Aanchal Parmar

Aanchal ParmarCommit 2 : Improving Enterpise Billing Controls

Commit 2 : Improving Enterpise Billing Controls

Commit 2 : Improving Enterpise Billing Controls

Commit 2 : Improving Enterpise Billing Controls

Aug 18, 2025

Aug 18, 2025

Aug 18, 2025

• 12 min read

• 12 min read

Aanchal Parmar

Product Marketing Manager, Flexprice

Self-serve pricing works well in the beginning. But the moment you land an enterprise deal, things start to break. Customers ask for changes, 20% off for 3 months, custom billing cycles, usage caps, or access to just one premium feature.

These requests don’t fit into your existing plans. So you end up duplicating plans, editing invoices manually, or tracking changes in spreadsheets.

Today’s launch removes all these issues. We’re adding enterprise billing workflows to Flexprice that let you support real-world deals, without breaking your system.

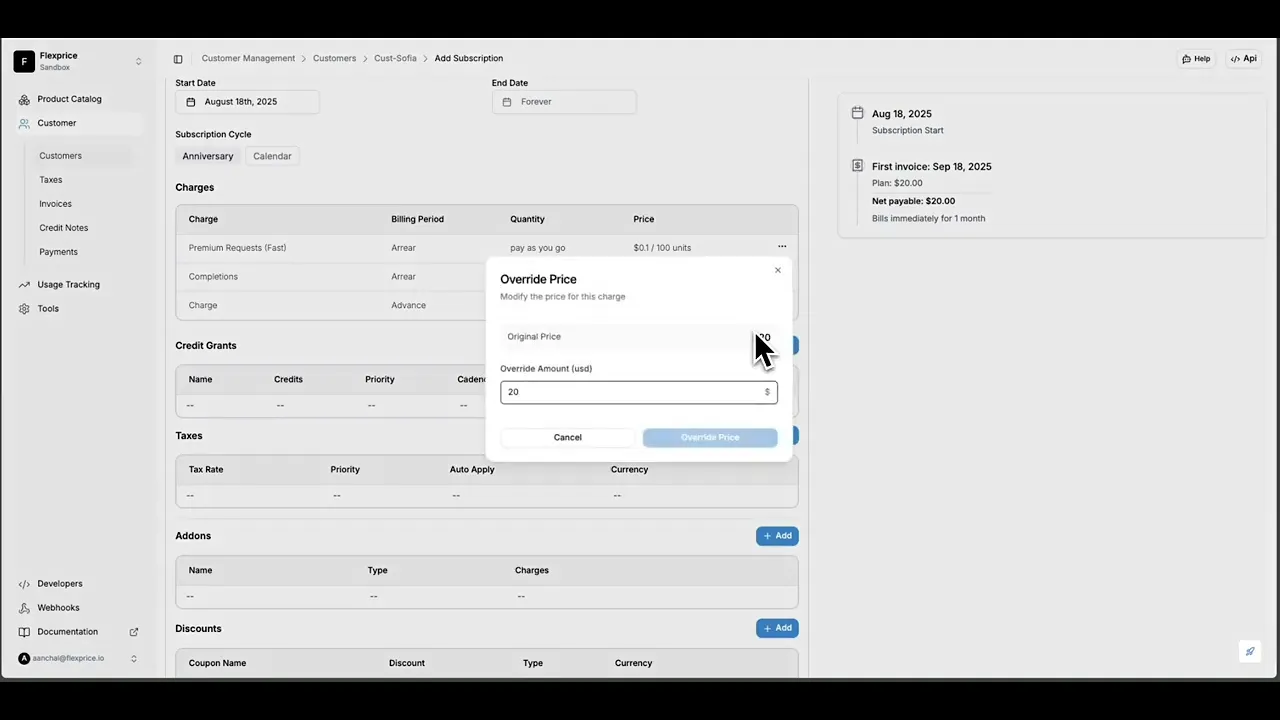

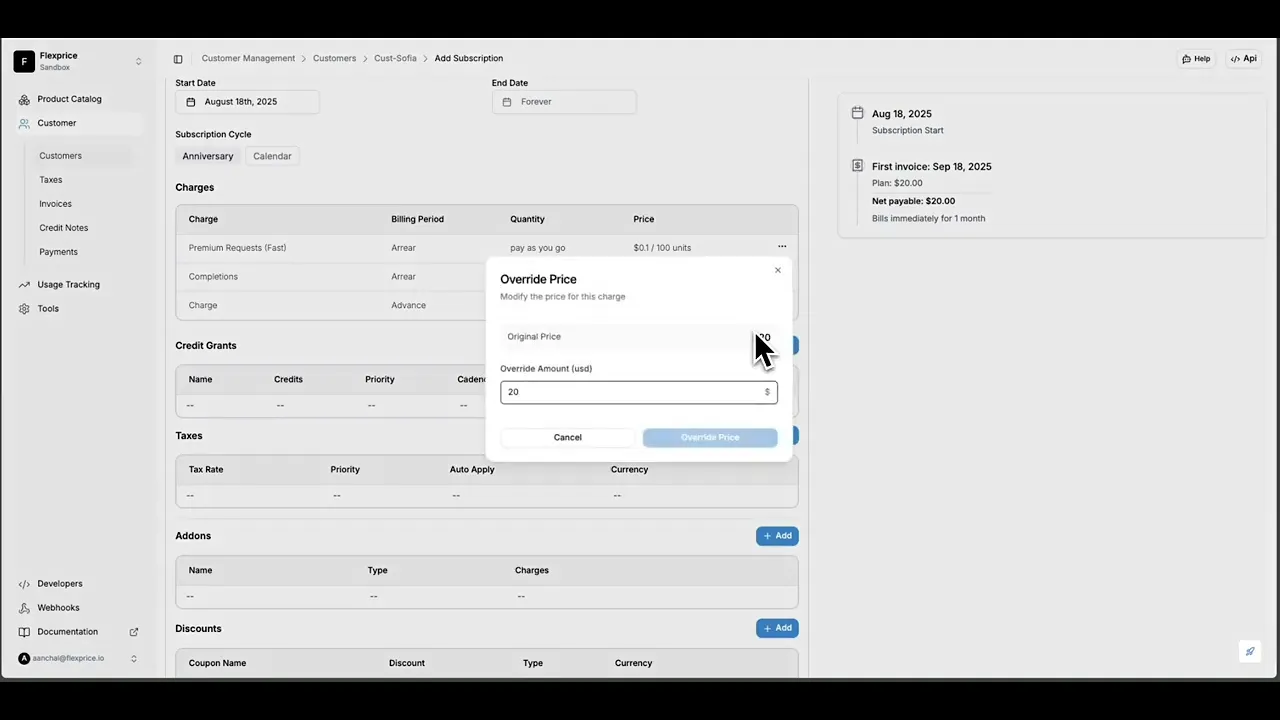

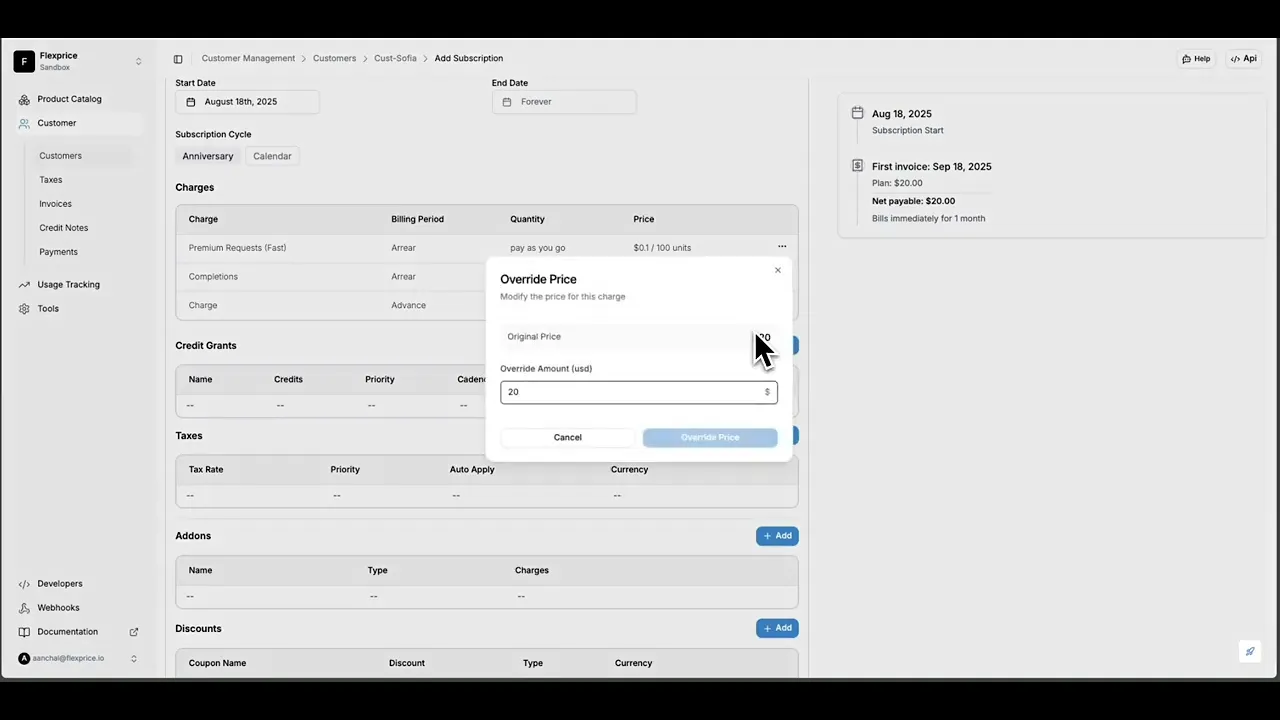

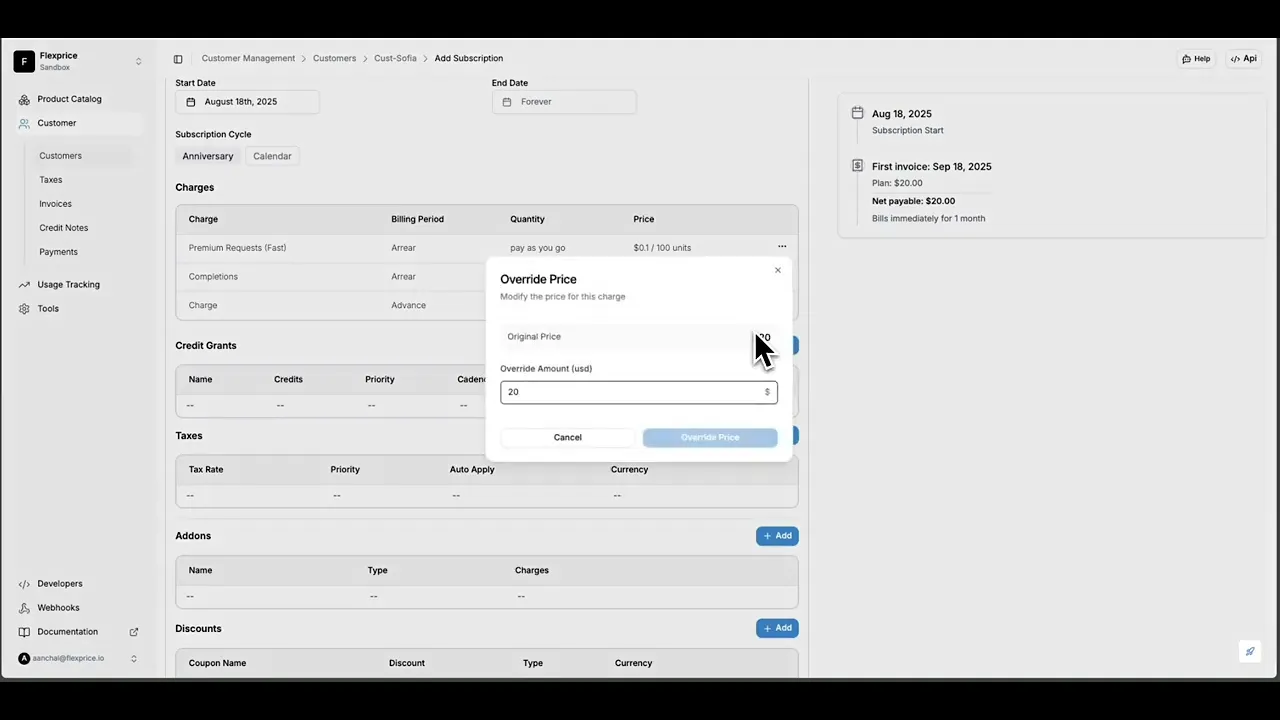

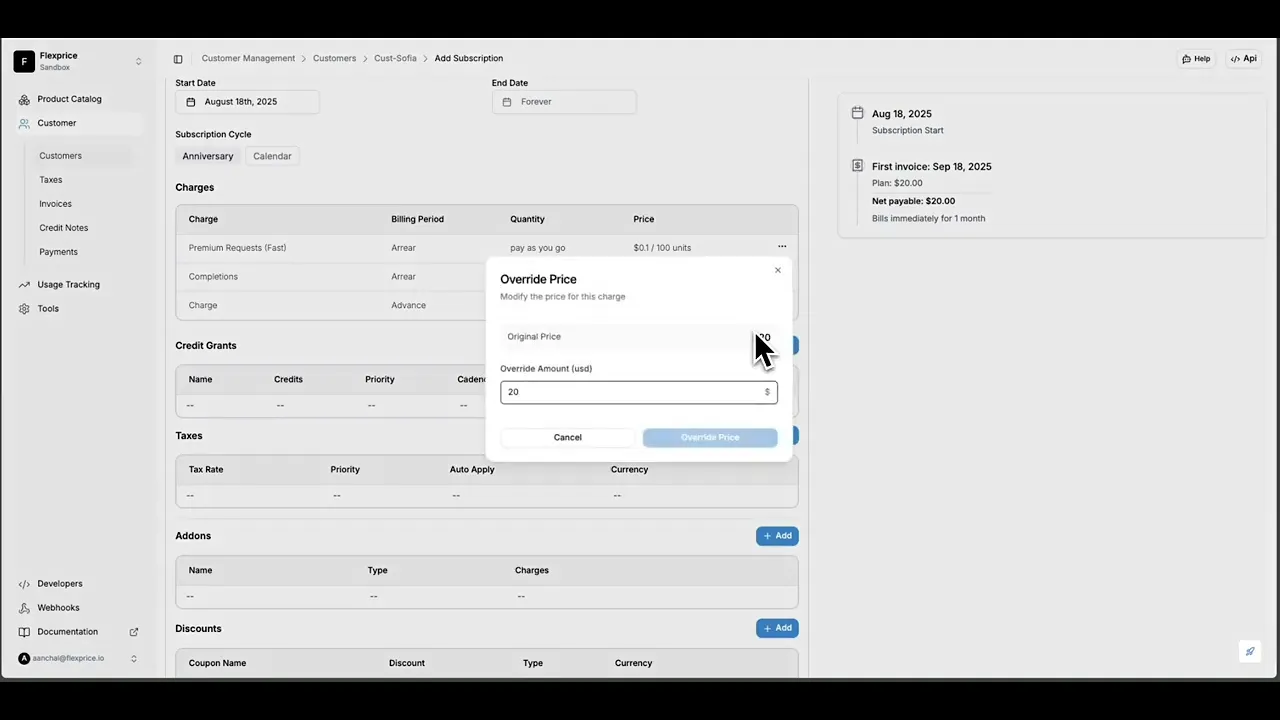

Price Override

Enterprise customers don’t just sign up and pay like regular users. They have specific needs, larger volumes, and longer contracts, so they usually negotiate the pricing.

Those negotiations rarely fit into the fixed numbers on your pricing page, which is why price flexibility becomes essential.

Take an example:

Startup A runs 10,000 minutes per month for basic support and you’re charging them $1 per minute

Now an enterprise customer comes and tells you that they’re running 2 million minutes per month, and they don’t agree to the usual pricing of $1 per minute. So they negotiate the pricing to $0.8 per minute because of the volume of events.

With conventional billing systems you’d have to either:

Duplicate plans and set new price

Handle the change offline with manual invoices and the risk you accept here is breaking the ledger

Instead of creating duplicate plans on Flexprice, you override pricing at the subscription level. While assigning the plan, just set the price you’ve agreed on.

Apply Discounts natively

Let’s say your sales team closes an enterprise deal with this clause:

“20% off for the first 2 months, then standard pricing.”

To apply a discount using coupons, start by creating the coupon in your product catalog:

→ Go to Product Catalog

→ Click on Coupons

→ Click Create Coupon

→ Fill in the coupon name, type (fixed or percentage), discount amount, cadence (once or recurring), and optionally set a start/end date and max redemptions

→ Click Create

Once the coupon is created, just go to the customer, click “Assign Plan,” and select the coupon from the list of coupons you’ve created.

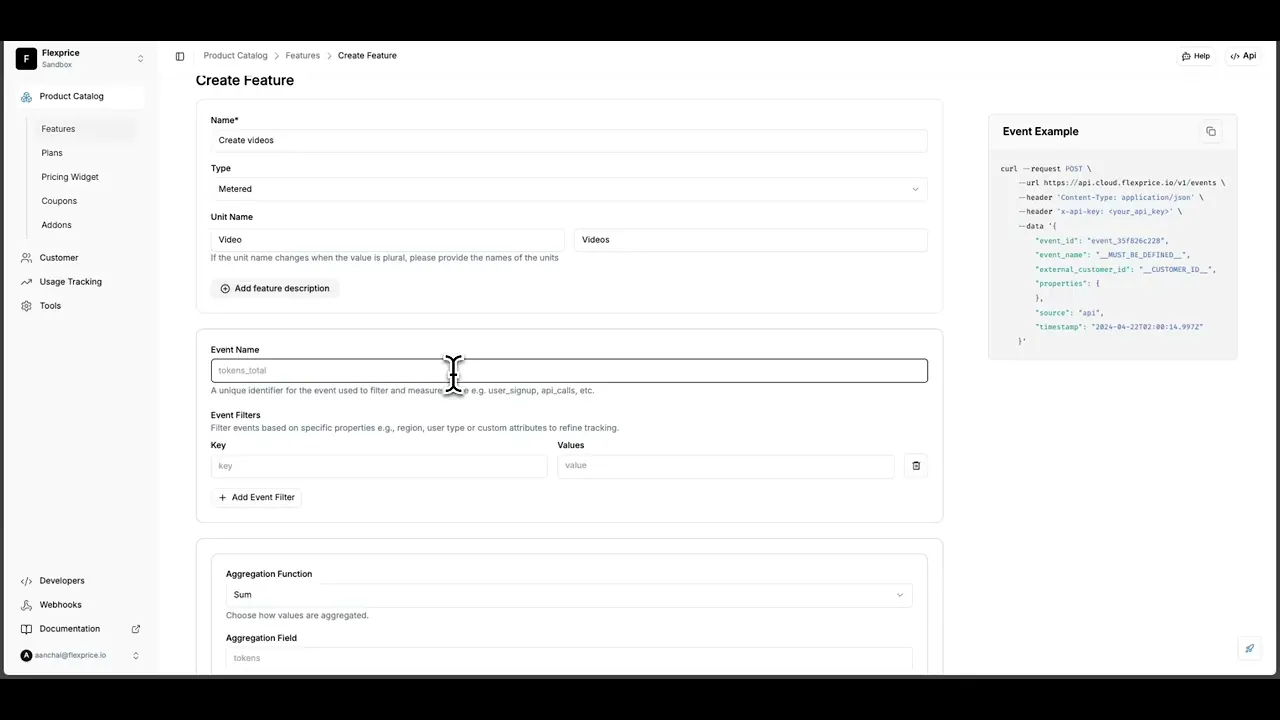

Max Aggregation

Max Aggregation captures the highest observed value in a given window (hourly, daily, or monthly). Instead of summing all usage, it chooses the peak usage window and bills for that.

This is common with AI agents and long-running sessions where memory grows and shrinks.

Billing on the peak reflects what it actually costs you to serve that customer, and avoids undercharging.

With Flexprice, you can now bill based on peak usage, using Max Aggregation. The MAX aggregation type identifies the maximum value among the metered data points within a specific time window.

There are two ways to do it:

Single Peak

Find the highest usage in the billing period and bill for that. If the customer hits 120GB once, they’re billed for 120GB.

Repeated Peak

Find the peak in each bucket (like each hour or day) and add them up.

If they hit 10GB, 15GB & 8GB in 3 hours respectively, they’re billed for 33GB.

This is useful for metrics like maximum parallel users, peak storage, or GPU load,w here the highest value in a window is the one that matters.

Get started with your billing today.

Get started with your billing today.

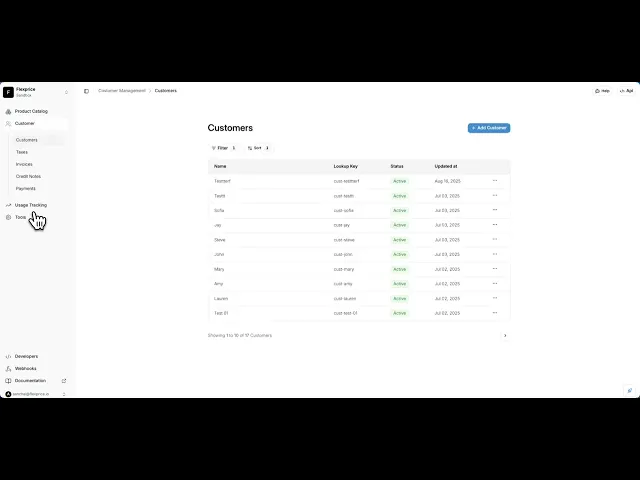

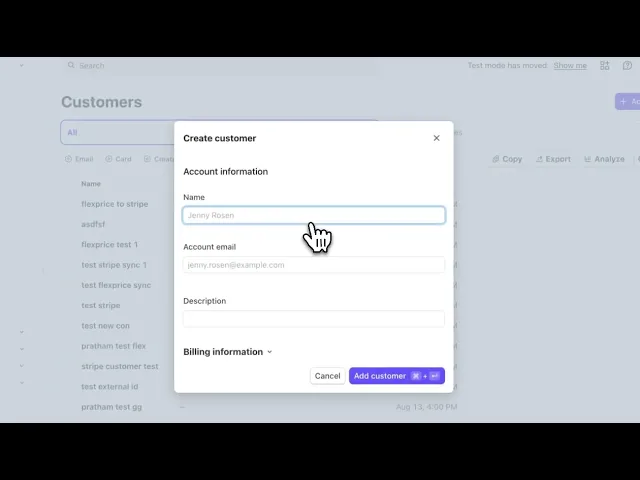

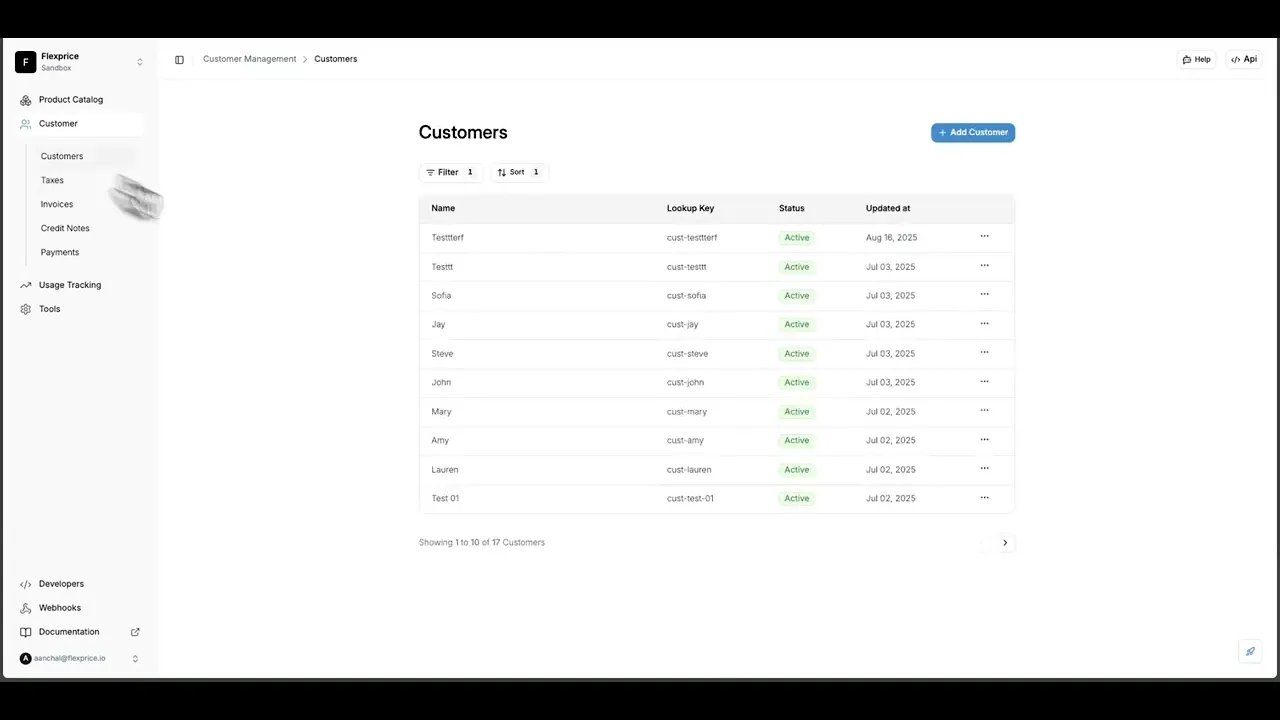

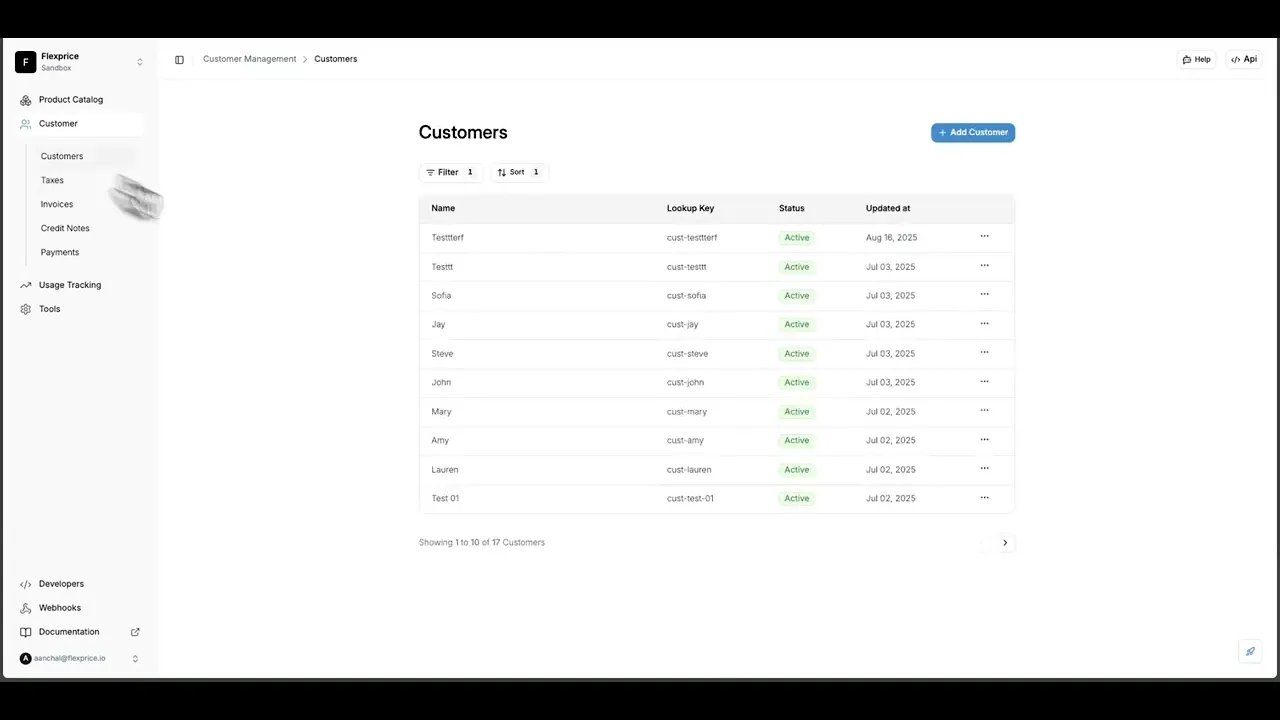

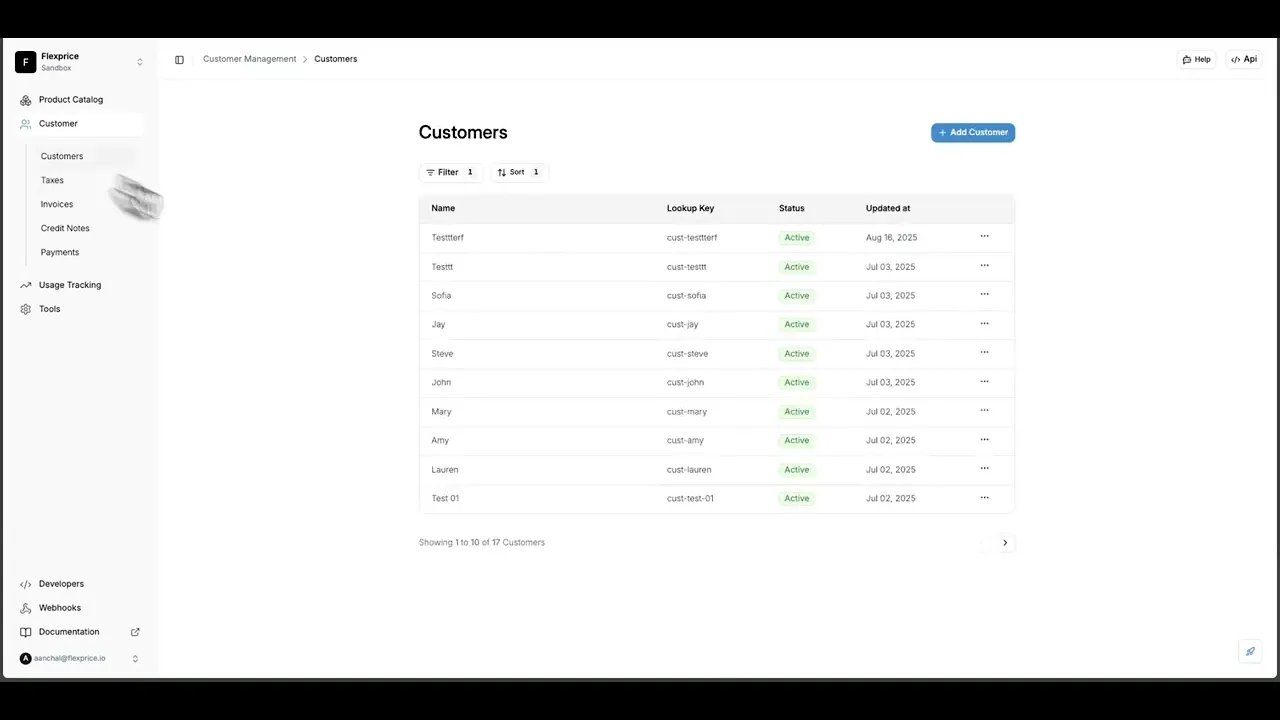

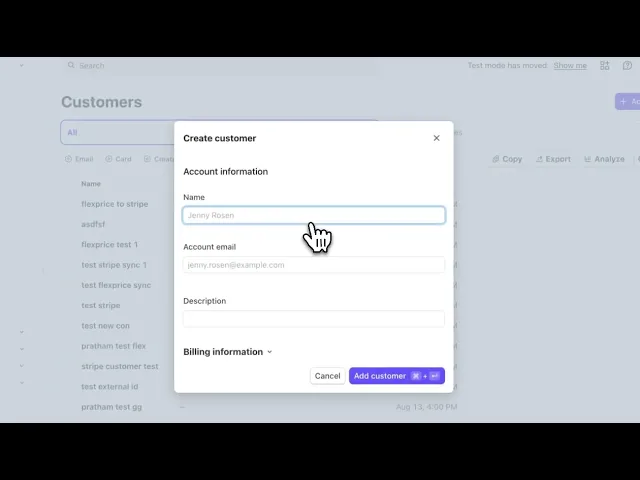

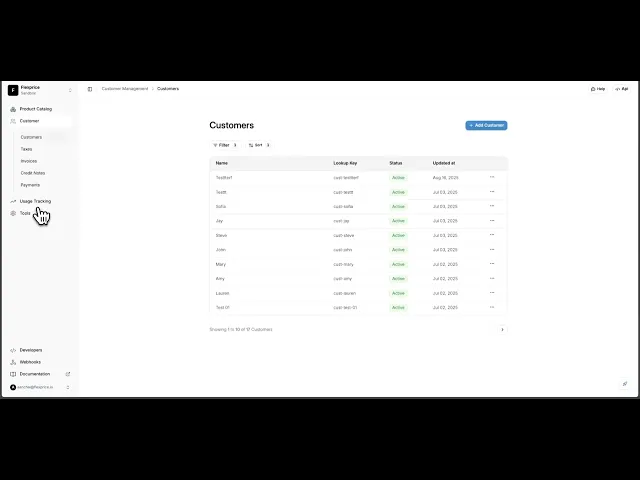

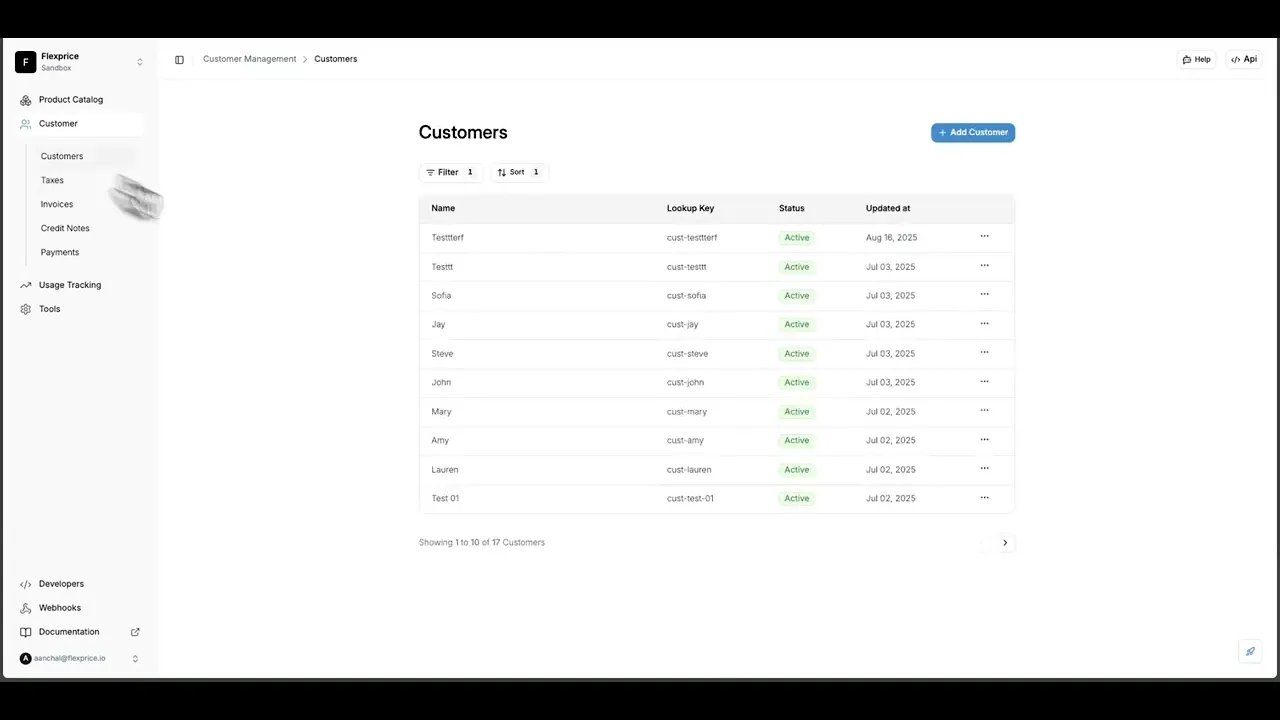

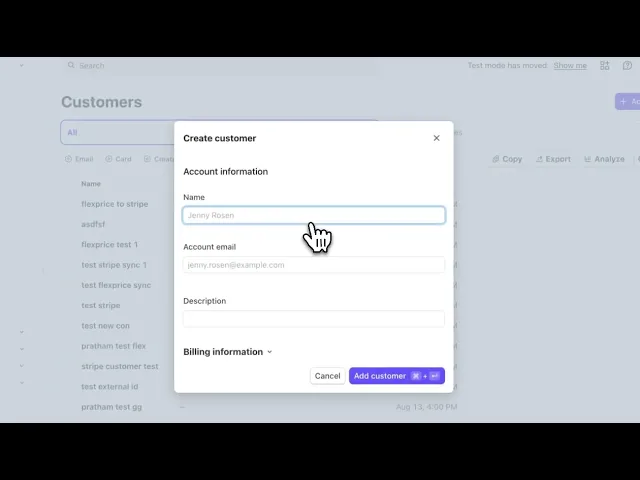

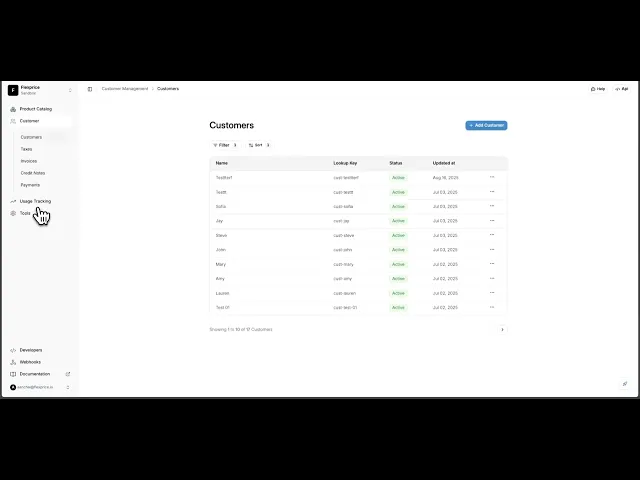

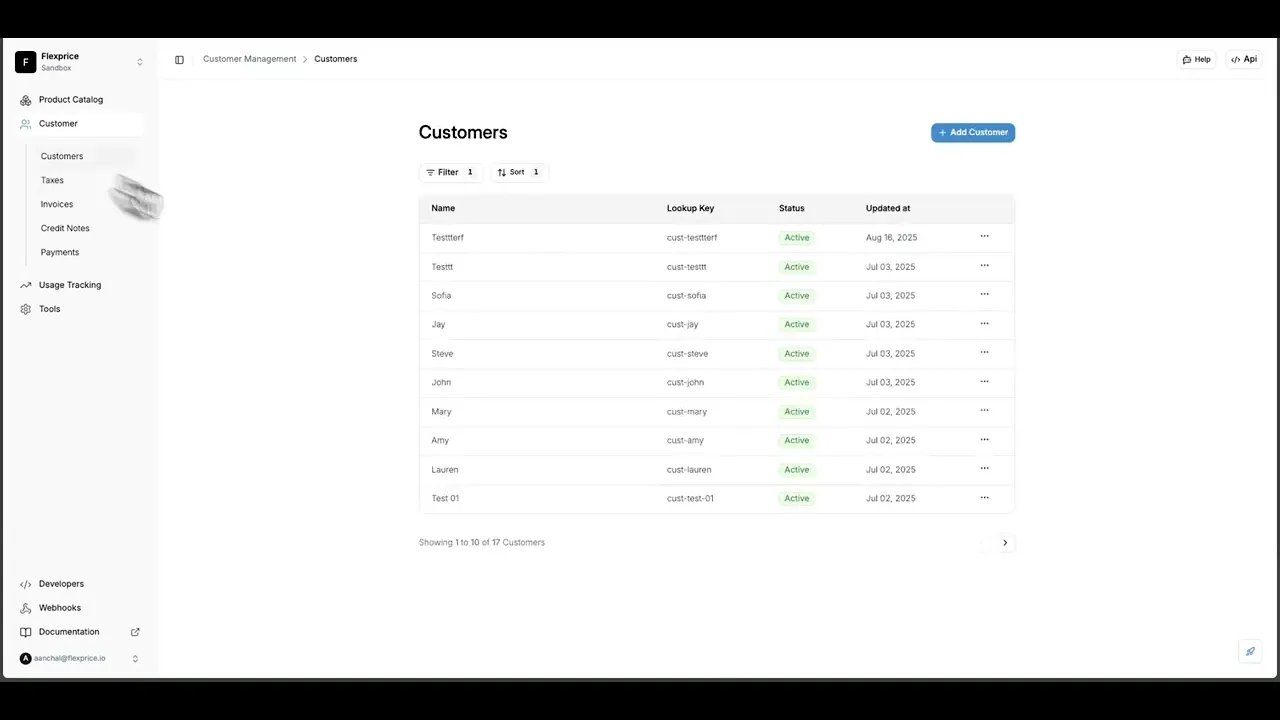

Stripe <> Flexprice Integration

Most teams use Stripe to collect payments but billing logic often lives outside Stripe. Without a reliable sync, you end up creating duplicate customer records & manually updating their plans and invoices.

With the new Stripe integration, Flexprice syncs customers both ways:

→ Create a customer in Stripe → it appears in Flexprice

→ Create a customer in Flexprice → it syncs to Stripe

You can also:

Generate payment links directly from Flexprice

Record partial payments (e.g., customer paid $50 on a $250 invoice)

Track payment status without switching tools

This means less manual work, fewer errors, and one connected flow between sales and billing.

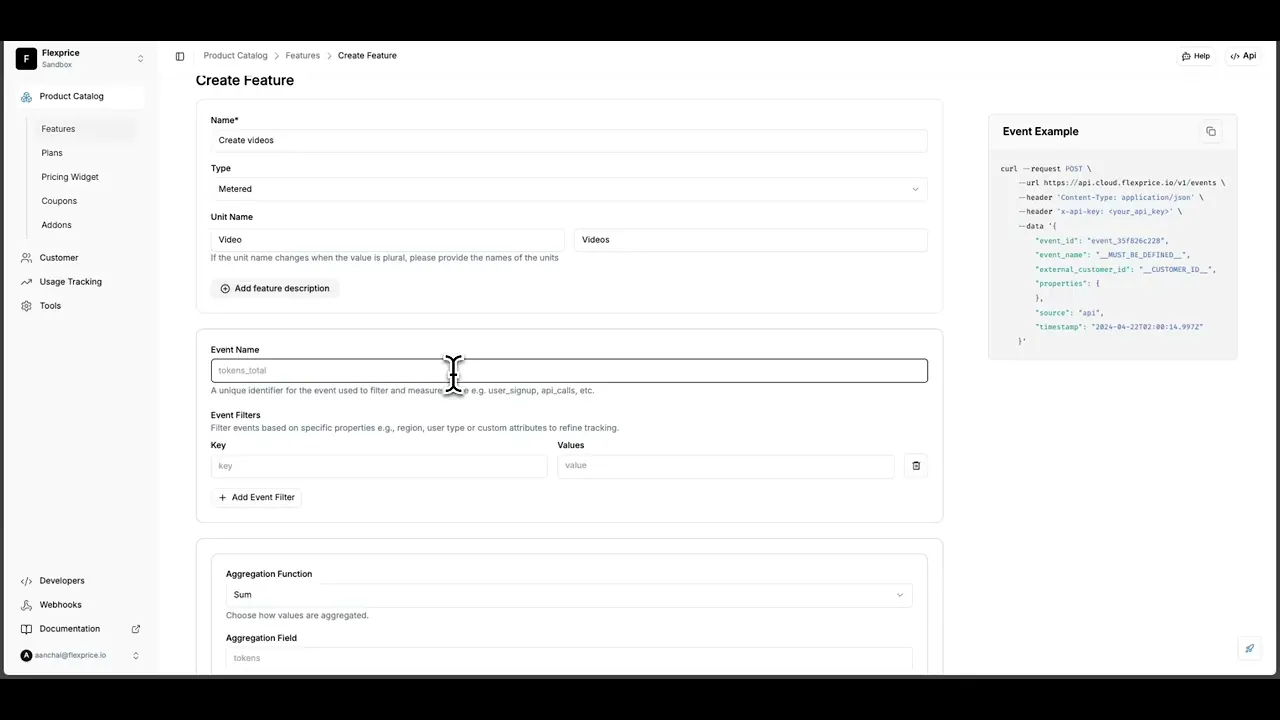

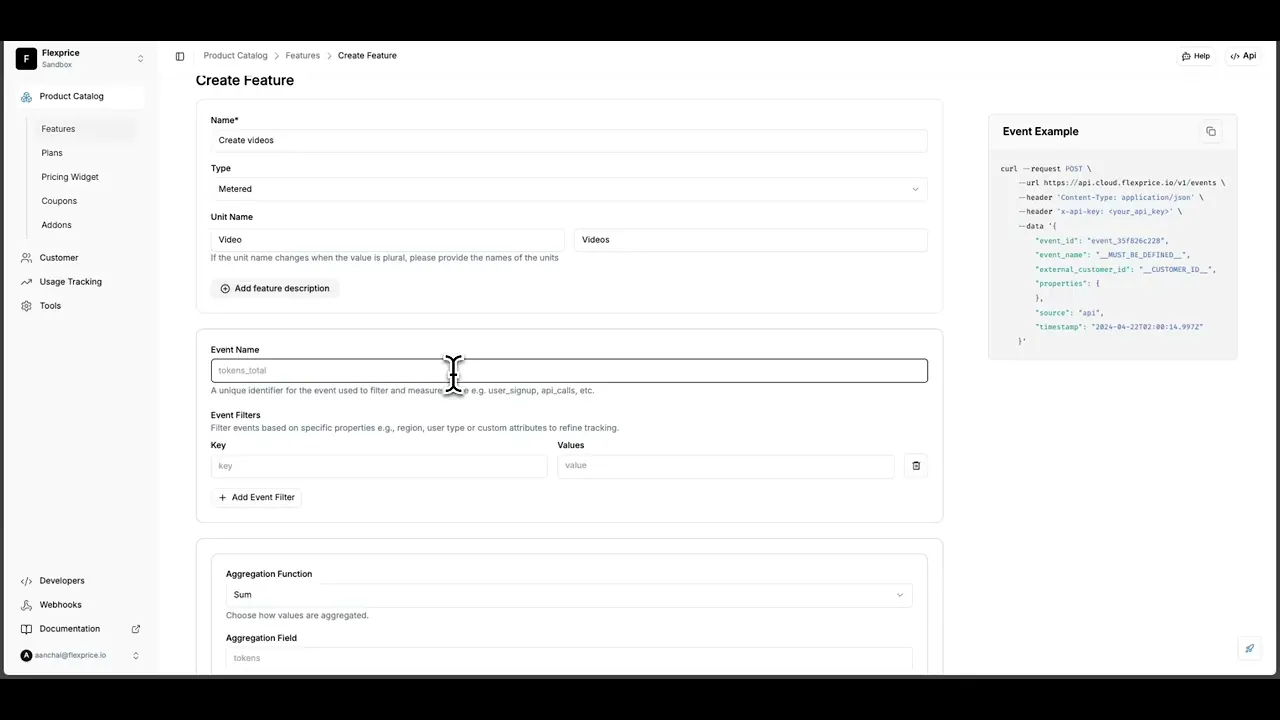

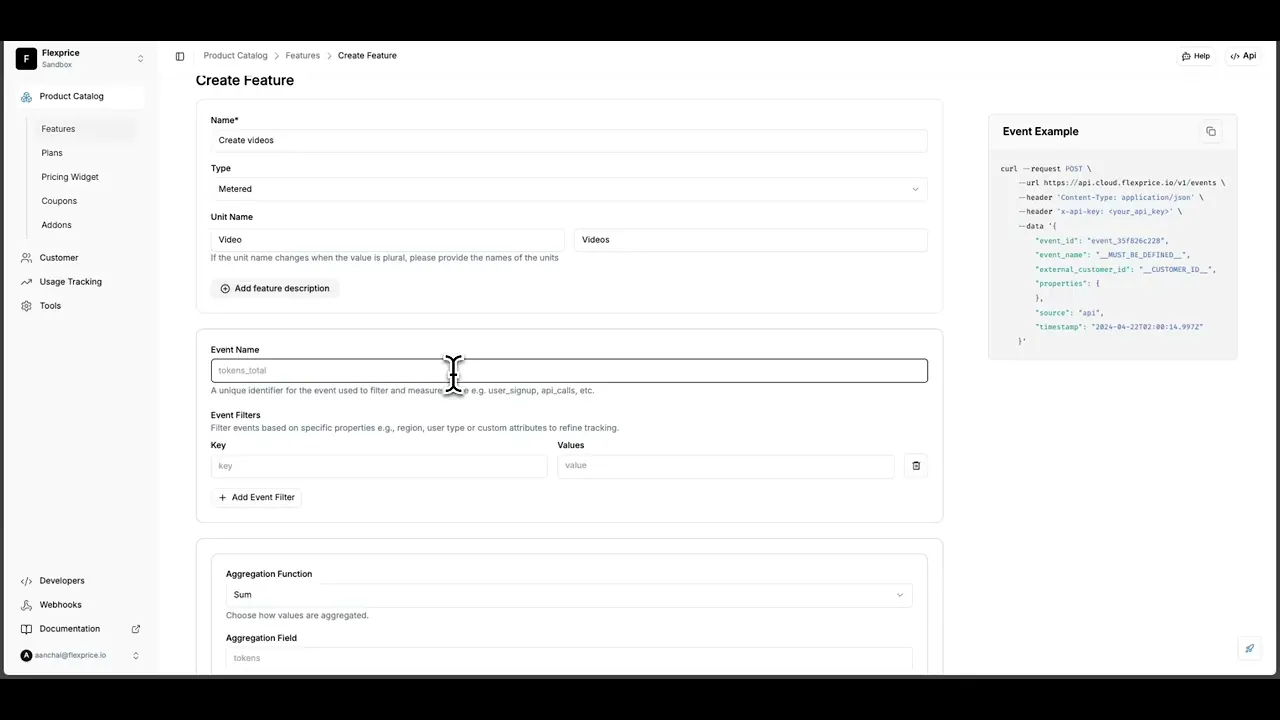

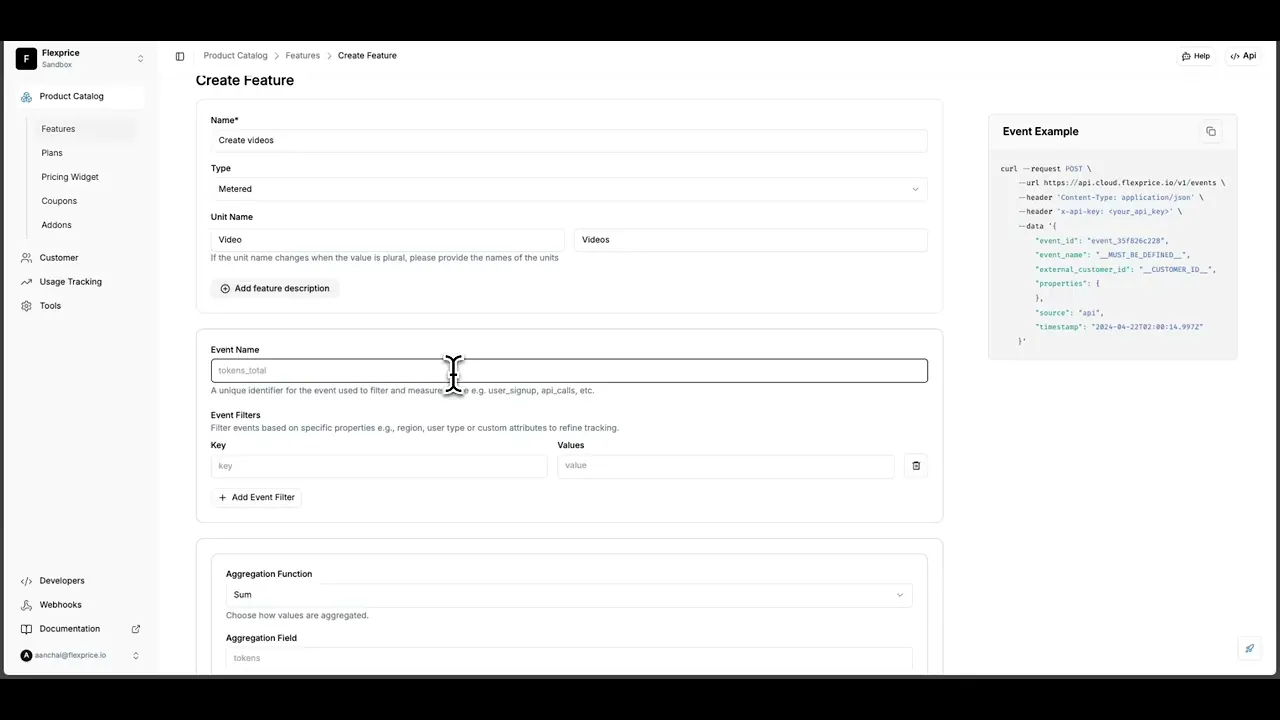

Create Feature and Usage Add-ons

Let’s say your base plan includes 100 API calls. The next plan includes 1,000, but also adds advanced analytics, audit logs, and other features your customer doesn’t need.

All they want is 30 more API calls. Upgrading them doesn’t make sense, and creating a new “130 API calls” plan just for this use case clutters your catalog.

Flexprice now supports add-ons, so you can sell exactly what’s needed, without changing the core plan.

Here’s how it works:

→ Keep the customer on the 100-call base plan

→ Create an add-on plan that supports the additional requirement for additional 30 calls

→ Assign both to the customer, Flexprice bills them together

For example, Ahrefs supports add-ons so customers can implement exactly what’s needed without changing the core plan.

On Ahrefs, you can stay on your current plan and:

→ Add Brand Radar AI for $199/mo

→ Add Report Builder for $99/mo

→ Add Project Boost Pro for $20/mo per project

→ Add Content Kit starting at $99/mo

These add-ons work independently of the base plan. You don’t need to upgrade or change tiers, just add on what you need.

This is useful when:

A customer’s usage slightly exceeds their base plan limits

They need one specific capability (like more storage or bandwidth) without upgrading the whole tier

You want to offer flexible upsells without duplicating plans

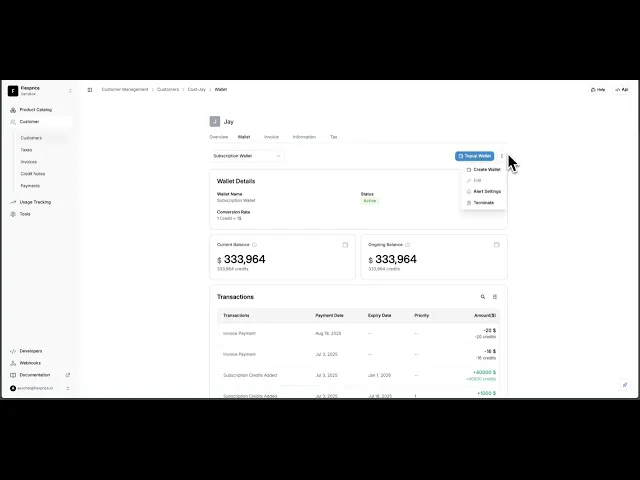

Low balance alerts

When customers use prepaid wallets, running out of balance can break their workflows. Such as:

API requests may be declined

Service can be interrupted and you won’t be able to use the platform anymore

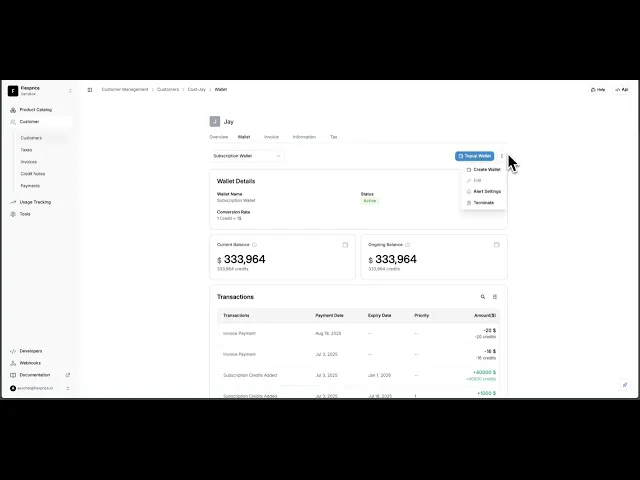

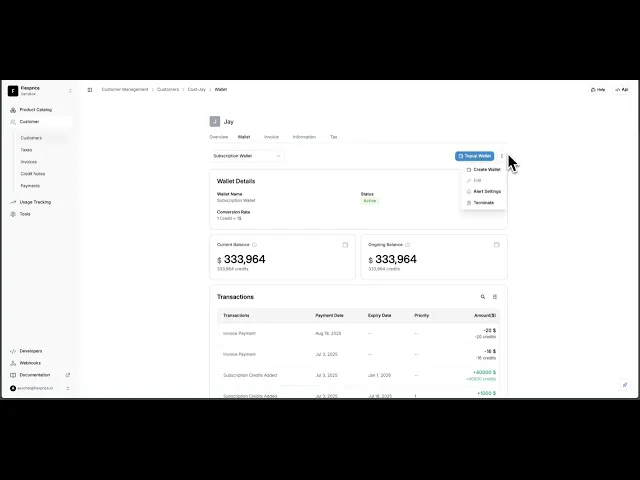

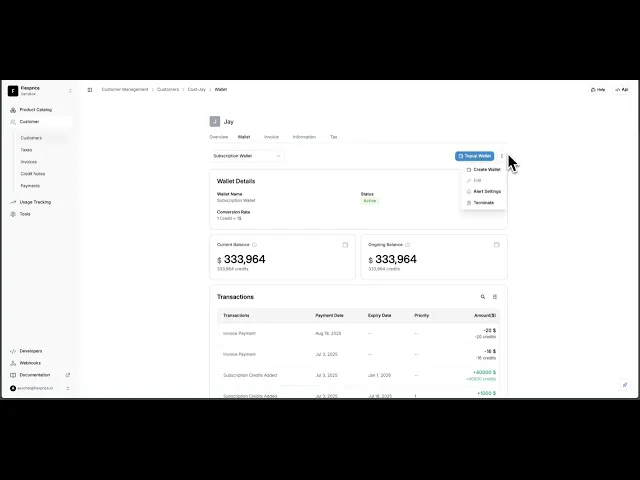

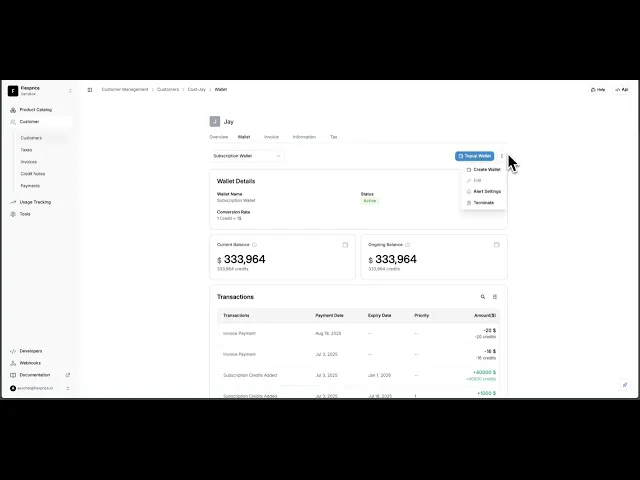

So now Flexprice lets you set Low Balance Alerts on customer wallets. And here’s how it works:

→ Go to the customer’s wallet

→ Open Alert Settings

→ Set a threshold amount (e.g., $50)

→ Enable the alert

When the wallet balance drops below that threshold, Flexprice automatically notifies you, so they can top up before hitting zero.

This helps you:

Avoid downtime due to insufficient balance

Reduce support tickets from failed usage

Encourage timely top-ups without manual chasing

Apply Country Specific Taxes

Every country has different tax rules and your invoice needs to reflect those correctly. With Flexprice, you can define taxes with complete control:

→ Set a tax name (e.g., GST, VAT)

→ Add a unique code (for internal mapping or reporting)

→ Choose a fixed amount or a percentage

→ Apply them at the invoice or you can set default tax rate to a specific customer

Every tax is visible on the invoice and linked to your ledger. You don’t need a separate system to manage country-specific tax logic.

Wrapping Up

As we mentioned enterprise billing isn’t about features, it’s about flexibility under pressure.

What we shipped today isn’t just a list of features. It’s a better way to handle all the complicated enterprise billing cases that don’t fit into standard plans.

And the more you scale, the messier billing gets. This launch makes sure you’re ready for every enterprise billing exception.

→ If you have any questions, talk to us

→ Sign up for launch updates to get tomorrow’s drop in your inbox

Stripe <> Flexprice Integration

Most teams use Stripe to collect payments but billing logic often lives outside Stripe. Without a reliable sync, you end up creating duplicate customer records & manually updating their plans and invoices.

With the new Stripe integration, Flexprice syncs customers both ways:

→ Create a customer in Stripe → it appears in Flexprice

→ Create a customer in Flexprice → it syncs to Stripe

You can also:

Generate payment links directly from Flexprice

Record partial payments (e.g., customer paid $50 on a $250 invoice)

Track payment status without switching tools

This means less manual work, fewer errors, and one connected flow between sales and billing.

Create Feature and Usage Add-ons

Let’s say your base plan includes 100 API calls. The next plan includes 1,000, but also adds advanced analytics, audit logs, and other features your customer doesn’t need.

All they want is 30 more API calls. Upgrading them doesn’t make sense, and creating a new “130 API calls” plan just for this use case clutters your catalog.

Flexprice now supports add-ons, so you can sell exactly what’s needed, without changing the core plan.

Here’s how it works:

→ Keep the customer on the 100-call base plan

→ Create an add-on plan that supports the additional requirement for additional 30 calls

→ Assign both to the customer, Flexprice bills them together

For example, Ahrefs supports add-ons so customers can implement exactly what’s needed without changing the core plan.

On Ahrefs, you can stay on your current plan and:

→ Add Brand Radar AI for $199/mo

→ Add Report Builder for $99/mo

→ Add Project Boost Pro for $20/mo per project

→ Add Content Kit starting at $99/mo

These add-ons work independently of the base plan. You don’t need to upgrade or change tiers, just add on what you need.

This is useful when:

A customer’s usage slightly exceeds their base plan limits

They need one specific capability (like more storage or bandwidth) without upgrading the whole tier

You want to offer flexible upsells without duplicating plans

Low balance alerts

When customers use prepaid wallets, running out of balance can break their workflows. Such as:

API requests may be declined

Service can be interrupted and you won’t be able to use the platform anymore

So now Flexprice lets you set Low Balance Alerts on customer wallets. And here’s how it works:

→ Go to the customer’s wallet

→ Open Alert Settings

→ Set a threshold amount (e.g., $50)

→ Enable the alert

When the wallet balance drops below that threshold, Flexprice automatically notifies you, so they can top up before hitting zero.

This helps you:

Avoid downtime due to insufficient balance

Reduce support tickets from failed usage

Encourage timely top-ups without manual chasing

Apply Country Specific Taxes

Every country has different tax rules and your invoice needs to reflect those correctly. With Flexprice, you can define taxes with complete control:

→ Set a tax name (e.g., GST, VAT)

→ Add a unique code (for internal mapping or reporting)

→ Choose a fixed amount or a percentage

→ Apply them at the invoice or you can set default tax rate to a specific customer

Every tax is visible on the invoice and linked to your ledger. You don’t need a separate system to manage country-specific tax logic.

Wrapping Up

As we mentioned enterprise billing isn’t about features, it’s about flexibility under pressure.

What we shipped today isn’t just a list of features. It’s a better way to handle all the complicated enterprise billing cases that don’t fit into standard plans.

And the more you scale, the messier billing gets. This launch makes sure you’re ready for every enterprise billing exception.

→ If you have any questions, talk to us

→ Sign up for launch updates to get tomorrow’s drop in your inbox

Stripe <> Flexprice Integration

Most teams use Stripe to collect payments but billing logic often lives outside Stripe. Without a reliable sync, you end up creating duplicate customer records & manually updating their plans and invoices.

With the new Stripe integration, Flexprice syncs customers both ways:

→ Create a customer in Stripe → it appears in Flexprice

→ Create a customer in Flexprice → it syncs to Stripe

You can also:

Generate payment links directly from Flexprice

Record partial payments (e.g., customer paid $50 on a $250 invoice)

Track payment status without switching tools

This means less manual work, fewer errors, and one connected flow between sales and billing.

Create Feature and Usage Add-ons

Let’s say your base plan includes 100 API calls. The next plan includes 1,000, but also adds advanced analytics, audit logs, and other features your customer doesn’t need.

All they want is 30 more API calls. Upgrading them doesn’t make sense, and creating a new “130 API calls” plan just for this use case clutters your catalog.

Flexprice now supports add-ons, so you can sell exactly what’s needed, without changing the core plan.

Here’s how it works:

→ Keep the customer on the 100-call base plan

→ Create an add-on plan that supports the additional requirement for additional 30 calls

→ Assign both to the customer, Flexprice bills them together

For example, Ahrefs supports add-ons so customers can implement exactly what’s needed without changing the core plan.

On Ahrefs, you can stay on your current plan and:

→ Add Brand Radar AI for $199/mo

→ Add Report Builder for $99/mo

→ Add Project Boost Pro for $20/mo per project

→ Add Content Kit starting at $99/mo

These add-ons work independently of the base plan. You don’t need to upgrade or change tiers, just add on what you need.

This is useful when:

A customer’s usage slightly exceeds their base plan limits

They need one specific capability (like more storage or bandwidth) without upgrading the whole tier

You want to offer flexible upsells without duplicating plans

Low balance alerts

When customers use prepaid wallets, running out of balance can break their workflows. Such as:

API requests may be declined

Service can be interrupted and you won’t be able to use the platform anymore

So now Flexprice lets you set Low Balance Alerts on customer wallets. And here’s how it works:

→ Go to the customer’s wallet

→ Open Alert Settings

→ Set a threshold amount (e.g., $50)

→ Enable the alert

When the wallet balance drops below that threshold, Flexprice automatically notifies you, so they can top up before hitting zero.

This helps you:

Avoid downtime due to insufficient balance

Reduce support tickets from failed usage

Encourage timely top-ups without manual chasing

Apply Country Specific Taxes

Every country has different tax rules and your invoice needs to reflect those correctly. With Flexprice, you can define taxes with complete control:

→ Set a tax name (e.g., GST, VAT)

→ Add a unique code (for internal mapping or reporting)

→ Choose a fixed amount or a percentage

→ Apply them at the invoice or you can set default tax rate to a specific customer

Every tax is visible on the invoice and linked to your ledger. You don’t need a separate system to manage country-specific tax logic.

Wrapping Up

As we mentioned enterprise billing isn’t about features, it’s about flexibility under pressure.

What we shipped today isn’t just a list of features. It’s a better way to handle all the complicated enterprise billing cases that don’t fit into standard plans.

And the more you scale, the messier billing gets. This launch makes sure you’re ready for every enterprise billing exception.

→ If you have any questions, talk to us

→ Sign up for launch updates to get tomorrow’s drop in your inbox

Aanchal Parmar

Aanchal Parmar

Aanchal Parmar

Aanchal Parmar heads content marketing at Flexprice.io. She’s been in the content for seven years across SaaS, Web3, and now AI infra. When she’s not writing about monetization, she’s either signing up for a new dance class or testing a recipe that’s definitely too ambitious for a weeknight.

Aanchal Parmar heads content marketing at Flexprice.io. She’s been in the content for seven years across SaaS, Web3, and now AI infra. When she’s not writing about monetization, she’s either signing up for a new dance class or testing a recipe that’s definitely too ambitious for a weeknight.

Share it on: