revenue declines immediately when usage drops.

If 70% of credits are spent on one API endpoint, the pricing model may be misaligned with the cost structure or perceived value. Advanced systems should allow feature-level reporting so product and finance teams can rebalance credit costs dynamically, protecting margins while preserving customer fairness

Revenue forecasting based on consumption patterns

Forecasting in credit-based pricing must evolve beyond bookings. Traditional SaaS metrics like ARR and contract value don’t fully capture revenue timing when customers draw down prepaid credits at variable rates.

A modern forecasting layer should do the following:

Ingest usage data continuously

Model consumption curves per customer

Segment customers by behaviour

Project credit depletion timelines

Estimate future top-ups and overages

This creates a predictive revenue engine. Finance teams can forecast cash flow based on burn velocity. Sales teams can identify accounts approaching expansion thresholds.

Mainly, companies ask about:

How fast are customers consuming value?

When will wallets require replenishment?

Which segments are driving expansion?

Credit-based pricing is a strategy: choose it wisely

By now, the pattern should be clear. Credit-based pricing isn’t just about converting dollars into credits. It’s about whether your systems can support wallets, ledgers, usage signals, enterprise workflows, forecasting, and automation all at once.

There’s no universally “perfect” pricing model. You have to decide what fits your product complexity, customer expectations, and growth stage

If your product has:

multiple features with different cost curves

variable AI compute

budget-conscious or procurement-led buyers

→ Then yes, credit-based pricing makes sense.

If you’re serving both self-serve users and enterprise customers, running experiments on packaging, or iterating pricing every quarter, the answer is almost always hybrid.

But here’s the real mistake most founders make:

They don’t fail because they chose the wrong model. They fail because they locked themselves into a billing infrastructure that makes change painful. They hard-code pricing into product logic. They manage credits in spreadsheets. And six months later, they’re rebuilding everything.

With platforms like Flexprice, launching credit-based pricing doesn’t mean months of custom engineering or irreversible architectural decisions.

Here’s what “launch fast” actually looks like in practice:

To launch credit-based pricing

Create a wallet per customer

Define prepaid and promotional credit packs

Map features to credit costs

Enable real-time deductions, top-ups, and balance alerts

To add forecasting and revenue visibility

Stream usage into real-time dashboards

Track burn rates and depletion timelines

Segment customers by consumption behaviour

Project top-ups, overages, and expansion

To support enterprise sales

Attach credits directly to CRM opportunities

Enforce discount approvals

Auto-provision wallets on closed-won deals

Handle renewals and amendments without manual intervention

To go hybrid

Bundle monthly credits with plans

Allow overages via usage or top-ups

Keep invoices predictable while preserving flexibility

The takeaway is simple.

Spend your time deciding why credit-based pricing helps your customer enhance their experience value

Product & growth packaging

In 2026, SaaS and AI companies don’t grow on static pricing. They grow by testing, learning, and iterating their product. The real question customers ask is whether this credit system helps me experiment with pricing and packaging, or drags me down?

Here is the solution to this doubt:

Prepaid vs promotional credits

What buyers need to understand about credit pricing is that not all credit serves the same purpose. A mature system always differentiates between prepaid credit and promotional credits, and this actually matters far more than founders initially realise

Basis | Prepaid Credits | Promotional Credits |

Source and purpose | Purchased by a customer with real money, and the purpose of this is revenue generation and budget control | Issued for free by the company, and it serves in growth, trials, and user activation |

Real-world example | Startup buys $500 worth of credits, like 50,000 credits upfront, for their AI API usage over Q1 | New signups get 1,000 free credits to test the product before buying |

Actual users | Enterprises with fixed budgets, teams needing predictable spend, and customers wanting volume discounts | Trial users, PLG signups, beta testers, event attendees, referral programs |

What founders look for | ARR/MRR contribution, revenue recognition schedule, prepayment conversion rate | Trial-to-paid conversion rate, cost per activated user, promotional ROI |

Expiration policy | 6-12 months, which is flexible for enterprise deals; creates urgency for renewals without being aggressive | 30-90 days; creates urgency to experience value quickly and convert |

Common mistake | Not setting clear expiration terms, leading to customers sitting on unused balances indefinitely | Giving too many promo credits that customers never convert, or too few that they can't experience real value |

What customers complain about | I paid for this and haven't used it yet. Can I get a refund?" or my credits will expire before I can use them. | I ran out of free credits too quickly, or free credits weren't enough to test properly. |

Red flag to watch out for | Large unused prepaid balances = customers aren't getting value = churn risk | High promo usage but zero conversion = you're funding tire-kickers, not real customers |

Low balance alerts: preventing chaos before it happens

Most of the time, auto top-up is not enabled, especially for the enterprise customer who requires manual approvals or strict spending controls. And this is where low balance alerts prevent critical situations.

Low balance alerts proactively notify users or administrators when credit levels fall below a predefined threshold. Instead of discovering the problem after services stop working, teams get a warning and can purchase a plan accordingly.

Key features and functionality

Threshold setting: Users can define a specific credit amount, which, when reached or dropped below, triggers an alert that informs teams that the threshold is reached.

Automated Monitoring: Modern AI and SaaS software, such as Flexprice or Vonage API, helps in tracking consumption in real-time and at frequent intervals to detect low balances.

Notification Methods: Alerts are typically delivered via email, but some platforms also support SMS, which is preferred, especially for critical thresholds.

Frequency Limits: To avoid spamming and disturbing flow, alerts are often limited to once per day or per breach. With this, teams get notified on time and don't get bothered again and again

Automated Actions: Advanced systems can trigger automatic, pre-configured top-ups when a low balance is detected. This keeps the flow of work unstoppable, which gives the customer a smooth experience.

Source: flexprice docs

Enterprise pricing control and flexibility

Enterprise organisations need a flexible, hybrid, and prepaid usage model that bridges the gap between predictable, fixed-cost subscriptions and variable pay-as-you-go models.

It provides a control that large organisations need over budgets while enabling flexibility in how they consume services.

Enhanced control for enterprises

Budget predictability: Customers purchase a set amount of credits in advance, making it easier to forecast spending compared to unpredictable monthly usage fees. The result is fewer surprises and much stronger financial control.

Reduced overages: Many systems include built-in dashboards, low-credit alerts like, 50%, 10% remaining, and configurable pausing usage when limits are hit. This dramatically reduces billing disputes, emergency approvals, and last-minute budget escalations.

Centralised purchasing: Enterprises can buy large credit wallets that are pooled across different teams or users. It creates organisation-wide visibility and control without slowing down day-to-day operations.

Transparent ROI: Because credits are tied directly to actions like an AI generation or API call, enterprises can easily measure cost against value. This transparency transforms billing data into product insight, helping leaders connect spend directly to value delivered.

High flexibility for shifting needs

Volume-based discounts: Similar to enterprise software, buying credits in bulk allows for negotiating lower per-unit rates, providing cost efficiency for high-volume users. For customers, it means spending less as they grow, without needing to renegotiate pricing every time usage increases.

Unified metric: A single, abstract credit can cover various services, for example, storage, compute, and API calls, allowing customers to switch between products without renegotiating contracts. It helps in turning complex infrastructure costs into one clear unit of value.

Burstable usage: Credits allow for high-volume, short-duration bursts of activity, making it ideal for fluctuating demand. This flexibility is especially valuable for AI workloads and event-driven usage. Customers pay only for what they need and when they need.

Flexible expiration policies: While some credits expire at the end of a contract, many enterprise agreements offer flexible roll-over policies to ensure value is not lost. This protects customers from losing value when usage fluctuates across quarters, and also allows for creating a fairer, long-term partnership between vendor and customer.

Implementing flexibility

Hybrid models: Pairing a low-cost subscription with a credit pool provides a blend of stability and flexibility. Meanwhile, finance teams benefit from a fixed baseline expense, and product teams retain the freedom to experiment and scale usage as needed. It creates the right balance between recurring revenue predictability and consumption-driven growth.

True-Up mechanism: Annual true-up is a contract that allows enterprises to commit to a base volume while permitting extra consumption with regular, transparent adjustments. Using this approach gives predictable revenue commitments while protecting customers from overcommitting upfront. It ensures alignment between actual usage and contract value without constant renegotiation.

Dynamic rebalancing: Vendors can adjust how many credits specific features consume over time without requiring a full contract renegotiation. It ensures long-term adaptability while avoiding disruptive pricing resets for customers.

Sales integration with CRM and opportunity management

Integrating CRM and opportunity management with credit-based pricing requires a shift from tracking flat-rate subscriptions to managing consumption-based wallets. In this model, customers purchase credits upfront, which are then consumed in real-time as services like API calls, compute time, and AI tokens.

This means billing and usage data must flow back into the CRM in near real time. Without that loop, sales teams operate blindly, closing deals without understanding burn rate, expansion signals, and churn risk.

Real-time consumption visibility

A production-ready CRM integration should surface credit balance, historical usage, and consumption velocity directly on the customer profile. Sales reps shouldn’t need to jump between dashboards or ask finance how much a customer has left.

When sales reps can see these options clearly:

Remaining credits

Weekly or monthly burn rate

Which features are driving spend

They gain immediate context for renewals and expansions. Instead of generic check-ins, conversations become data-driven:

Example: You’ve consumed 70% of your credits in three weeks, let’s plan your next package before you hit limits. This transforms sales from reactive account management into proactive revenue orchestration.

Automated triggers for expansion and retention

Static CRM data isn’t enough. Modern credit systems should push real-time events into the CRM using automated workflows.

Examples include:

Alerting reps when a customer drops below 20% credit balance

Flagging sudden usage spikes that signal strong product adoption

Notifying account owners when consumption slows, indicating churn risk

These triggers turn usage signals into sales actions. Instead of discovering expansion opportunities during quarterly reviews, teams can engage customers at exactly the moment value is being realised.

This is especially critical in AI and usage-based products, where growth happens through consumption, not seat upgrades.

Advanced reporting and forecasting

Credit-based pricing smartly changes the foundation of revenue planning.

In credit-based and usage-based pricing models, revenue is driven by consumption behaviour, which is dynamic, non-linear, and often unpredictable.

Without an advanced reporting infrastructure, finance teams are forced to forecast using outdated assumptions, and sales teams operate without clear expansion signals.

That’s where advanced reporting becomes non-negotiable.

Real-time usage and credit consumption reports

In a mature system, credit usage reporting isn’t a monthly CSV export. It’s a live operational layer that guides teams through.

Sales, finance, and ops teams should be able to see:

Remaining credit balance per customer

Daily and weekly burn rate

Historical consumption trends

Feature-level usage breakdown

Prepaid vs promotional vs overage consumption

This visibility allows companies to move from reactive billing to proactive revenue management.

Example:

If a customer’s burn rate accelerates unexpectedly, it may indicate product-market fit expansion, but it also signals timing sensitivity. A rising burn rate often precedes budget exhaustion, which creates both opportunity and risk.

If usage suddenly slows, it could signal churn risk, shifting priorities, technical integration issues, or internal budget freezes. Consumption-based models amplify this signal because revenue declines immediately when usage drops.

If 70% of credits are spent on one API endpoint, the pricing model may be misaligned with the cost structure or perceived value. Advanced systems should allow feature-level reporting so product and finance teams can rebalance credit costs dynamically, protecting margins while preserving customer fairness

Revenue forecasting based on consumption patterns

Forecasting in credit-based pricing must evolve beyond bookings. Traditional SaaS metrics like ARR and contract value don’t fully capture revenue timing when customers draw down prepaid credits at variable rates.

A modern forecasting layer should do the following:

Ingest usage data continuously

Model consumption curves per customer

Segment customers by behaviour

Project credit depletion timelines

Estimate future top-ups and overages

This creates a predictive revenue engine. Finance teams can forecast cash flow based on burn velocity. Sales teams can identify accounts approaching expansion thresholds.

Mainly, companies ask about:

How fast are customers consuming value?

When will wallets require replenishment?

Which segments are driving expansion?

Credit-based pricing is a strategy: choose it wisely

By now, the pattern should be clear. Credit-based pricing isn’t just about converting dollars into credits. It’s about whether your systems can support wallets, ledgers, usage signals, enterprise workflows, forecasting, and automation all at once.

There’s no universally “perfect” pricing model. You have to decide what fits your product complexity, customer expectations, and growth stage

If your product has:

multiple features with different cost curves

variable AI compute

budget-conscious or procurement-led buyers

→ Then yes, credit-based pricing makes sense.

If you’re serving both self-serve users and enterprise customers, running experiments on packaging, or iterating pricing every quarter, the answer is almost always hybrid.

But here’s the real mistake most founders make:

They don’t fail because they chose the wrong model. They fail because they locked themselves into a billing infrastructure that makes change painful. They hard-code pricing into product logic. They manage credits in spreadsheets. And six months later, they’re rebuilding everything.

With platforms like Flexprice, launching credit-based pricing doesn’t mean months of custom engineering or irreversible architectural decisions.

Here’s what “launch fast” actually looks like in practice:

To launch credit-based pricing

Create a wallet per customer

Define prepaid and promotional credit packs

Map features to credit costs

Enable real-time deductions, top-ups, and balance alerts

To add forecasting and revenue visibility

Stream usage into real-time dashboards

Track burn rates and depletion timelines

Segment customers by consumption behaviour

Project top-ups, overages, and expansion

To support enterprise sales

Attach credits directly to CRM opportunities

Enforce discount approvals

Auto-provision wallets on closed-won deals

Handle renewals and amendments without manual intervention

To go hybrid

Bundle monthly credits with plans

Allow overages via usage or top-ups

Keep invoices predictable while preserving flexibility

The takeaway is simple.

Spend your time deciding why credit-based pricing helps your customer enhance their experience value

Product & growth packaging

In 2026, SaaS and AI companies don’t grow on static pricing. They grow by testing, learning, and iterating their product. The real question customers ask is whether this credit system helps me experiment with pricing and packaging, or drags me down?

Here is the solution to this doubt:

Prepaid vs promotional credits

What buyers need to understand about credit pricing is that not all credit serves the same purpose. A mature system always differentiates between prepaid credit and promotional credits, and this actually matters far more than founders initially realise

Basis | Prepaid Credits | Promotional Credits |

Source and purpose | Purchased by a customer with real money, and the purpose of this is revenue generation and budget control | Issued for free by the company, and it serves in growth, trials, and user activation |

Real-world example | Startup buys $500 worth of credits, like 50,000 credits upfront, for their AI API usage over Q1 | New signups get 1,000 free credits to test the product before buying |

Actual users | Enterprises with fixed budgets, teams needing predictable spend, and customers wanting volume discounts | Trial users, PLG signups, beta testers, event attendees, referral programs |

What founders look for | ARR/MRR contribution, revenue recognition schedule, prepayment conversion rate | Trial-to-paid conversion rate, cost per activated user, promotional ROI |

Expiration policy | 6-12 months, which is flexible for enterprise deals; creates urgency for renewals without being aggressive | 30-90 days; creates urgency to experience value quickly and convert |

Common mistake | Not setting clear expiration terms, leading to customers sitting on unused balances indefinitely | Giving too many promo credits that customers never convert, or too few that they can't experience real value |

What customers complain about | I paid for this and haven't used it yet. Can I get a refund?" or my credits will expire before I can use them. | I ran out of free credits too quickly, or free credits weren't enough to test properly. |

Red flag to watch out for | Large unused prepaid balances = customers aren't getting value = churn risk | High promo usage but zero conversion = you're funding tire-kickers, not real customers |

Low balance alerts: preventing chaos before it happens

Most of the time, auto top-up is not enabled, especially for the enterprise customer who requires manual approvals or strict spending controls. And this is where low balance alerts prevent critical situations.

Low balance alerts proactively notify users or administrators when credit levels fall below a predefined threshold. Instead of discovering the problem after services stop working, teams get a warning and can purchase a plan accordingly.

Key features and functionality

Threshold setting: Users can define a specific credit amount, which, when reached or dropped below, triggers an alert that informs teams that the threshold is reached.

Automated Monitoring: Modern AI and SaaS software, such as Flexprice or Vonage API, helps in tracking consumption in real-time and at frequent intervals to detect low balances.

Notification Methods: Alerts are typically delivered via email, but some platforms also support SMS, which is preferred, especially for critical thresholds.

Frequency Limits: To avoid spamming and disturbing flow, alerts are often limited to once per day or per breach. With this, teams get notified on time and don't get bothered again and again

Automated Actions: Advanced systems can trigger automatic, pre-configured top-ups when a low balance is detected. This keeps the flow of work unstoppable, which gives the customer a smooth experience.

Source: flexprice docs

Enterprise pricing control and flexibility

Enterprise organisations need a flexible, hybrid, and prepaid usage model that bridges the gap between predictable, fixed-cost subscriptions and variable pay-as-you-go models.

It provides a control that large organisations need over budgets while enabling flexibility in how they consume services.

Enhanced control for enterprises

Budget predictability: Customers purchase a set amount of credits in advance, making it easier to forecast spending compared to unpredictable monthly usage fees. The result is fewer surprises and much stronger financial control.

Reduced overages: Many systems include built-in dashboards, low-credit alerts like, 50%, 10% remaining, and configurable pausing usage when limits are hit. This dramatically reduces billing disputes, emergency approvals, and last-minute budget escalations.

Centralised purchasing: Enterprises can buy large credit wallets that are pooled across different teams or users. It creates organisation-wide visibility and control without slowing down day-to-day operations.

Transparent ROI: Because credits are tied directly to actions like an AI generation or API call, enterprises can easily measure cost against value. This transparency transforms billing data into product insight, helping leaders connect spend directly to value delivered.

High flexibility for shifting needs

Volume-based discounts: Similar to enterprise software, buying credits in bulk allows for negotiating lower per-unit rates, providing cost efficiency for high-volume users. For customers, it means spending less as they grow, without needing to renegotiate pricing every time usage increases.

Unified metric: A single, abstract credit can cover various services, for example, storage, compute, and API calls, allowing customers to switch between products without renegotiating contracts. It helps in turning complex infrastructure costs into one clear unit of value.

Burstable usage: Credits allow for high-volume, short-duration bursts of activity, making it ideal for fluctuating demand. This flexibility is especially valuable for AI workloads and event-driven usage. Customers pay only for what they need and when they need.

Flexible expiration policies: While some credits expire at the end of a contract, many enterprise agreements offer flexible roll-over policies to ensure value is not lost. This protects customers from losing value when usage fluctuates across quarters, and also allows for creating a fairer, long-term partnership between vendor and customer.

Implementing flexibility

Hybrid models: Pairing a low-cost subscription with a credit pool provides a blend of stability and flexibility. Meanwhile, finance teams benefit from a fixed baseline expense, and product teams retain the freedom to experiment and scale usage as needed. It creates the right balance between recurring revenue predictability and consumption-driven growth.

True-Up mechanism: Annual true-up is a contract that allows enterprises to commit to a base volume while permitting extra consumption with regular, transparent adjustments. Using this approach gives predictable revenue commitments while protecting customers from overcommitting upfront. It ensures alignment between actual usage and contract value without constant renegotiation.

Dynamic rebalancing: Vendors can adjust how many credits specific features consume over time without requiring a full contract renegotiation. It ensures long-term adaptability while avoiding disruptive pricing resets for customers.

Sales integration with CRM and opportunity management

Integrating CRM and opportunity management with credit-based pricing requires a shift from tracking flat-rate subscriptions to managing consumption-based wallets. In this model, customers purchase credits upfront, which are then consumed in real-time as services like API calls, compute time, and AI tokens.

This means billing and usage data must flow back into the CRM in near real time. Without that loop, sales teams operate blindly, closing deals without understanding burn rate, expansion signals, and churn risk.

Real-time consumption visibility

A production-ready CRM integration should surface credit balance, historical usage, and consumption velocity directly on the customer profile. Sales reps shouldn’t need to jump between dashboards or ask finance how much a customer has left.

When sales reps can see these options clearly:

Remaining credits

Weekly or monthly burn rate

Which features are driving spend

They gain immediate context for renewals and expansions. Instead of generic check-ins, conversations become data-driven:

Example: You’ve consumed 70% of your credits in three weeks, let’s plan your next package before you hit limits. This transforms sales from reactive account management into proactive revenue orchestration.

Automated triggers for expansion and retention

Static CRM data isn’t enough. Modern credit systems should push real-time events into the CRM using automated workflows.

Examples include:

Alerting reps when a customer drops below 20% credit balance

Flagging sudden usage spikes that signal strong product adoption

Notifying account owners when consumption slows, indicating churn risk

These triggers turn usage signals into sales actions. Instead of discovering expansion opportunities during quarterly reviews, teams can engage customers at exactly the moment value is being realised.

This is especially critical in AI and usage-based products, where growth happens through consumption, not seat upgrades.

Advanced reporting and forecasting

Credit-based pricing smartly changes the foundation of revenue planning.

In credit-based and usage-based pricing models, revenue is driven by consumption behaviour, which is dynamic, non-linear, and often unpredictable.

Without an advanced reporting infrastructure, finance teams are forced to forecast using outdated assumptions, and sales teams operate without clear expansion signals.

That’s where advanced reporting becomes non-negotiable.

Real-time usage and credit consumption reports

In a mature system, credit usage reporting isn’t a monthly CSV export. It’s a live operational layer that guides teams through.

Sales, finance, and ops teams should be able to see:

Remaining credit balance per customer

Daily and weekly burn rate

Historical consumption trends

Feature-level usage breakdown

Prepaid vs promotional vs overage consumption

This visibility allows companies to move from reactive billing to proactive revenue management.

Example:

If a customer’s burn rate accelerates unexpectedly, it may indicate product-market fit expansion, but it also signals timing sensitivity. A rising burn rate often precedes budget exhaustion, which creates both opportunity and risk.

If usage suddenly slows, it could signal churn risk, shifting priorities, technical integration issues, or internal budget freezes. Consumption-based models amplify this signal because revenue declines immediately when usage drops.

If 70% of credits are spent on one API endpoint, the pricing model may be misaligned with the cost structure or perceived value. Advanced systems should allow feature-level reporting so product and finance teams can rebalance credit costs dynamically, protecting margins while preserving customer fairness

Revenue forecasting based on consumption patterns

Forecasting in credit-based pricing must evolve beyond bookings. Traditional SaaS metrics like ARR and contract value don’t fully capture revenue timing when customers draw down prepaid credits at variable rates.

A modern forecasting layer should do the following:

Ingest usage data continuously

Model consumption curves per customer

Segment customers by behaviour

Project credit depletion timelines

Estimate future top-ups and overages

This creates a predictive revenue engine. Finance teams can forecast cash flow based on burn velocity. Sales teams can identify accounts approaching expansion thresholds.

Mainly, companies ask about:

How fast are customers consuming value?

When will wallets require replenishment?

Which segments are driving expansion?

Credit-based pricing is a strategy: choose it wisely

By now, the pattern should be clear. Credit-based pricing isn’t just about converting dollars into credits. It’s about whether your systems can support wallets, ledgers, usage signals, enterprise workflows, forecasting, and automation all at once.

There’s no universally “perfect” pricing model. You have to decide what fits your product complexity, customer expectations, and growth stage

If your product has:

multiple features with different cost curves

variable AI compute

budget-conscious or procurement-led buyers

→ Then yes, credit-based pricing makes sense.

If you’re serving both self-serve users and enterprise customers, running experiments on packaging, or iterating pricing every quarter, the answer is almost always hybrid.

But here’s the real mistake most founders make:

They don’t fail because they chose the wrong model. They fail because they locked themselves into a billing infrastructure that makes change painful. They hard-code pricing into product logic. They manage credits in spreadsheets. And six months later, they’re rebuilding everything.

With platforms like Flexprice, launching credit-based pricing doesn’t mean months of custom engineering or irreversible architectural decisions.

Here’s what “launch fast” actually looks like in practice:

To launch credit-based pricing

Create a wallet per customer

Define prepaid and promotional credit packs

Map features to credit costs

Enable real-time deductions, top-ups, and balance alerts

To add forecasting and revenue visibility

Stream usage into real-time dashboards

Track burn rates and depletion timelines

Segment customers by consumption behaviour

Project top-ups, overages, and expansion

To support enterprise sales

Attach credits directly to CRM opportunities

Enforce discount approvals

Auto-provision wallets on closed-won deals

Handle renewals and amendments without manual intervention

To go hybrid

Bundle monthly credits with plans

Allow overages via usage or top-ups

Keep invoices predictable while preserving flexibility

The takeaway is simple.

Spend your time deciding why credit-based pricing helps your customer enhance their experience value

Frequently Asked Questions

Frequently Asked Questions

Frequently Asked Questions

What is credit based pricing?

What is credit based pricing?

What is credit based pricing?

What is credit based pricing?

What is credit based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

What are the advantages and disadvantages of credit based pricing?

When does credit-based pricing make sense for an AI or SaaS product?

When does credit-based pricing make sense for an AI or SaaS product?

When does credit-based pricing make sense for an AI or SaaS product?

When does credit-based pricing make sense for an AI or SaaS product?

When does credit-based pricing make sense for an AI or SaaS product?

What core infrastructure do I need to support credit-based pricing?

What core infrastructure do I need to support credit-based pricing?

What core infrastructure do I need to support credit-based pricing?

What core infrastructure do I need to support credit-based pricing?

What core infrastructure do I need to support credit-based pricing?

Can I combine subscriptions with credits based pricing models?

Can I combine subscriptions with credits based pricing models?

Can I combine subscriptions with credits based pricing models?

Can I combine subscriptions with credits based pricing models?

Can I combine subscriptions with credits based pricing models?

Ayush Parchure

Ayush Parchure

Ayush Parchure

Ayush is part of the content team at Flexprice, with a strong interest in AI, SaaS, and pricing. He loves breaking down complex systems and spends his free time gaming and experimenting with new cooking lessons.

Ayush is part of the content team at Flexprice, with a strong interest in AI, SaaS, and pricing. He loves breaking down complex systems and spends his free time gaming and experimenting with new cooking lessons.

Share it on: